Sell below the market settlement price for a fair price

When sellers want to sell a stable range of products in high demand, one option they usually choose is to set a good price below "the market can be avoided".

As a result, products sell out quickly and lucky buyers are early buyers. This has happened several times in the Ethereum ecosystem, especially in NFT sales and token sales. But as is often the case, concerts and restaurants often choose the same thing: by lowering the price, seats sell out faster or customers wait longer.

Economists have been asking these questions for a long time. Why do sellers do this? Market capitalization theory says that the best sells in the market at the clearing price, i.e. the value of buyers willing to be as much as sellers willing to sell. If the seller does not know the market price, he must sell it by bidding and let the market decide the price. Selling below not only sacrifices the seller's revenue, but also hurts the buyer. Products sell out so quickly that many buyers may not have time to buy them no matter how badly they want them. I'm willing to pay for it. Sometimes the competition created by distribution processes without added value can create external negative effects that cause damage to third parties. This particularly affects the Ethereum ecosystem.

However, the fact that prices are even lower in the market is a strong indication that sellers are able to do just that. In fact, most of the reasons, as content research over the past few years has revealed. It is therefore worth asking:Is there a fair, more cost-effective, safer way to achieve the same goal?

Selling for less than the market pullback has its downsides and drawbacks.

If the seller is under-selling or under-priced, there is an easy way for anyone who really needs it. You can pay the fees or, in the event of a competition, bet the prize. When a seller sells an item for less than the market price, demand exceeds the item, so some people get the product and some don't. However, the process of determining who gets the item is clearly not random and generally has little to do with the need for the item participant. Sometimes you have to press the button faster than others. Other times include getting up at 2 a.m. (but until 11 p.m. or 2 p.m. at other times). At other times, it becomes a "different race", a more competitive, less productive and more negative competition.

There are many clear examples of this in the Ethereum ecosystem. Let's first look at the ICO boom in 2017. In 2017, several companies were launched to launch coins (ICO), and the general structure is as follows:restricted sales: The project will just start selling at a special time by setting the maximum token value and the number of tokens that will be sold. The sale ends when the number of tokens reaches the limit.

What is the result? In practice, these sales seem to close in 30 seconds. When the sales started (or just before), everyone started sending companies to join and offered higher prices to encourage miners to join the trade first. This is a contest by any other name. Only the revenue goes to the miners and not to the token seller, and in the selling process there is a negative external problem that increases the cost of all other applications in the chain.

The most expensive BAT transaction is 580,000 gwei, requiring a value of $6,600 to include in the exchange.

Since then, many ICOs have tried various strategies to avoid these competitive costs, exceeding 50 gwei. But that doesn't solve the problem. Customers trying to trick the system have sent many companies hoping that at least one will ship to the system. Competition from other names further blocks the chain.

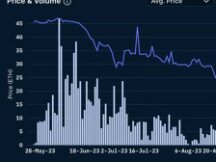

ICOs have been popular recently, but NFTs and selling NFTs are very popular now.Unfortunately, the NFT site did not study the information of 2017 and achieved stable sales of fixed assets like ICOs (see for example the announcement of the position on lines 97-108 of this agreement). What is the result?

And it's not the biggest, but some NFT sales pushed fuel prices up to 2000gwei.

I say,Naturally high fuel prices encourage consumers to stay ahead by sending more exchange rates.Another name is auctions, which, as before, cost all other apps in 15 minutes.

Why do sellers sometimes sell below market value?

Selling below market value is not a new phenomenon in and out of the blockchain space, and over the years many books, articles, and podcasts have been written (sometimes with great intensity) regarding the denial of Use auctions or set the value of in- store advice. Yes).

Many arguments are similar between examples in the blockchain space (NFTs and ICOs) and outside the blockchain space (popular restaurants and concerts). The emphasis is on integrity and not wanting to block the poor, lose fans, or create stress thinking it's greed. A 1986 article by Kahneman, Knetsch and Thaler explains well how an understanding of justice and greed influences these decisions. As I personally remember from the 2017 ICO season, the desire to avoid greedy thoughts is also a decisive measure against the use of tools such as competition (I see the links, but here there is doesn't have a lot of space, they mainly rely on memory, parody . .

In addition to the question of justice, there is the long-standing controversy,In other words, commercial products and long queues create a reputation that makes the product attractive to others.Of course, in the rational actor model, the high value should be the same as a long queue, but in reality a long queue is more pronounced than the high value. This applies to ICOs and NFTs as well as restaurants. In addition to benefiting more from these strategies, some people find that they enjoy playing or watching a game that is stolen a lot of time before others steal less time.

However, some of the blocks of chain has a specified character. An application for sale ICO loops in the market (also using the soft idea to persuade the Omiseon group) Strong communities are associated with token advertising. The simplest rules of mind management in the community are simple. You want the price to go up, not down. Neighbors rejoice when they are "green". However, if the price is lower than what your neighbors will buy and you leave a loss, they will be unhappy and start calling you a liar. It can interfere in relationships where everyone thinks you're a liar.

