Vitalik: I'm happy with the multi-channel ecosystem, but not the use of cross-channel.

Editor's note: On January 7, 2022, the research team of the Ethereum Foundation (EF) conducted the AMA (Online Questions and Answers) section of the Ethereum platform on the r/ethereum platform, developer of Ethereum.Vitalik ButerinAnd members of the Ethereum Foundation, including Justin Drake, Danny Ryan, Joseph Schweitzer, David Theodore, Barnabé Monnot, Dankrad Feist, and more, answered questions from the community about Ethereum advancements and research. . Here is the old English text: enter:

https://www.reddit.com/r/ethereum/comments/rwojtk/ama_we_are_the_efs_research_team_pt_7_07_january/

Here are some highlights from this AMA:

josoj: Hello! I am very satisfied with the safety of the balls.

Do you think that the bridge over the different L1 (process 1 network) (e.g. using ZK technology egress) is as secure as the bridge over the two different L2 (process 2 network) in the same L1 network?

If the fork occurs in one of the L1 networks, the L1 network bridge must be repaired. Does this make the L1->L1 bridge more dangerous than the L2->L1->L2 bridge?

Regarding the ZK Rollup, what is the best mechanism to ensure that the ZK Rollup does not pose a security risk to users and maintains upgradeability to new features? Specifically, I think there will be users who want to shut down the L2 network for a long time without being able to quickly remove it from the chain (L2) (for L1).

Vitalik Buterin: A major limitation of the "bridge" in terms of security is what I can doOptimistic about the multi-channel ecosystem(There are different communities with different results that are better separated than all candidates for the same impact),Pessimistic about cross-chain usagethe reasons.

To understand why bridges have these limitations, one must look at the difference in connectivity between blockchains and surviving 51% strength bridges. Many people are of the opinion that "if the network blockchain receives 51% attacks, everything is broken, so we must do everything we can to prevent 51% attacks from happening".. I never agree with this idea; In fact, even after 51% of protests, the blockchain can maintain a high recognition, and the management of these guarantees is very important..

For example, let's say you have 100 ETH on the Ethereum network and the Ethereum network is under 51% attack, causing some transactions to be censored and/or rolled back. However, you can still have 100 ETH. Even the 51% of protesters could not defend ETH. Indeed, such blocks are rejected by the network for violation of the protocol. Even if 99% of the network hashrate or stake wants to bring you ETH, a node operator only follows the chain with only 1% (hashpower or stake). Because only blocks in this chain follow the rules.

In general, if you have an Ethereum application, 51% of attacks will allow you to censor or repeat the application process for a while, but in the end you will get a similar state. For example, if you have 100 ETH but sell it for 320,000 DAI at Uniswap, even if the Ethereum chain is attacked madly, this will still be true in the end. Or save 100 ETH. Earn ETH or 320,000 DAI. If you don't receive something (or both), it will violate protocol and will not be accepted.

Now, if you send 100 ETH through the Ethereum network to a "bridge" on the Solana chain and get 100 Solana-WETH, consider the Ethereum network to be 51% off. The attacker deposited large sums of his ETH into Solana-WETH, and once the exchange was confirmed on the Solana chain, they attacked the Ethereum network by 51% and reversed (reversed) the change offer. Then your 100 Solana-WETH is only eligible for 60 ETH today, according to the Solana-WETH contract, at that time, will not be returned enough ETH. So even though all decks based on ZK-SNARK must be fully approved, the deck can still be easily stolen with 51% off.

Therefore, holding Ethereum assets in Ethereum or Solana assets in Solana is always safer than holding Ethereum assets in Solana or Solana assets in Ethereum.By "Ethereum" we mean not only the Ethereum L1 chain, but also the L2 chain built on top of Ethereum. If Ethereum is 51% off and business returns, L2 like Arbitrum and Optimism will still be back, so even if Ethereum is 51% off, the "cross-rollup" app that saves state for Arbitrum and Optimism is guaranteed. You can make the end result the same. And if Ethereum is not a 51% attack, Arbitrum and Hope alone cannot be a 51% attack. Therefore, it is completely safe to package Arbitrum's Optimism Network products.

The problem is exacerbated when the tool has more than one chain. If there were 100 chains, there would be multiple interactions between these chains, and 51% collision of one of them would lead to a contagious disease, threatening the economy of the whole ecosystem. The reason I think this is most likely because shared territories are connected to sovereign territories. Applications from the Ethereum ecosystem and applications from the Avalanche ecosystem must not interfere with each other.

