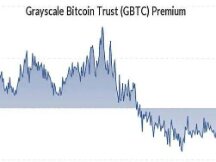

Greyscale Bitcoin Trust's negative price bottomed out at 26.5%.

Greyscale Bitcoin Trust (GBC) posted negative data of 26.53% on Wednesday, according to data from YCharts. GBTC traders suffer more losses.

GBTC has been a capital vehicle that allows many businesses to trade cryptocurrencies without having to purchase Bitcoin directly.

However, there are some downsides, like a 2% annual maintenance rate and a 6-month closing period.

The added value of GBTC has gone to minus since February 2021 due to lower demand supply. A negative value for Asset Value (NAV) not only means that existing GBTC holdings are turning into the red, but can also be seen as a general indicator for companies trading for Bitcoin.

In other words, the current discount may mean less interest on the asset because GBTC is in excess.

Bitcoin was hovering around $42,000 as GBTC hit an all-time low, according to data from the BitTui terminal.

Although, recently announced Bitcoin Futures exchange-traded funds (ETFs), such as the ProShares Bitcoin Strategic ETF (BITO), are still struggling.

However, real estate gives investors exposure to the cryptocurrency market with no closing hours and low prices.

Despite the poor performance of Grayscale's Bitcoin products, the company plans to convert GBTC into Bitcoin-based ETFs.

However, the US Securities and Exchange Commission (SEC) delayed the issuance of Bitcoin ETFs last month.

Given SEC Chairman Gary Gensler's hard line on Bitcoin-backed investment products, Greyscale is unlikely to make a difference.

According to Bloomberg Intelligence ETF analyst James Seyffart, another option for Grayscale to bridge the gap between Bitcoin's lowest price and GBTC's market value is to lower the price and provide buyback services.

According to the weather forecast, he even ordered the permanent closure of the funds and the return of the funds to the investors.

However, he said, “It would be very bad for Bitcoin,” adding that it was unlikely to happen anytime soon as Grayscale would spend a lot of time trying to get Bitcoin ETF approved.

The continued discount may be due to investor skepticism of Greyscale's plans to shift funds to the ETF. Some analysts don't expect that to change anytime soon.

The SEC has not yet approved a Bitcoin ETF.

“Bitcoin is still unable to exit GBTC, which means it needs to continue trading at a deep discount to offset this skepticism,” said Dave Nadig, chief research officer and capital manager at ETFTrends.com.

The recent cryptocurrency selloff was also a reason for the bigger discount on GBTC. Bitcoin has fallen 37% from its all-time high of nearly $69,000 in November and has remained stable around $42,000 at the time of writing.

Scan QR code with WeChat