Gambling 2022: Many Commercial Companies Will Be First To Enter The Crypto Market

2021 is a banner year for the cryptocurrency market and businesses and investors have taken advantage of it for some. For most analysts and industry insiders, 2022 will be another year of growth in the adoption of crypto assets in both niche and potential automotive markets and in finance. ~

This article gives the perspective of many people in the crypto industry to predict the news for 2022 from our perspective:

Defier:

Reshaping the DeFi market advantage based on investors and management expectations.

DAOs can join more in DeFi.

We will see market share and revenue of NFT-related products in 2022.

Integration of DeFi and blockchain games.

Cryptocurrency Industry Rules:

Small countries can take the initiative to regulate the crypto industry.

A good way to manage crypto assets should emerge.

Finances are always a matter of fair competition as a rule.

Trading with a smart chain contract often does not follow the key points.

There may be more debate on whether sports income is taxable in the NFT industry.

Venture Capital Companies:

Business enterprises have always known that encryption is the next wave of technology.

Traders will focus on Metaverse, Web 3, DeFi, NFT and blockchain games.

Now, metaverse impact campaigns need to improve their relationships to get more investments.

An important question remains. Will the involvement of venture capital funds in the crypto market make the SEC safer for dealing with crypto assets?

DeFi Trends in 2022

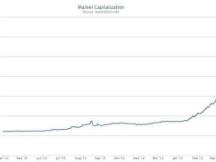

Decentralized finance (DeFi) saw strong growth in 2021 and supported the growth of the crypto industry in general, which in the past has had an impact. According to Defi Llama, total closing costs on the DeFi site are currently over $240 billion.

DeFi is expected to continue through 2022, with significant growth in many areas of DeFi, from hydrology to mining and agriculture to decentralized autonomous organizations (DAOs), decentralized exchanges (DEX ) and DeFi NFTs. ~

Continuous growth, adding new users

As of this writing, the cryptocurrency market is in decline. The question therefore cannot arise. Can DeFi grow this year?

Brad Yasar, CEO of EQIFI Lending Protocol, said: "Even beyond 2020, the 2021 outbreak will continue to affect our daily lives and our ability to earn a living and stay open. Global trade/financial markets To achieve greater profitability in 2022 as businesses and financial services companies are increasingly aware that using certain DeFi standards will increase their growth faster and better serve their customers.

According to Yasar, the macro virus market brought more people to DeFi, which increased the capital of DeFi and the crypto industry, as well as the involvement of financial institutions. . ~

Similarly, Timo Lehes, founder of Swarm Markets, predicts that tokenization assets, clear management and lower transaction costs will lead to a major shift in DeFi in 2022.

“Bringing more global assets and financial assets (including securities) to the chain will greatly expand the DeFi ecosystem and attract more investors and investors. DeFi offers There are more ways that companies can n never have and there's a lot of things that they can benefit from and promote. Those types of assets. People who are more independent."

Other industry data shows that by 2022, DeFi will be popular among non-cryptocurrency users. AllianceBlock CEO Rachid Ajaja says:

Globally, according to a survey by Goldman Sachs Research, around 15% of family businesses have some knowledge of cryptocurrency, while 7 out of 10 consultants globally have spoken to consumers about crypto assets, according to the research. , I said yes., a few years ago. "

DeFi rules will become a reality in 2022

Ajaja also noted that one of the biggest issues for DeFi adoption today is compliance and regulation. Fortunately, there is a chance that DeFi will follow, believing that 2022 will become a reality. For example, future regulation of the cryptocurrency market (MiCA) in the EU will have a major impact on DeFi sites. The US SEC will also perform additional inspections that would require the DeFi protocol to improve compliance.

“For the DeFi protocol to meet these requirements and take into account the real benefits of governance, cross-border collaboration and the need for KYC/AML. Centralized crypto exchanges and decentralized DeFi exchanges, Wallets with KYC integrated into [know-you - users, KYC] and [Anti-Money Laundering, AML] would support building DeFi for the next year.”

Timo Lehes also agreed that the rule would be a priority in 2022. “The good news is that some policymakers, like Germany, have made crypto assets compliant with regulatory requirements. Existing security. opportunities in the presence of investors and managers.”

DappRadar CDO Dragos Dunica believes that dealing with the issues facing DeFi in 2022 could be huge, but good work has been done to resolve the issues.