This is also why rollups cannot directly "use other file levels". If your rollup stores your data in Celestia, Bitcoin Money or elsewhere, but your assets are successfully processed in Ethereum, the data layer will be hit by 51%. The 51% attack rate provided by Celestia's Data Design Standards (DAS) doesn't really help because the Ethereum network doesn't read DAS. Easy for 51% strike.For Rollup to provide security for applications that use native Ethereum tools, it must use Ethereum as the data layer.(Ditto for other ecosystems.)

I don't think these problems arise immediately. Hitting 51% of the chain is difficult and expensive. CornThe greater the combination of chains and crossovers you use, the bigger the problem.. Nobody will have 51% against Ethereum and steal 100 Solana-WETH (or 51% will kill Solana by stealing 100 Ethereum-WSOL). However, if there is 10 million ETH or SOL on the bridge above this line, the strike incentive is greater and a larger lake could trigger the strike. Therefore, cross-chain operation has the potential to protect the network. If you don't have a lot of lice (e.g. working across ropes) it's still safe, but the more of it the greater your risk.

freedom: Are you surprised by the research on zkEVM? Given the success so far, do you think it will be true for Polygon Hermez and Scroll to shut down the zkEVM version until the end of 2022?

Justin Drake(Ethereum Foundation): Actually, I'm very happy with the promotion, finances and reliability of zkEVM compared to a year ago. There are several good teams competing in zkEVM, investing hundreds of millions of dollars in production in 2022-2023.

It is important to note that the word "zkEVM" has several meanings depending on the context. I split the zkEVM into:Three:

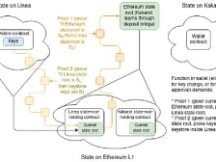

approval level(Optional Tier): The zkEVM optional tier aims to provide full compatibility with the Ethereum Virtual Machine (EVM) used by Ethereum. In other words, this zkEVM will generate SNARK to prove the usability of Ethereum L1 statebases. Trust-level deployment of zkEVM isEthereum development roadmap(See image below) Part of "ZK-SNARK ALL".

Above: Vitalik Buterin's Modified Recent Ethereum Upgrade Process

bytecode level(Grade bytecode): zkEVM by bytecode class aims to translate (translate) EVM bytecode. This is the path followed by Scroll, Polygon Hermez and others. zkEVMs can be developed into different states by EVM, for example by replacing EVM's anti-SNARK Patricia-Merkle test with the SNARK-compatible test.

language levelLanguage level: The zkEVM language level aims to convert EVM-compatible languages (such as Solidity or Yul) into SNARK-compatible VMs that can be completely different from the EVM. Here is the path of Matter Labs and StarkWare.

I am eager tolanguage zkEVMThis type of zkEVM is used first because it is technically the easiest to build. so i thinkbytecode level zkEVMLock down EVM integration and enhance the network impact of EVM. Finally L1zkEVM at trust levelTurn EVM into a "pure rollup" and improve the security, decentralization and usability of Ethereum L1.

A bytecode-level zkEVM (like Polygon Hermez or Scroll) that will release the zkEVM level in 2022 makes me wonder. Here are some of the features expected to be included in the announcement:

me me gas cap: At the bytecode level, the fuel cap of zkEVM seems to start less than that of L1 EVM (probably about 10 times lower than that of L1), and will gradually increase over the next few years.

central prover loj: Initial evidence (evidence) does not seem to need to be divided into categories and can be obtained from a central location with large evidence. I expect we will have certification (such as international GPU-based certification) by 2023 and ZNARK certification ASICs by 2024.

kab kab mob: Due to the circuit complexity of zkEVM at the bytecode level, there may be different power lines and equivalent EVM bytecode. These lines (some of which require significant securing) must be dealt with in time. Finally, the bytecode equivalent can be seen by a legitimate source tool.

Maswasunos: What does the Ethereum Foundation (EF) think of Dankrad Feist's new sharing venture to use independent high achievers? Specifically, does the research team (Ethereum) think there should be some sort of capital layer at the data center level on the network? Or can he accomplish more leadership?

Vitalik Buterin: Only nodes requiring data center support areconstructor node(constructor node), see contentProponent/Builder Separation(Manufacturer/developer separation, 即 PBS):

https://notes.ethereum.org/@vbuterin/pbs_censorship_resistance

Validator and end-user nodes continue.You just need a regular computer to run node.(In fact, one of the best things about PBS is that there is a Verkle tree that allows users to have no state!)

