Let's explore digital assets, starting with the history of money

The NFT digital art collection is published on the I-pad. Picture: Eva Labs

There are many ways to save money today, such as saving money, housing, and assets. As technology advances, the revenue collection process is constantly improving and expanding.

The "difference" is especially important when it comes to the financial community which needs immediate interest and no prior knowledge before we even know it.

The rise in popularity of NFTs has fueled financial motivation and innovation in many areas. (NFTs are unique assets that are digitally recognized and protected by the blockchain.) Advances in NFT technology enable open, hassle-free value when delivering a “culture” of value to property.

As NFT continues, future riches can be preserved in a culture created through the use of electricity. The decentralized application allows users to use NFTs for more complex financial applications and to develop new standards for better financial management.

Over the next few years, NFTs will become more versatile in terms of real estate or other assets.

Before talking about the future, it is good to look at the past and understand how wealth and wealth have changed throughout human history.

finance history

More than 4,000 years ago, the people of Micronesia used an ancient, unweathered stone called the "rye stone" as their symbol. Owners will place stones weighing up to 4000 kg in a well-lit place. Rhystone members have walked through history, highlighting the early benefits that the value of money was shared through shared beliefs.

Rhystone is primarily used for large-scale commercial and symbolic enrichment, making it unusable for everyday consumption.

In 800 BC, the Lydians of ancient Greece brought bodily coins to market. A portable divisible system helps improve the simplicity of modern businesses that can be expanded rapidly in increments. In addition, incomes have become higher.

In an effort to improve access and spending, the Dutch East India Company introduced the first trade in 1611, allowing people to enjoy the best benefits (like exports). Finances are harder to tell the difference.

However, the lack of regulation allows many traders to quickly buy stocks without research. In the 1720s, these fears continued to plague the market, causing major upheaval and discrediting traders. You can only imagine how many people were bidding on the market back then.

To improve trading confidence, in 1972, 24 American investors signed the Buttonwood Agreement in the Wall Street mulberry tree which became the basis of the New York Stock Exchange. The agreement commits to meeting Plaintree's daily industry security requirements to set minimum standards for exchange rates and other markets. The popular point is that companies can only change based on the prepaid rate.

After the Plaintree Accords, business confidence returned and this confidence gradually established the market.

From fiat currency to banknotes representing the shares of companies, money is constantly transformed into various forms by which people can collect and store various financial assets. Wealth, resources, and physical advantages are some of the assets that can save money.

Before the advent of digital, these tools appeared and brought new forms of investment.

The exchange of money and wealth - from ryestone to electrical appliances. Photo: Canva

Internet accelerates innovation and risks

Early benefits and value-added benefits focus on mobility and performance for certain people. The Internet and its popular adoption have proven that the system can meet the needs of the world.

Internet-based products have extended the fruits of the Sycamore Charter around the world, improving access to capital for all.

The stock market as an open source technology still needs help from big business. These companies continue to build on existing trading products with new trading instruments such as Forex Trading (ETFs), Options and Credit Default Swaps (CDS), all with different risks and gifts, and business has been very good.

However, it is true that even a single malicious attacker can affect the security of the entire system. In 2008, the US real estate market crashed due to defaulters on "risky" mortgages not rated "AAA" (the highest rating for a mortgage).

These non-partisan businesses have been in high demand and have impacted the profiteering network that is causing financial problems worldwide.

Improving confidence after a financial crisis

In the shadow of the financial crisis, Satoshi Nakamoto, behind Bitcoin, introduced a new global financial layer, the blockchain. The blockchain eliminates the existing, reintroducing trust into the system. (Satoshi Nakamoto: English Satoshi Nakamoto, self-proclaimed Japanese-American, often translated by Japanese media as Nakamoto Tetsuhi. This person is the creator of the Bitcoin protocol and other Bitcoin-Qt software, but he himself doesn't really know it)

The blockchain is a distribution board where each participant can identify which changes are real. In this way, these systems do not need intermediaries to support transactions and profits like Bitcoin can be made free, providing online financial services to everyone.

People don't have to rely on third-party middlemen for exchange rates, and the exchange rate can be much faster than wire or wire orders.

If the history of money represents the tenacity of human innovation, blockchain is not the end of everything.

Bitcoin and subsequent payment-centric blockchains generate fungible tokens (tokens that can be traded with each other).

While NTFs can be used on these networks, the emergence of smart contractual blockchains has made NFTs a programmable and rich tool, driven by the development of specialized tools that can turn into an open global network.

Freddie Mercury NFT. "A Celebration" by artist Chad Knight is being sold by Reuters for AIDS charity Mercury PHOENIX TRUST /SUPERRARE/.

Before NFT, collectibles were only available in small areas (e.g. baseball cards were really hard to trade and were only useful to other baseball players). Likewise, before the blockchain, online content was only accessible on this network.

And now the collections benefit everyone because of their niche value and find a great price. Blockchain-powered baseball collections can now be traded on digital celebrity collections and vice versa.

Will NFTs become financial instruments in the future?

NFTs have been around for six years, but it wasn't until 2020 that they began to receive critical attention.

Companies, celebrities and artists can easily design and promote digital products to the global market.

Of course, marketing is not without risk, but that means the market potential for digital products is greater than ever. The popularity of NFTs proves the potential of this new technology.

Do you remember when the product was announced? Indicates when the company is accustomed to making profits. For NFTs, this is a time when culture moves the economy with money.

Bored Ape Yacht Club and CryptoPunks - Digital devices rarely focus on cultural explanations and highlight the need to invest in culture. Many collections have been bought and sold for millions of dollars.

People are turning these digital devices into images on social media, bringing them to life with real-life interpretation, and even selling them on the high-end art spaces of Christie's and Sotheby's.Interestingly, this area is just getting started.

NFT enables greater use.

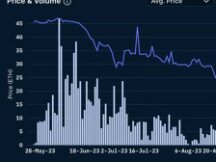

Today, people use digitally proven products that are a valuable asset. The more an NFT is marketed outside of blockchain content, the stronger this legacy.

The next few years will be very important for NFTs, as NFTs continue to prove their legitimacy, and this legacy is still strong thanks to improvements in energy efficiency.

NFTfis Early sought to complement the use of electricity by allowing holders to obtain cryptocurrency loans for the value of these assets. This behavior is similar to traditional lending where physical assets and other investments are used for business purposes.

In the future, more and more internet users will have easy access to financial products and do more with their money. Free assets and network resources such as NFs will reduce financial loss.

People who can identify the products associated with the culture will be successful in the exchange.

Scan QR code with WeChat