"I think DeFi will do everything it can to meet its own needs and become a real competitor for CeFi [the middle ground]."

more and more products

Assuming that the DeFi site can eliminate more and more administrative problems by 2022, it will be able to provide more users.

Timo Lehes believes that “in 2022, NFTs will turn into an asset with fundamental value and we will see a positive product based on the mix of DeFi”.

According to Lehes, “In 2022, we expect DAOs to be key players in the crypto industry, including consumer protection, DeFi, and NFT.”

One of the most promising companies in the crypto industry in 2021 is Axie Infinity, which grew its daily users from 38,000 in April to 2.7 million in mid-November. The increase in the number of users is also encouraging the development of GameFi, and DeFi is a fact of that.

Dragos Dunica believes, “Seeing the success of Axie Infinity and Alien Worlds, we look forward to further growth in financial competition and friendships. Gamification has attracted an increasing number of people. any height, with over "over 2 million." Wallets are active in October." There is this. Further integration of DeFi and blockchain games is planned in 2022 to provide a more immersive experience for users. "

part

While the predictions above cover the outlook for DeFi in 2022, it should be noted that the industry is now in its infancy and growing rapidly. So the most interesting thing is not what will happen, but what will not be expected. guess.

The rules of the cryptocurrency industry however in 2022

As in 2021, 2022 will see more features of crypto assets in certain countries (like El Salvador) and stricter regimes (like China). However, some insiders are predicting that most of the rules that come into effect in 2022 will support more economies as many countries and agency leaders begin to realize cryptoassets.

Meanwhile, industry insiders say regulators will start regulating certain areas of the crypto industry in 2022, with a focus on fixed funds, NFTs and DeFi. Although some members of the crypto community may be surprised by the introduction of various policies, the introduction of anti-cryptocurrency measures could have a positive impact on the crypto industry.

Forecast and achievement 2021

By November 2020, insiders predict that the use of crypto by 2021 will explode. This is often the case, and it seems that most countries are still discussing and discussing cryptocurrency assets, except for countries like Ukraine, Cuba, and El Salvador.

They also believe that the United States will introduce cryptocurrency by 2021. Some states have declared their own statewide policies, but the government has been slow to implement this fact.

The rules will evolve towards reform.

DappRadar CEO Skirmantas Januškas said in an interview that the crypto industry will continue to be dominated by foreign regulators in 2022. For him, this is largely because crypto assets are driven by the request below.

"The demand below is likely to be higher in countries with weak economic models, high inflation or limited access to global markets."

CryptoUK CEO Ian Taylor hopes the differences in approach to governance will be further highlighted in 2022, with significant differences between East and West.

"Western countries do not restrict cryptocurrencies because they see other countries ban them frequently. This shows that different regimes can be affected by the use of different crypto devices seen in many parts of the world. This shows, for example, that Bitcoin (BTC) is often "used as an investment in Western countries. In Asia and other developed countries, data can be used for more than just payments, especially for money transfers. "

Skirmantas Januškas believes that by 2022, any country will adopt the new crypto rules, which will be a small country that will increase the popularity of the cryptocurrency market.

Although some countries may create restrictions on the crypto market, insiders predict that broader regulatory rules will lead to more profitable crypto assets with blockage protection.

Etherisc legal counsel, Jan Stockhausen, said: "When it comes to blockchain technology, administrators will soon be aware of the realities that blockchain-based smart contracts can help protect merchants and prevent fraud. I think you'll know, "Sometimes you do. the same that follows without him. Whether that will happen as early as 2022 remains to be seen, but industry insiders have been hard at work informing regulators of blockchain technology opportunities. "

The evolving complexity of the crypto industry

As one of the specialized areas of the crypto industry, the stablecoin has received international attention, with the United States, United Kingdom, and European Union (EU) particularly committed to controlling the stable currency. ~

According to Ian Taylor, most legislations have already risen sharply in terms of legislation and more legislations will go through the fixed coin by 2022.

He said: "Companies with a stable profit in the UK will be considered e-money institutions," he said.

In the EU, Crypto Market Regulation (MiCA) will provide similar safeguards in the UK for securities traders. In the United States, regulators have made their voices heard on the coin, and the chairman of the Financial Institutions Task Force has said repeatedly over the past year that oversight of the coin needs more power.

Besides fixed funds, another area that will be covered in 2022 is NFTs. NFTs are now worth thousands of dollars from businesses like DeFi that have become too big to ignore.