Another key is being able to develop decentralized business people. There will becoordinator node(coordination node) records exchanges with contract data, but since each contract is self-organized by other nodes and passes to the articulation, coordination This can only be done to the extent that the organism in has normally. The partnership has to rely on some of the reputations to ensure that the data behind this agreement is valid, but this is something that some L2 DAO protocols can achieve easily.

Joseph Schweitzer(Ethereum Foundation): I'm sure some academics will opine, but it should be noted that the Ethereum Foundation, which is an organization, doesn't have a common sense of what actually happened in their R&D research there -low.

When it comes to blogging for the past few years, the Ethereum Foundation (EF) is more of a business venture than a church. Independent research and development work can sometimes be included in the EF ceiling, which saves control of the research and development budget. However, just as the Ethereum Foundation does not know the differences between consumers or Ethereum Implementation Agreements (EIPs), the opinion of Dankrad and other consensus can only be that of research experts. uniquely. There is usually a lot of discussion and change even within the group.

3679: It should be noted that the Brand New Sharding Proposal (Dankrad) strategy based heavily on PBS (Advertising / Design Separation) is currently under discussion. According to PBS, a continuous source that can work on modern home devices is still valid, and 32 ETH validating nodes can still work on this device, which can be applied to blockchain blockchain. , block authentication trusted by other users.

What has changed with PBS is that consumers can rely on external "manufacturers" to choose which companies to include (within a block) and determine their path to the most relevant profitability. This is what Flashbot does today with volunteers. These "builders" need high-performance tools and an internet connection to assemble the blocks and identify the most profitable process to advise the client (builder). .

When the PBS strategy is combined with the new sharing strategies (from Dankrad), sharing can become very easy.

freedom: How will this innovation (Ethereum development) affect the process/timeframe?

Vitalik Buterin: I think this will make sharding faster.

Danny Ryan(Ethereum Foundation): Developer Dankrad recognizes that multi-shard MEVs are available in *all* sharding designs, so the data sharding company will opt for more sharding.the founder(non-auditing professional)feedback(Validator) Provides information. In a design like this, manufacturers use a lot of resources, which makes it difficult to capture MEVs. Additionally, in a sharing design, this does not affect end-user capital or the end-user requirements needed to join the agreement.

This means value in the design of the "firewall" and the operation of sponsors and developers in the design process. (General) Validators do not need to have dire circumstances to participate in the market *no*. Protected and operated by state-of-the-art equipment. We like to call these ideas PBS (Propose/Builder Separation).

Recognizing the need for PBS frames to meet high belt life requirements and avoid energy consumption in the middle, Dankrad said, “Recognizing that PBS needs and MEVs have a lot of accidents due to industry forces, so we will review it and simple sharing design to achieve high renewalthe founderCombine and expand partition files associated with the block. "

This facilitates student approval (some PBS templates may already be required for sheet music).

In this model, the fragmented design can be "distributed", but the behavior of the manufacturer is not clear, because a powerful machine is required. If you can create a DAO developer, he will be happy to explore this project. :)

Also, if these heavyweights are temporarily unavailable (i.e. they are all offline or unsponsored by the Marketplace), developers can still comment on the quality of the great hardware. public with limited performance and blocks. Data throughput is made up of fragmented data transactions, but data throughput will decline until industry participants incentivize the work.

freedom: Do you think there is any idea or implementation outside of the Ethereum ecosystem that could improve the state of blockchain technology which is now excluded from the Ethereum roadmap (The Urges), and would like- do you see it in Ethereum to use it? What concepts are related to the competition you want to see in the Ethereum process?

Justin Drake(Ethereum Foundation): Here are some ideas.

Many current rollups (such as Optimism, Arbitrum, zkSync, etc.) now have a preview, familiar to users. But I don't know how to stabilize it.Preselection(Currently, accumulations are used by a centralized sequencer) as welldistribute orders(This is the goal of many rollups). If the competition succeeds in fulfilling the guarantee according to the shipment, the Ethereum L1 may have the guarantee first.

Arbitrum also thinksFair Order ProtocolRelieves MEV. I don't know much about their research, but I'll take care of them. Similarly, if a fair trial rule works well on L2, Ethereum L1 may benefit.

InfoSecure: Beacon Chain is still early days (just over a year!) and many users have written recently and much later than popular and well-tested users (eth1). Is the Ethereum Foundation currently working to improve the security of its Multi-Beacon Chain customers?