The only way to avoid this impact is to set the sale price low enough that the after sale price will almost certainly increase.But how can you do that without the obstacles that lead to competition the other way?

extend solutions

This year is 2021. We have blockchain. Blockchain not only includes the strong power of the financial management ecosystem, but also the many categories of non-financial products. Blockchain also offers a unique opportunity to reset relational relationships. Uber has been subject to price increases, despite years of failing what the industry calls "performance." Of course, there is no competition with the difference between a competitive point of sale in the market and a sale in store (and perhaps in the second we can use the right tools to establish a sense of justice for the problem). auctions and fixed price).

First, let's set our goals. We will try to cover all (i) ICOs, (ii) NFTs and (iii) conference tickets (actually NFTs). Most items should be shared by all three.

1. Process:Don't exclude low-income people through mainstreaming, but at least give them time. In the case of a token sale, there is a related goal, although different from that of avoiding the first concentration of wealth and having a large and diverse community.

2. Do not create competition:Don't create a situation where many people are rushing to do the same thing and only a few people can get it for the first time (it's the situation seen above that makes the race dangerous).

3. No detailed understanding of the market is required.This process should work even if the seller doesn't know how much they need.

4. Interests:Participating in sales should also be fun and playful, but don't stress.

5. Give positive feedback to customers:In the case of tokens (or NFTs), buyers are more likely to see an increase in the price of the product rather than a loss. This inevitably means selling to the buyer at less than the market price.

You can see (1) in advance. From Ethereum's point of view, there is a clear solution. Change the direction of race design using targeted design tools to complete the project. Proof name protocol! Its very important. Here is a quick guide mechanism.

Mechanism 1: Each participant (identified by ID) can buy up to X units at a value P, and if he wants to buy more, he can buy at a competitive price.

It provides equity in terms of a person, and if the auction price is higher than P, the buyer will receive a good return on the part sold by an equity mechanism, and the auction seems to have reached many goals otherwise. Inform suppliers of the level of demand. What Races Can You Avoid? If the number of participants per buyer is not high, it will be like this. But what if so many people find that not all pools are big enough to share?

I have an idea. Make each distribution auto-dynamic.

Mechanism 2: Any participant (in particular by self-identification) can declare interest on X tokens by depositing in a smart card. Finally, each customer receives a minimum token (X, N / number_of_buyers). where N is the total amount of silver sold by the pool per person (some of the silver is also sold via sale). Any customer deposit greater than the amount required to purchase quota will be returned to the customer.

Now, no matter how many clients are trading through a pool of men, there is no competition. Whatever the request, early participation is never better than late participation.

If you want to make game mechanics smarter and use nicer square patterns, I have another idea.

Mechanism 3: Each participant (created by self-proof) can buy X units at the price of P*X^2, and each customer can buy up to C tokens. C starts with a small number and increases over time until there are enough sales.

This process has particular interesting properties. If you manage tokens (don't, it's an anti-disaster trick), the money distributed to each customer is the best and ultimately reduces the exchange rate after sale. This optimality over time. Mechanisms 2 and 3 seem to meet all of the above objectives, at least to some extent. It doesn't have to be perfect or ideal, but it's a good starting point.

I still have questions. For NFTs with limited resources and stable equipment, there may be a problem with the equivalent of buying a participant (in mechanism 2, the number of customers > N, while in mechanism 3, C is set to 1, resulting in sufficient demand). It oversubscribes to sell.) In this case, you may be able to provide a lottery ticket for the most part. If you have N products, then registration will be granted to you or give N/number_of_buyers a chance to receive or receive an item. money back. For reunions, groups that want to reunite can bind a lottery ticket to ensure victory or defeat. The possibility of obtaining items with the latest novelties can be sold at the auction house.

A proposed strategy for conference tickets is to hide a pool of ticket sales at a market price based on the lowest "support" level. Support logs can have many faces, but...right? After all, the EthCC Sponsorship Committee has the face of John Lilic!

In all these cases, the key to the solution is simple. To be honest with people, procedures must measure the accuracy of human ideas.proof of proof(Can be combined with zero-proof proof to ensure confidentiality if required). so,We must provide the best value in the market and competitive prices with the equal value of the proof of concept process.

answer a few questions

Q: Will there be more customers through similar services and will they be sold immediately, with no interest in your project?

A: First, maybe not. In fact, this metagame takes time to appear. However, when there is a market slump, one downside is turning it off over time. This works well because you cannot change your personal identification number. You can use your face to confirm that your old number has been stolen, and you, including everything in it, should be forwarded to your new number.

Q: What if I want my products to come from a specific community in addition to the public?

A: Change the Personal ID to the community involvement symbol. Another way, with equal and playful values, consists in enclosing certain objects in a solution of an open puzzle.

Q: How do I know if people will accept this? People fought against foreigners and reformers in the past.

A: It's very difficult to get people to latch onto new ideas that they see differently, and to get scientists to write what they "need" for "performance" (or "righteousness"). "). However, rapid changes in the environment can do a good job of restoring people's existing expectations. so,If there is a good opportunity to try this, then the blockchain space is here.You can wait for the "metaverse", however, the best version of the metaverse will usually work on Ethereum, so it's a good idea to start now.

Scan QR code with WeChat