End Market Guide for NFTs: 6 Dimensions of How NFT Can Be a Safe Value

There are countless investment traps behind the success of the NFT industry, and for the little ones mentioned in this article this will be an easy test site to assess whether the NFT project is worth investing in for the long term.

According to the real data at the NFScan Browser, 39.43 million NFT products are recommended in January 14, 2022, and NFF assets are listed as 64.73 million. The number of addressed envelopes that associated with that is 37.97 million. In addition, the number of king's rats are more valuable and average is added at the rapid of 100,000 a day. No doubt, the focus is the new and new industry development.

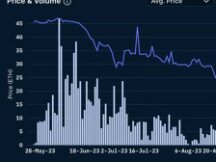

In 2021, the NFT field paved the way for heavy goods vehicles. Every day we open our eyes and see a new face. From Cryptopunks to the Bored Ape Yacht Club (BAYC), from JPG avatars to Loot Programmable Assets, and from Land to the Metaverse, NFT sites have never stopped innovating. Whether short or out of reach, areas of NFT, connected to new blood vessels, can be surprising. After the ups and downs of the market, there are only a handful of NFT projects that can be resolved and improved upon. The figure below shows the leaders in the field of NFT.

According to current data, 29,570 smart contracts exported from Ethereum correspond to more than 30 of the top NFT devices currently on the market, so the completion rate of NFT operations is only 0.1%. If you think about it, that number is staggering, out of 1,000 NFT assets, only a good NFT project can produce a worthwhile investment. For the average trader, this figure means that after the success of the NFT sector, countless investment pitfalls lie ahead. Therefore, based on this, we would like to share some past experiences that we think are useful from the perspective of leading experts in the field of NFTs and NFT traders. .

How to determine if an NFT project can improve to become the best blue chip, I think can be identified in the following.

Expression of Interest: I love and have a Doodles service which in my opinion is a business measure. Therefore, in the following terms, I will sometimes use Doodles as an example to help understand and explain.

Standard Procedures for NFT Assets

Currently, most of the legacy NFT protocols are the ERC-721 and ERC-1155 protocols. NFT assets with robust capabilities are typically the ERC-721 protocol, while the ERC-1155 protocol is more prone to NFT industry scenarios with ruggedized equipment. .

For the NFT legacy protocol, it is typically inspected at the NFT asset contract level to determine if it is ERC-721 compliant. Here are some bad things. Cryptopunk does not follow the development process in time due to the initial distribution of the asset contract code, and the result can be explained by four drawbacks. Cryptopunk is not an ERC-20 token-type asset or an ERC-721 Model NFT-type asset, and also has its own built-in trading capabilities. This forces the following NFT frameworks including Opensea and NFTSCAN to be integrated, which creates a lot of problems for developers.

Therefore, the models modeling for NFT resources are based on the following. The equipment recommended at the NFT method follows the ERC-721 model protocol and build the basis for future improvements.

How to Store NFT Asset Metadata

It doesn't matter that NFT can access metadata if it's just a receipt or a certificate, but most of the NFT assets we pass are now eligible for value. . This is a very important factor that is an integral part of NFT as an investment asset.

According to NFTSCAN data analysis, there are currently four ways to store NFT asset metadata.

It is stored in blocks on the blockchain network.Base64 general type: data: image/svg xml; base64, PHN2ZyB3aWR0aD0iMjkwIiBoZ…

For example, LP NFTs on Cryptopunk and Uniswap V3 are stored in blocks, which is the most secure way.

It is stored on the node server according to the IPFS protocol.Format : QmYBYWMwGcyn1GoettFnn4yzpzRUwtaYrt3XscsxcyN6hD

For example, Doodles, BAYC and other large companies use IPFS protocol storage and are highly secure.

Centralized server, stored on multiple cloud servers. The general formats are:

It's the best and cheapest way to store.

There are also a few projects that use the Arweave network for storage.