David TheodoreEthereum Foundation: The Ethereum Foundation has a security research team.EF Consensus Layer Security Research Team. The team has extensive experience in security research (cryptocurrency expertise, business development, ad attacks, etc.) and focuses on a variety of (eth2) layer approaches to consumer products (Prysm, Lighthouse, Teku, Loadstar and Nimbus). Here are some of the things the team does.

Customer implementation audit: We carry out digital measurement of our customers' key products and carefully follow their development. There are some user functions, such as measuring and supporting multiple test users, and reviewing significant impacts that occur across different applications (eg, BLS library). . It also tests the user for new features before major changes like Altair.

Purge Assessment of Key Attack Areas: We made a number of efforts to rig network interfaces and key user-defined processes (such as the use of state transitions and fork options). We have dedicated purging infrastructure and may expand some of our purging facilities in the future.

Network level simulation and testing: We regularly run users on our testnet and maintain our internal "attacknet" to try out various scenarios where we want the client to be robust (DDOS, isolation, network connectivity, etc.). We are also funding the development of anti-stress tools to work with other software testing platforms to test these situations and understand their effectiveness in assessing stress.

Assess the needs of different clients and address differences: We research the financial performance of beacon chain data (e.g. nodewatch.io/) and regularly monitor beacon chain health (cloud and host OS diversity, etc.). We educate community members (hobbyists, community partners, affiliates) on best practices and identify areas where we can support various users, people and more.

Bug Bounty Submission Note:There are big bugs that deal with viruses in the beacon string specification as well as viruses in consumer products (see ethereum.org/en/eth2/get-involved/bug-bounty/). Our team analyzes data sent to the bug bounty program, reviews other users' data, and monitors security patches to report issues. We plan to report bug fixes to the bug bounty service in the future, including bugs seen by our internal team (until the Altair hard fork upgrade).

New: What is the L1 security budget due to the introduction of the L2 network (rollup)? When the L2 network (upgrade) reaches outbound reach, expect most revenue to stay in L2 and affect non-ETH tokens in L2 and pay for Ethereum. The L1 ETH price will be reduced as follows: large order. In this case, is there a mechanism to ensure that the cost of staking (ETH) L1 is of sufficient scale compared to the cost protected by L1?

I've heard "L1 always expensive", but I don't understand why it's because L2 can provide almost everything L1 does at a lower price (eg L1 always kim).

Will EIP-4488 be reversed in the future to increase fuel prices for the L2 industry?

Danny Ryan(Ethereum Foundation): I think there is no limit to how much L1 security can prevent. I also think where L1 performance happens will depend on where in the industry it's worth it. So you don't expect to have an event like "because L2 happens, all operations happen immediately in L2, no functions happen in L1". I expect the market to have a lot of activity until the day when L1 will be controlled by the L2 exchange, but this is due to the intense competition with many L2 networks. .

Although the L2 exchange has become the main L1,You also need a user switch to L1.. For example, manufacturers swap/revitalize L2s. In Ethereum's design, L2 networks are anchored to a rich runtime layer with first-class connectors connecting them, so if there are more thriving L2 networks.Connect gamesThere may be high financial requirements (for certain levels of investors).

Banabemono(Ethereum Foundation): Additionally, L2 (like the competition) pays a fee when sending databases/status/evidence to L1. L2 advertises with this information using ETH to pay L1 wrapper fee, L1 trading fee paid by EIP-1559. So another question is, "Will L2 reduce the total cost of L1 from L2 because L2 pays less for L1 and more payments go from L1 to L2?"

The lower values offered by Rollups (via Compression Swap) mean:Many users who were previously disappointed with the L1 prize will enter the contest., which means that the cost of the Ethereum network (i.e. the costs of electricity that the entire network provides to users) increases at the same rate. In the past you couldn't do this deal because you were willing to pay $1 to complete the deal and the L1 cost was higher than that, but now you can (competition). L1 network dollar prices. Any fees charged by the network are still charged for L1 fees (because paying more than what you received is not a good idea for using the network). In fact, the goal of the network is to maximize efficiency while reducing costs, but the cost still increases for the payment staff (node) and to maintain good network integration.

My point is,Rollup/L2 provides significant scalability, but never solves network congestion., many users capture the value of the network, create network problems, etc. All of these operations post data changes to access L1. However, this additional scalability can reduce the cost per transaction.

Justin Drake: Some of my thoughts:

Ethereum (unlike Bitcoin) guarantees secure budgets in the form of additional ETH (1 million users can provide an additional 1 million ETH per year).

Historically, despite considering the potential situation, only the total L1 value has increased. We expect this gap to continue as the competition develops.

