Why do people still think about Bitcoin?

Last year, in 2021, I promised myself never to speak or write about Bitcoin again. I'm not talking about bitcoin out of pity. Why beat another old horse to death?

But until now, I couldn't control myself. Especially when we see more people repeating Bitcoin's optimism.

Finally, the Bitcoin crisis has come to the public. (It doesn't matter if Bitcoin proponents are lying or deliberately wrong)

However, Bitcoin buzzwords are still tradable and their voices are sure to fool new entrants who don't even know that Bitcoin is the most profitable 2021 coin. You can't just sit back and watch.

checkmate chain

Bitcoin's long-term weakness is not due to the blockchain slowdown.

the ecosystem does not exist

Yes, Bitcoin has nothing to say other than its value, and talking about these coins is limited by inserting boring stories about inflation, fiat battle, etc. . However, I will not write about them anymore, because even the so-called key points do not exist. Of course, the Bitcoin network has some minor improvements, such as integration with Twitter or more mobile devices. However, if you're familiar with the crypto space, you know that "wallet aggregation" isn't going to be big news. It's just a bit of a split wallet, and it's not that some designers have rolled out fancy voting tokens.

Bitcoin is a ghost town compared to many other successful crypto tracks.

Ponzi scams, non-existent business

Oh, and not because Bitcoin is a Ponzi scheme.

The biggest Mimecoin of all time.

How can ordinary people make money on the Bitcoin network? No, mining has been around for too long.

The only way people can make money with bitcoin is to increase its value. You would buy it cheap and sell it to someone who is willing to pay more than you. Give, sell high and buy low.

And Bitcoin has always wanted “the other”.

At a market capitalization of $1 trillion, Bitcoin needs more “others”.

Why doesn't anyone know this is a Ponzi scheme?

Let's compare to Ethereum. On the Ethereum network, people also want prices to rise. However, this can be done, for example, by staking and then when the user uses the process (eg token exchange) and pays the price. Part of this cost is paid to the insurer's code number.

The concept of revenue sharing is almost identical to the distribution of goods in a business. It's not about the Ponzi scheme, it's about the product (and Ethereum).

The Bitcoin network clearly does not have this.

racine

But these two reasons are not the reasons why I am concerned about the stability of Bitcoin. It's not by users or (without) ecosystems, rather it's a ticking time bomb in the default functioning of the network.

I tried to explain this as easily as possible.

Like other sources of evidence, Bitcoin wants miners to continue. The miner performs the transactions and pockets paid by the user. However, miners are not mine due to exchange rates. Because exchange rates are so low. After all, Bitcoin is such a popular payment system that miners can't make money from exchange rates alone (yes, I swear).

This is why Bitcoin has block rewards. Bitcoin gives miners BTC on top of their prices. This is how the new BTC enters the world by blocking the rewards. As a result, Bitcoin network assets are only 21 million.

However, this gift block declines. Each time the miner's reward is halved, it is halved. For miners to benefit, the value of Bitcoin would need to more than double. It's easy if you have a retail value of $100 million. But at its current value, Bitcoin will have to trade millions of dollars to maintain its current value.

Bitcoin price increase has become incomplete.

So what will happen?

Failure to use these conditions results in lower rewards and exchange rates, which is the vortex of death. And ironically, the so-called Bitcoin ETF further deprives Bitcoin of time-trading (on-chain) like a traditional cryptocurrency.

When this happens, Bitcoin mining becomes unprofitable. Small miners will lose money because they cannot pay their electricity bills. This will place a handful of people in charge of the operation of the Bitcoin network and the security of its systems.

Imagine a time when the Bitcoin network eventually had 4 miners, large and small miners, equating to low decentralization. And 4 people are not allowed to talk about decentralization. We can go back to a time when only Satoshi Nakamoto and Hall Finney (the first to trade with Satoshi Nakamoto for bitcoin, one of the pioneers and developers of the bitcoin network) were mining. The difference is that there is now over $100 billion at stake.

Consider a new large miner appearing immediately with more capital and energy than the existing 2 miners (assuming 4 miners have the same power).

Already have the ability to strike 51%.

The last question no one wants to answer

What happened when Bitcoin's announcement finally fell to zero?

This is a question that no one wants to answer. I'll write more about the next question in the next bullet point.

The 21 million Bitcoin cap is a liability, not an asset.

Many prominent cryptocurrency analysts expressed concern long before the recent halving.

Some believe Bitcoin was destroyed and abandoned, which is part of why cryptocurrencies like Ethereum were born. There's no reason to fix something that's broken.

Ethereum has no maximum. Inflation protection is achieved by other means (after EIP-1559 they indicated a fire). Gift blocking is never reduced.

Among other things, Ethereum has developed the ability to use electronic devices instead of crypto: the programmable currency. Simply put, that's why we now have exchanges, loans, insurance, options companies and NFTs. These are products and services, a real business. And they also occur in chains.

But is it 21 million?

To be honest, no one can answer these questions because no one knows what will happen when all bitcoins are mined in 2140.

But 21 million people think it won't be enough, and some parties know it. People are getting more and more frustrated because there aren't enough cookies for everyone.

Expect to see wars affecting size, like this year's "Block Wars". Now this is the most advanced equipment.

Can Bitcoin's Highest Commodity Win? details.

It's just a line of rules. Add 0 and you're done.

Yes, changing a course of action is easy, but consensus is another matter. it's true The code can't be changed if people agree.

So that's also true. If everyone agrees, we can increase the maximum Bitcoin proceeds. However, the final decision rests with the individual. And when it comes to lust, human beings are wonderful.

Previously, there was no code change for War Block winners. A large block of 1MB is the goal (which deliberately slows Bitcoin down so it can't work much harder than smart contracts). Many other players are planning to create second-hand solutions to get their own slice of the pie. (Lighting and fluids are not solutions, but unfortunately they have not been completed so far).

This is how we get BTC and losses like BSV, BCH, etc.

Consider that at this point the raise is to redeem Bitcoin Code. If you do not accept the changes, your investment is void. They immediately agreed to change the law, and all the so-called "beliefs", "consensus" became meaningless. The greedy will do anything to protect their interests. by all means.

Needless to say, Bitcoin Core developers now rely on a support system to support their ongoing work. No one backs you unless you have corporate backing (no bitcoin foundation). It's a closed loop and not everyone can participate.

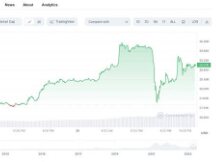

Currently, Bitcoin is struggling to maintain its ultimate dominance in the cryptocurrency market. Given the size of its store, there is still a long way to go before the blockchain finally raises its white flag.

Now the miners want my coins as much as possible because the gift block will always end at zero. Hikers and missionaries can pack their bags and do anything to stay alive.

Business pens like me, what can we do?

Your best bet by far is bitcoin.

After all, there are plenty of other options in the store. Ethereum is now a better retailer if that's your consequence. If what you are looking for is called monthly data, then other coins are better for you. Anything better than Bitcoin is good, even a meme.

Scan QR code with WeChat