Rothschild Investments GBTC Based on Gold Yields

Rothschild Investments, a leading Chicago-based financial services firm founded in 1908, has made a significant investment in Grayscale's Bitcoin Trust, according to data from the United States Securities and Exchange Commission on Monday morning.

According to Form 13F-HR, Institutional Manager Shareholding Report,As of December 31, 2020, Rothschild Investments held 30,454 shares of GBTC.In October, the company said it held 24,500 shares.

BTC Reviews:

In a statement to the SEC this morning, Rothschild Investments, acquired in 1908, said it held 30,454 shares of GBTC.

In a statement before October, the company held 24,500 shares.

File link: https://t.co/AC3rvwgnwr

- MacroScope (@ MacroScope17) 25 janvier 2021 »

According to the company's website, Rothschild Investments was established in 1908 as the Rothschild Company. Founder Monroe Rothschild and his grandson Samuel Karger used the company as a full-time employee. However, according to Bloomberg, he was not part of the Rothschild dynasty.

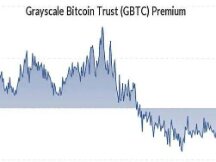

GBTC refers to a listed product in Greyscale's preferred Bitcoin Trust, which currently manages over $20 billion in assets.In the fourth quarter, GBTC's weekly average hit an all-time high of $217.1 million.

"Hloov kho 01/22/21: NAV, equity per share and price per share for our investments.

Total assets under management: $24.2 billion

- Grayscale (@grey levels) January 22, 2021 »

GBTC is currently trading below $ 34.00 per share.

Rothschild increased his exposure to Bitcoin at a critical juncture in the cryptocurrency bull market.Bitcoin traded nearly three times in the quarter and hit $ 42,000 in January. While the price order has been a bit cool, the BTC price is currently hovering around $ 34,000 at the time of writing.

The Cryptocurrency Manager is one of the many key player organizations that have entered the cryptocurrency industry over the past year. These patterns are expected to continue as central banks and governments expand their finances to support a gap after a widespread gap.In this context, Bitcoin is increasingly recognized as an inflation hedge currency.

Digital assets will be the hottest topic on Davos' agenda this week. The conference, hosted by the World Economic Forum, consisted of two sessions focused on “recapturing digital advantages”. While the discussion will focus on the Digital Credit Crisis (CBDC), it will expand on Bitcoin's impact on the traditional financial system.

Scan QR code with WeChat