The classifications above show that the retention of NFT inventory metadata is not uniform and is not standardized. At the same time, such large data, not the NFT standard, cause many problems for manufacturers in the industry, require large personnel investment and computational effort to identify data and establish design standards. Recently, Networks worked with Protocol Labs and a third NFTSCAN team to develop an IPFS integration of NFT asset metadata and create access protocols. Going forward, NFTSCAN Open API developers will benefit from these benefits.

Degree of broadcast rights of NFT works developers

The level of legal dissemination is important to the NFT Project community as it reflects the leadership and further development of the NFT community. If fully regulated, it would be difficult for the community to grow as an NFT asset even in the second stage of development or commercialization.

There are three types of legal notices:

Copyright is completely open.In other words, the law is the owner of the NFT, and whoever owns the NFT property is the owner of the NFT equipment and can do business. An example is BAYC NFT.

The design team has all the rights.NFT insurers may not be satisfied with the rights of the assets contained in the NFT assets. An exception is CryptoPunks.

Team building restrictions on civil rights.Allows NFT holders to perform small-scale trading experiments. One exception is Doodles, which allows businesses to try for less than $100,000.

Of course, we go for fully open legal NFT activities, closer to the blockchain theme and more popular with the community!

The scalability of the content of the NFT tool itself

I got Doodles and Jaylen Bear PhantaBear together and everyone will understand what that means.

Obviously, the main theme of Doodles NFT is its ability to be effective, unique and very attractive. However, unlike PhantaBear, the scalability is also poor and not even scalable. Some people here can say that I am applauded and Jaylen did well. If there is, it can be said that Jay Bear's success isn't in the design of the NFT itself, it's the key to Jay whether he's a bear or whatever. other animal.

Ability to work in a team on an NFT project

We all know that peer-to-peer tokens are more cash-dependent; In the case of NFTs, they rely on Web2 traffic because they are not inherited. Yes, I just read internet traffic. Because there is enough traffic and the product is visible, you can change a lot of buying power. In verse 4 I mentioned that Jaylen Bear was a bad book, and here is the success story of Jaylen Bear. We see the so-called success because Jaylen Bear captured Jaylen's power and drive.

The functional capabilities of the NFT project team demonstrate its ability to detect vehicles. How you stand out from the 1,000 NFT projects in this complex NFT marketplace depends not only on the quality of the NFT itself, but also on the capital of your team.

We all know that blockchain networks and processes are basically made up of a cooling system and this product is very objective. Transportation and investing cannot be accomplished in an amazing process, but they can transport bears like Jaylen to the skies. Since the end is not the goal, his life is made up of details.

Financial assets of NFT assets

The financial characteristics mentioned here are directly related to the benefits of holding NFT assets in this position.

There are generally two types of benefits.Right to dividend

A license is a permit or PASS for a specific event that can be obtained by owning the NFT tool. Income policy refers to income from investments or distributions that can be earned through the availability of NFT assets.

Here is an example of Doodles with DoodleBank for price capture and revenue distribution.

Product of the Doodle project in the market and product of the export to Doodle Bank. Of course, there are many sources of income that are not described here.

Therefore, the most important step in the research of the NFT project is to analyze the finances of NFT assets to determine whether they can generate value and security. Moreover, the strength of the fund is directly in the measure of the NFT itself. The stronger the financial quality, the more popular the NFT assets are in the market and the greater the potential for aversion.

Most NFT assets are bullish bullish and bearish bullish stocks. That is, the property when there is traffic and the plane when there is no traffic. So how can we change this situation? Then actively improve your financial resources when NFT assets are financially strong, they will still be business assets and not run out.

In summary, the 6 points above are a simple checklist for determining if an NFT project is worth the long-term investment.

Additionally, NFT tools are durable tools that are not specialized fluids, so they require patience and perseverance. When the car arrives, you have to take heart, and performance can affect the value of an investment.

Scan QR code with WeChat