OlympusDAO (OHM) loses 44% in one hour! A series of wind-ups caused by whale eyes

According to 'News BTC', due to the huge size of the whale, the value of OHM, the traditional symbol of the OlympusDAO algorithmic stability protocol, fell by 44% on the 17th and less than an hour after the crash. , the efficiency of APY up to 190,000%. According to data from CoinGecko, the price of OHM, which recorded a high of $1,415.26 in April last year, fell 91.7% to $117.02 before the close, and has dropped 10% and 66% 24 hours ago. The last 30 days.

Whale selling pain

As to why OHM prices fell on the 17th, Twitter user Freddie Raynolds, citing information from Etherscan on Twitter, pointed out that Olympus DAO users sold $11 million worth of OHM. OHM prices plummeted due to over $5 million worth of products.

According to data from Etherscan, this big sell off took place at 1:55 a.m. on the 17th (09:55 a.m. Beijing time on the 17th), and the big OHM whale traded up to 82,526 OHM using the decentralized exchange SushiSwap. It was traded for $11 million in DAI, an exchange believed to have been made by Twitter user jsonΩ.

Despite expectations, jsonΩ seems to recognize his eye on Twitter. I gave OHM some risk so my family could have a financial impact, and the rest will be at risk indefinitely.

According to the “Decryption” announcement, in addition to this change, data from the DeFi Rari project showed that several projects took place on this day, including the duration of the OHM, which also caused a sharp drop in prices. of the OHM currency. high.

Selini Capital CIO Jordi Alexander tweeted an article about OlympusDAO, OHM and the prospect of the mechanism (3.3), which Jordi Alexander dropped as a Ponzi scheme.

Jordi Alexander said: Some commentators are asking if they think this article will affect the value of the currency. Only sales will affect the value of the currency. It's not short selling, only whale holders can sell big, so you can ask them if they're interested, but I think they're looking out of nowhere. Prices have fallen sharply in recent weeks.

DAO Olympus

According to the “Decrypt” report, since its release last year, the OlympusDAO project has already made a splash in the cryptocurrency space. The interest of traders is mainly in the design and reward staking of the OlympusDAO platform, called Ponzi Economics.

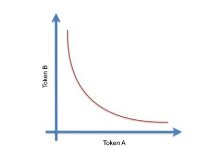

OlympusDAO is a specialized cryptocurrency experience. The tokens are retrieved from the value of the project finances (return currency of the asset). The size of the financial institution is also increasing with the rise of OHM coins, the distribution of financial resources, and the rise of OHM bonds. .

Users can buy OHM rebates, called rebate contracts, using DAI or other cryptocurrencies like WBTC, or LPtokens like OHM/DAI, OHM/Frax, etc. These contracts expire after 3pm to know their full value. After selling these contracts to get the financial process, these funds will be used to advertise and distribute more OHM for competitive OlympusDAO customers.

Since the implantation is very high, users who write multiple OHMs will be highly encouraged to attach the tokens to OlympusDAO. This design also affects many other functions. OlympusDAO has announced a free contract which can be used for other purposes. Olympus Pro.

Although the token contract was all the rage, data from OlympusDao shows that the total cost to close (TVL) of the project fell 80% from its current high of $3.922 billion on November 21 this year. last. Its trading volume was only $846 million.

Scan QR code with WeChat