美联储四年多来首次加息 点阵图显示后面连着还有9次

在结束两天的会议后,北京时间今天凌晨,美联储宣布加息25个基点。

这是2018年以来美国首次加息。

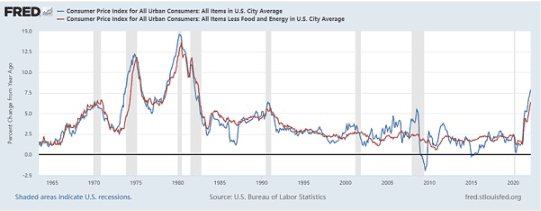

从新闻稿看,联储认为价格压力是普遍的,不只是能源价格,还有劳动力等,目前的失业率已明显下降(2月份美国CPI通胀率为7.9%,40年来最高;失业率为3.8%,已接近疫前水平)。

联储准备从下次会议开始,减少国债和机构债MBS的持有量。

投票委员中,圣路易斯联储主席James Bullard投票加息50个基点。

据FT报道,在会后的记者会上,联储主席鲍威尔谈到加息是为了应对高通胀和紧张的劳动力市场 extremely tight labor market in high inflation.

点阵图(dot plot,投票委员对利率区间的预测)显示,联储官员比三个月前调高了利率预测,预计2022年剩下的时间还将加息6次,2023年加息至少3次。联邦基金利率届时将达到2.8%,高于影响经济增长的“中性位置”(多数官员预测的中性利率为2.4%)。

美国CPI(1965-2022)

美国劳动参与率(1948-2022)

联储新闻稿如下:

March 16, 2022

Federal Reserve issues FOMC statement

For release at 2:00 p.m. EDT

Indicators of economic activity and employment have continued to strengthen. Job gains have been strong in recent months, and the unemployment rate has declined substantially. Inflation remains elevated, reflecting supply and demand imbalances related to the pandemic, higher energy prices, and broader price pressures.

The invasion of Ukraine by Russia is causing tremendous human and economic hardship. The implications for the U.S. economy are highly uncertain, but in the near term the invasion and related events are likely to create additional upward pressure on inflation and weigh on economic activity.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. With appropriate firming in the stance of monetary policy, the Committee expects inflation to return to its 2 percent objective and the labor market to remain strong. In support of these goals, the Committee decided to raise the target range for the federal funds rate to 1/4 to 1/2 percent and anticipates that ongoing increases in the target range will be appropriate. In addition, the Committee expects to begin reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities at a coming meeting.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on public health, labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Michelle W. Bowman; Lael Brainard; Esther L. George; Patrick Harker; Loretta J. Mester; and Christopher J. Waller. Voting against this action was James Bullard, who preferred at this meeting to raise the target range for the federal funds rate by 0.5 percentage point to 1/2 to 3/4 percent. Patrick Harker voted as an alternate member at this meeting.

微信扫描关注公众号,及时掌握新动向

2.本文版权归属原作所有,仅代表作者本人观点,不代表比特范的观点或立场

2.本文版权归属原作所有,仅代表作者本人观点,不代表比特范的观点或立场