Iteration or optimization? Details on what's new in AAVE V3 coming soon

Yesterday, the request to send Arbitrum to Aave V3 was approved and voting lasted a week, with all-time highs of 580,000 votes (AAVE) and a success rate of 99.99%.

There has been a lot of talk about Aave V3 on Twitter recently, and it is still considered a modded DeFi game.

However, these are just some of the highlights of Aave V3 (over 3500 words), but I don't know which one is better or if there are any changes.

This article systematically categorizes the new features and modifications of Aave V3.

Iteration: rau Cross-Chain Lending Portal

DeFi users are divided into 2 different chains and processes. The chain of chains is generally used when a chain link is required. Cross-chaining is prohibited due to the complexity of the steps and the additional fuel or operating cost for each step. Chain interaction chain behavior.

And Aave V3 has launched a portal that allows users to trade assets of Aave V3 funds on different chains.

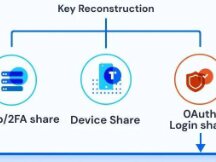

Applying the rule is very simple. In other words, it breaks the aToken from the original chain and simultaneously sets up the aToken component on the target chain.

These features were realized last year in some small and new DeFi protocols such as the Flux V3, a division of the lending chain that can be accessed and borrowed from BSC, OEC and Heco without loss.

As a key rule for the DeFi architecture, upgrades may still be rare, but Aave V3 accommodates this technology.

When the Aave V3 ships to various public markets and into Phase 2, it will bring two easy changes.

First, because user assets (aTokens) of the Aave V3 can cross the chain without falling, the Aave V3 interest of the other chains has been achieved. This exchange is for Aave users.

Second, the Aave V3 can be a DeFi terminal.

Cross-chain flash exchange functions can also be used, but Aave V3 not only has a large investment portfolio, but also provides loan services according to the chain exchange exchange, allowing accustomed users to increase their previous experience capacity. Get more DeFi items and more revenue. This exchange is for all DeFi users.

In general, the portal function of the Aave V3 can solve the problem of efficiently distributing revenue from the Aave protocol to multiple blockchains, including the whole DeFi field solution.

Although this specialty is not the most successful in the first place, Aave offers a high-level process of improving users, investment, wealth and public channels, and can cope with daily loan users.

The release of Aave V3 should not only maintain the product adherence of existing users, but also introduce new users in a short period of time.

Optimization 1: High Efficiency Mode (eMode) for cost and clearance rate customization

Portal can be considered a redirect, but eMode can only be considered an upgrade.

The performance module (eMode) allows you to divide assets into several categories and has four main components: loan rate (LTV, Loan-For-Value, can be understood as interest rates), start-ups , profit margins and custom pricing oracles (optional).

You may see more tradable products as e-commerce platforms fill the shelves with quality metrics, terms, and more.

An e-commerce product can only match certain tags, for example, a glass of water can only reach the price and cannot be in the range of 5-20 yuan and 200-500 yuan at the same time. time time. .

Inheritance in Aave V3 can be based on different scripts. For example, water tariffs in DAI would be 50%, 75%, 90%, 97%, etc.

The four-dimensional texts form a group and all the treasures of this group can be considered as a lake. You can join any property in this category and you can borrow any property in this category.

High Performance Mode (eMode) can support up to 255 groups, and users can search for specific categories that match their needs.

For example, the efficient mode (eMode) of Aave V3 defines a stable product for the first time: interest rate -97%, payment rate -98%, clearance bonus -2%, Oracle custom price - none.

The user then puts the DAI in the class, and although the stable's ratio is usually 75%, since the class comparison is set at 97%, the other stable class can borrow at 97%.

If the initial liquidation is -98%, it means that the liability (interest on the loan) will be liquidated when it reaches 98% of the asset value.

It can be seen that High Performance Mode (eMode) can improve users' resource utilization by increasing user interest rate by 22% and reducing marketing potential. .

For the platform, high-performance models are risky and meet the needs of many users, some similar to Uniswap V3.

Although no additional data is currently available in the legal document, it is believed that the high efficiency mode (eMode) is more relevant for the interest rate.

Optimization 2: Optimal security management

High volatility in the crypto industry has created instability in the DeFi lending industry, and Aave has seen a number of asset breaks, this time with better risk management in V3.

The refinement of product features and approvals by Aave Governance allows for some risk of uncontrolled voting.

isolation type

If the community has ideas for creating new assets, you can list high-risk assets as separate assets.

Borrowers who have pledged their assets separately as commodities can only borrow fixed amounts (no ETH, BTC, etc.), and each asset has a limited down payment.

If users provide both risky quarantine assets and tokens in Aave V3, they will still be placed in exclusion mode. The tokens he deposits can only be used as LP, not as personal property to borrow.

The advantage of this is that if there is a high risk of a real estate crash, it does not affect the moving value of other assets.

Restrictions on shipments and loans

Support Aave Management to set up loans and provide caps to all real estate divisions to avoid bad credit, large scale and short term loans that lend into the liquid lake.

risk manager

Organizations on "approved lists" (possibly DAOs) can change some of the risks without a vote, but those organizations must add their votes to the agreed names.

This allows risk managers to react to risks more quickly.

Asset List Manager

Aave Governance is an "asset manager" that can add assets to Aave without a phone election, allowing anywhere (including smart contracts) authorization.

Risk management in Aave V3 truly integrates products with DAO management, leaving the work of experts and Aave Governance with more power to resolve temporary situations that the average user is unaware of.

Oracle Sentinel

The Sentinel feature is specifically designed for the Phase 2 process, indicating a time-consuming process and limiting loans in certain situations.

There are also some minor fixes such as interest rate adjustment, users using tokens to repay loans, NFT sites, etc. Changes in interest rates will not affect loans.

However, these features will still work correctly with or without V3.

concludes

The AAVE V3 has undergone a major overhaul this time around, making it easier and more versatile to integrate products from other chains into a single effort, and becoming the global DeFi dock.

There are also multiple product optimizations, finer segmentation capabilities, and a series of optimizations for risk management.

Too bad the iterations and optimizations are not original on AAVE V3. A similar shadow can be seen in many rules, but the early immigrant benefits did not go beyond the AAVE.

Does this mean that the DeFi sector, like the internet at home, is starting to harden behind consumer numbers and adult finances? Can't create new plans always be destroyed?

Scan QR code with WeChat