Skirmantas Januškas said, "I would like to see the discussion unfold about whether NFTs are safe, even if trading in NFT products is taxed, and whether revenue from 'gameplay' can be considered income. It accounts for half of Dapps financial performance, and in countries like the Philippines, their contribution to GDP per capita could start that conversation. »

part

The above estimates show that the crypto industry is not fully covered by certain regulations. Since it often transcends financial and legal constraints, it may take some time for lawmakers to implement the rules that establish the rules that ensure the crypto industry has been exploring for many years.

That said, there could be new regulations in 2022, but don't expect regulatory issues in the crypto industry to be fully resolved in 12 months.

Venture Capital Trends to 2022

The crypto industry is very dependent on capital. It increases the value of funds for blockchain platforms and developers through indirect funding by investors purchasing crypto assets, including funding in the form of various token release transactions and financial personalities that we see.

Cryptocurrency has evolved over the past few years as the initial coin wave (1C0) of 2017 and 2019 gradually shifts towards traditional capital (VC). By 2021, more VCs and revenue companies will move into crypto and blockchain with a focus on Web3 verticals such as Metaverse, DeFi, and blockchain gaming.

Many VCs are entering the crypto market

2021 could be a busy year for crypto assets in terms of the market, but it will also be a banner year for more VCs.

According to PitchBook, by 2021, investment capital will have invested up to $30 billion in the crypto and blockchain companies involved. That's more than four times the 2018 record and more than next year combined.

These revenues have created a new pattern for the industry, with a total of $30 billion more than the data set by ICOs in 2018 (around $11-22 billion). We will see more work to do to find investment funds in 2022 as the SEC sues Ripple for investing public funds in unregistered funds.

According to Mark Jeffrey, General Partner of the Boolean Fund and Founder of the Guardian Circle, "Mature VCs should now recognize that encryption is the next wave of technology, like the internet, and investment. They have no choice."

"It would be detrimental for the VC to forget about Google, Amazon or Facebook in the future, especially when they have already lost 1C0 on ETHereum (ETH), which could be a huge investment. One thing in history. So in 2022, VC. Interest rates will accelerate.

Analysts working in the crypto industry agree that many companies have traditionally entered the crypto industry this year.

Andy Lian, Senior Advisor at cryptocurrency exchange BigONE, said: “Yes, we are seeing more and more money flowing into the cryptocurrency world, especially family offices and real estate.” , said Andy Lian, digital rights expert at exchange BigONE.

Objectif : Metaverse, Chain Games, NFT, DeFi

Assuming more investors and businesses enter the cryptocurrency market, what goals do you typically focus on?

According to Kerner, "The metaverse is currently the most popular domain and this pattern will continue through 2022. However, the entire crypto industry is still in its infancy and investments in Everywhere, including the blockchain, will grow, L1 and L2, DeFi and NFT.

Mark Jeffrey also hinted that Metaverse will be the main target for venture capitalists in 2022, but he now thinks that Metaverse-related activities will be needed to improve the relationship platform like the big bucks.

“If you enter the virtual world of Decentraland, you will see that there are between 500 and 1,000 people online, but no one is talking to each other. They are all walking around, looking on the spot and, of course, buying land and clothes, supplies, but that's all."

Jeffrey predicts that the model won't be secure unless it goes social and people can't spend time communicating online like they do on social media such as Twitter and Facebook. ~

“With developers paying more for ad relationships, hopefully something explodes. Once achieved, this will create a huge opportunity for millions or hundreds of millions of dollars in the NFT and crypto industry.”

Metaverse-connected blockchain games will be another hot spot for VCs in 2022.

Jeffrey thinks, "Like the success of Axie Infinity, the P2E gaming space seems huge. The gameplay isn't like that, but it's grown in popularity."

custom problems

An important question remains. Does the SEC prefer to treat crypto assets as security if investor involvement in the crypto industry increases? This seems to appreciate Howey's testing as VCs will still be tokens in anticipation of the development platform.

(The Howey Test is used to determine if a product is a "contract investment" under the law. "A person invests their money in a contract, business, or plan to benefit from your efforts.")

For Anndy Lian, this is a difficult question to answer because it depends on so many differences.

"The large number of people who are self-investing in cryptocurrency does not mean that regulators will treat these investments as safe. It depends on the nature of the project on which the VC receives the capital, and ultimately they create the process . "

Site:

CryptoNews, Wikipédia, BainCrypto

Scan QR code with WeChat