XY Financial and GalaXY Kats Cross-Chain Trading Protocol

About XY Finance

Let's talk about XY Finance first.

This process is an interconnected process developed by Taiwanese cryptocurrency startup Steaker.Aim to address liquidity issues in the multi-chain ecosystem, facilitating and accelerating the exchange of crypto assets between different ecosystems.

As the name suggests, XY Finance is usually divided into two solutions: "X" and "Y".

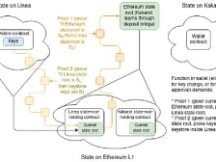

X is allowed to swap strings.X swab,Y is an inter-chain bridge based on a multi-chain pool.Waffle.

String Swap Completed After Build Completion - X Swap

Anyone who has ever built a chain on Ethereum, BSC, Polygon, Fantom and other networks knows how difficult it can be to find a chain connected to a sufficient and fast water supply.

No matter how painful it can be for new users, X Swap is specifically designed for this pain point.

X swap ouiIntegrated cross-chain trading platform developed through the integration of multiple interconnects and DEXs, can be understood as "an inch of cross-platform competition", allowing users to trade in different blockchains.

Whether it is "Convert USDT to Ethereum to USDT to BSC" or "Convert USDT to Ethereum to CAKE to BSC", these tasks can be accomplished with a single click through the XY Financial X Swap feature.

For users, just enter the transaction object and quantity, the system will automatically filter the link and DEXs, find all the way in the market, and provide the instructions and information methods for users.

Cross-chain fund pas dej ua ke, maximizing profits - Y Pas dej

Unlike X Swap, which deals with the exchange of chains by third-party revenue, Y Pool's solution isXY Esteem de Soi creates capital with a combination of funds, for X Swap users.

Lake Y liquidity service providers (LP) can receive exchange rates, and to support the cooperation of financial service providers, XY Financial announced the procedures for operating and setting up issuance operations of XY tokens as a financial aid provider. subsidies.

Moreover, improving the efficiency of Content Providers (LP) is one of Wipool's goals.

To this end, the team also developed YPool's Yield Optimization Greedy Algorithm (YOGA), which dynamically divides YPool's money between "pool" and "human loan" to be more efficient on the quality of the investment. .

Moreover, the most dangerous thing in a money-sharing company like YPool is "unreliability".

Use the USDT pool in the figure below as an example.Whichever chain works, the USDT provided by financial service providers is divided into segments.With a capital of 3 chains: Ethereum, BSC and Polygon.

When many users converted USDT from BSC and Polygon to Ethereum, Ethereum's USDT pool was exhausted and there was not enough money to know "USDT on BSC to Polygon exchange ".

For this, XY Finance has developed a "rebalancing mechanism", as long as the revenue provider calls for recovery, part of Polygon's BSC and USDT have been converted to Ethereum's USDT by X. Swap and can be placed in Y Lake as one. . Click on. ~

At the same time, the financial service provider will receive XYtokens as a gift after calling the recovery function (the more unreliable, the higher the reward).

Symbolic economy

Maybe most people want to know the information about XY financial symbols.

XY token holders can close their XY tokens in the veXY smart contract (closing time is optional regardless of 1 month, 3 months, 6 months, 1 year and 4 years). Curve Finance has the following post-closing benefits:

Self-management protocol, you can vote to change improvements and non-significant factors such as I/O rate coefficients, DAO reserves used, protocol changes, etc.

After locking XY tokens, you can increase the efficiency of liquid mining., and the longer the time of closure, the greater the revenue from mining.

At the same time, XY Financial has also invested heavily in the token industry to capture the growth of XY Financial with XY tokens.

Special:

"XS wap processing fee" + "20% of YPool operating costs (remaining 80% owned by LP)" total revenue in contract.

40% of the protocol funds will be SAFU funds directly from DAO, and an additional 60% will be used to redeem XYtoken.

Of the returned XY tokens, 50% will go to DAO for management and another 50% will be burned permanently.

GalaXY Kats> GameFi NFT

In addition to the two solutions of X Swap and Y Lake, the XY financial ecosystem also includes a small project, GalaXY Kats, based on the concept of the NFT application.

Galactic Cats

GalaXY Kats was launched by an independent Taiwanese artist and XY Financial Group.Projet NFT, a total of 10,000 GalaXY Kats (meerkat) special NFTs will be released.

Unlike the current NFT feature which can only be used as a Community Avatar (PFP) and not available, the main focus of GalaXY Kats isNFT that combines 'functionality' and 'playability'.

First, let's look at the features. Besides being an NFT collection, GalaXY Kats is close to the design based on XY Financial.

Notably, these 10,000 NFT Interstellar Meerkat are made from a variety of colors, including clothes, backgrounds, and easy-to-carry accessories, each with a unique design yes (eg red hair is less common than other hair colors). The higher the material of NFT, the higher their cost.

At the same time, the NFT itself suggests that other special operations be allowed to its employees when using the services opposite its parent company, XY Financial.Airdrop of tokens, exchange rates, interest rates, etc., the strength of a feature depends on its rarity.

Stopped,Meerkat NFT is the VIP level of XY Finance., you can get special discount, less Meerkat NFT, the higher the VIP level, the higher the VIP level, the more discount you can get.

In terms of games, the team will be releasing new gear for future Meerkat gear, including the "Play to Earn" game GalaXY Kats (still slated for release in 2022, according to the latest experience release announcement). Question 1).

Thus, GalaXY Kats can be seen as an NFT project that simultaneously combines the elements of GameFi and DeFi.

According to the information on the website, the operations of GalaXY Kats mentioned above will gradually open as the products are stocked in Opensea.

Chain Gold Trader Summary

XY Financial Solution overlaps with its competitors O3 Swap, but O3 Swap has not grown well since the last protest due to security concerns.

Additionally, the combination of XY Financial's smaller plans, GalaXY Kats and XY Financial, allows membership of XY Financial products with new designs that O3 Swap does not have.

However, in the case of the interconnection of chains, the most importantRapid integration of various ecosystems, which can enter the key ecosystem before the next wave of public channels or the 2nd layer eruption will have the opportunity to secure the distribution of business and obtain the quantity and revenue from users.

Ronin, Avalanche, Arbitrum and some of the other Ethereum Layer 2 are currently not supported on O3 Swap. If XY Finance could capture the O3 Swap integration, it would cause a very large queue.

Scan QR code with WeChat