Why L2 must pay L1 for available data. The more successful the L2 scalability, the more time L1 will have to increase the value to which it resides.

will always be cheap: It seems that all public key quantum protection algorithms use keys larger than 1 KB, how will this affect Ethereum? Thank you.

Justin Drake: Post-quantum cryptography prefers larger cryptographic devices (in bytes). I don't care because:

SNARK allows you to collect and extend cryptographic data on demand. We are also working on post-quantum cryptography (like signature signatures or state-of-the-art authentication).

Bandwidth is essentially a very big device that can grow exponentially over 10 or 20 years (about 50% per year, see Nielsen Policy). 50%/year is about 50x/10 years, so 1 KB in 10 years is 20 bytes today.

Hanzburger: Related question, does this mean that if a quantum strike occurs, the entire origin location will be threatened?

Vitalik Buterin: The money of an existing address (for example, the address of one or more business addresses) is at risk because the company extends the public key. Weak space for quantum computers. If the address is not used, it is safe. If quantum computers existed, we (Ethereum) would befork, you (the user) can transfer funds to a quantum safe account using the STARK quantum resistor to prove that you have a private key.

rov 21: Do you plan to participate in the partnership by participating in ETH in the fundraising of the Ethereum Foundation, and to use the rewards as a long-term investment rather than a partial sale? If you don't plan to use stakeholders as a financial mechanism, why not?

Danny Ryan: In most cases, the Ethereum Foundation has not participated in the partnership to date. It's more average in terms of communication and management, especially in the early stages.

Instead, the Ethereum Foundation intends to invest ETH in the hands of professionals to develop effective communication managers and provide long-term support to multiple stakeholders. All in all, it is a way to demand the distribution of resources and energy from the Ethereum Foundation. The Ethereum Foundation tries to find ways to improve the community, not just itself. Check out this article on the Ethereum Foundation Customer Incentive Program.

https://blog.ethereum.org/2021/12/13/client-incentive-program/

I appreciate the project on the Foundation. I personally think that this type of program is a great way to invest and support many players who have been strengthening the ecosystem from the beginning.

Me Me Dancing Snail:Distributed Validator(VD, Distributed Validators) is a tech project that appears to be sponsored by the Ethereum Foundation... You funded the project and saw DV at the top of the road recently released by Vitalik. But you rarely hear about it in the wider community. Even many prominent people in the Ethereum staking community were disrespectful or misunderstood this misunderstanding. So can you tell me why DV is important and how you think this project will lead to the Ethereum ecosystem?

Dankrad Celebration(Ethereum Foundation): DV is important. You can add features that don't work locally.

Although people can spend less than 32 ETH, they can get together and compete without having to send someone to run certificates for them.

It is an inexpensive way to provide security and resiliency, which is a user-friendly tool that anyone can use.

For those who don't want to run their own validator nodes and don't want to rely on a single vendor, DV provides a way to share trust across multiple vendors.

For staking pools, DV provides an easy way to run commit nodes even when a user's presence or security is less than 100%. This means that pools can be opened to more people.

Some improvements will come later, but bigger projects like Blox and Obol have also been involved.

blue tip: Can you tell us a bit about the research or engineering issues that need to be resolved to make DV a reality?

Dankrad Celebration(Ethereum Foundation): Currently there are no more research questions, the rest is done.

As far as I know, Blox has a working environment, but I'm not sure about its function and security. We are currently working on a survey process that will make it more secure and usable.

MrQot: Are there any long-term recommendations/decisions for the current minimum exchange rate of 32 ETH?

Vitalik Buterin: Many strategies are considered to reduce the damage caused by the decline in investment. Two of them are:

By reducing the load on a validator on a blockchain, the blockchain can control multiple validators. If the current blockchain could handle 8 times as many users in the same load, it could support (at least) deposits of 4 ETH instead of 32 ETH.

This allows the network to easily have a fully decentralized pool.

Distributed Validator (DV)Technology is precisely the main aspect of the effort of the second strategic trajectory. Another key is to achieve partial staking (i.e. staking less than 32 ETH) and faster and easier deletion, allowing users to quickly join and leave the pool, eliminating the need for the staking pool to use the simple process.

The first follow-up strategy is to look for better evidence that seems to be the most important right now. There are also procedures in which only a group of validators participate in validation at any time. Both of these methods can reduce the load on the blockchain, reduce the load per user, or reduce the execution time (although reducing the time to complete the current is considered more important).

Scan QR code with WeChat