Take a look at the details of the Free Payment Debt Consolidation Agreement

Note from Mars Finance: From October 2021, Element Finance, a fixed rate loan, will be announced by Polychain Capital, venture capitalist Andreessen Horowitz, Placeholder, A_Capital, Scalar Capital and its subsidiaries. New venture capitalists Advanced Blockchain, Republic, Rarestone, Yunt Capital, P2P Validator, Ethereal Ventures and private investors from DeFi Global have joined forces with the sponsor, Rune Christensen, founder of Femboy Capital and MakerDAO, and Stani Kulechov, founder and CEO of Aave. , the revenues will be used to improve solutions and expand the size of the team to constantly innovate. Going forward, Element's administration will continue to be developed and efforts will be made to improve the overall user experience of the platform. At the same time, Element will present new product ideas and pursue important research.

(1. Introduction

(1. Overview:

Element Finance is a platform that allows users to find stable value in the DeFi market, initially focusing on ETH, BTC, USDC, and DAI.

Users will be able to reduce access through Element's ecosystem and existing AMMs, ETH, BTC, USDC and DAI with no close times, allowing them to trade their assets and assets at a discounted price.

For active DeFi users, the Element protocol allows them to make investments in their depository platform, such as Yearn Pool or ETH2 staking.

Users can sell the Manager at a discounted price for fixed income securities while maximizing or increasing liquidity without liquidation risk.

This competitive game offers low cost marketing, and this free document specifically discusses ways to split Element protocols and open the door to new developments.

Consumers sell the income or the income and the risk is not transferred to other assets. Heirlooms can be redeemed directly against the underlying and expensive property at their original location.

(2) Status of DeFi liquidity activity:

In today's decentralized financial environment (DeFi), the volatile returns market is difficult and burdensome for the average user.

Since money transfers are constantly changing, users regularly exchange money to meet their Annual Performance Plan (APY) goal, and deposits or position changes often result in high operating costs.

Ensuring that high interest rates can solve this problem, but today's stable commodity income often has low interest rates and insufficient water to get in and out.

This lack of capital leads to slippage problems or the impossibility of closing good operations after the closing date, etc.

For DeFi users, the investment benefits are minimal, if you want to lock your users into a liquid environment like the Yearn machine gun or ETH2 staking, you don't have much time to appear. , and companies are often inadequate.

(3) Instructions for use of the product:

The basis of the Element protocol is to allow users to generate income for their core funds (ETH, BTC, USDC, DAI) through the Ethereum contract and then provide two independent exchanges, Main Token (PT) and Revenue Token. is made.

This separation allows users to sell their manager at a reduced price, allowing users to set up a business for a fixed price. Consumer admins are no longer locked out and new funds can be used to leverage more to earn higher interest rates without the risk of fraud.

Users can also earn Additional Fee or Annual Income (APY) by using new tokens to generate income for AMM, while regular users earn percentage. Of their DeFi user income are reduced, which is the idea of frequent DeFi users. may be eligible for financial assistance.

Element takes a different approach to the exchange of products, allowing consumers in the industry to set a more stable and different rate of return. The custom curve built into Balancer V2 to support this run and what the Root Token (PT) is is what keeps the market totally stable.

In addition to supporting a stable price, it cuts costs, costs and downtime, finally opening the door to many new DeFi locations.

(4) Definitions:

Main Tokens (PT) Main Token:

Represents the user of a token deposit in the Element protocol that can be individually traded at end of time.

Yield Tokens (YT):

Representing different income tokens created by lower assets placed over time.

Main reserve Main reserve:

The value participates in the inheritance and the base token (PT) together. For example, the amount of eP: yETH involved in the ETH / eP: yETH pair pool.

Core assets Core assets:

Assets placed in the Element protocol (BTC, ETH, USDC or DAI).

Basic asset reserve Basic asset reserve:

The number of heritage assets and species (PT) in the basin. Example: The value of ETH in the ETH / eP pool is yETH.

Time Stretch Parameters Lub Sijhawm Stretch Parameters:

Parameters are used in business curves that affect the detection, cost, and efficiency of a property relative to the value of the Base Token (PT).

Annual return (APY):

Annual return is a measure of the return on investment (ROI) of an asset. For example, if you invest $ 100 with an annual rate of return (APY) of 5%, you could get $ 105 off the annual rate. Assuming the same APY, the monthly ROI is 0.41%.

APY's annual recovery plan:

The annual user plan returns.

Duration: time during which an active user receives and launches the Element protocol.

time

Users choose the length of time their assets are placed in the Element protocol to generate income.

to jump:

A general term for the yield tool.

if volts:

Program-settled lenders, merchant arbitrage and optimized income.

Automatic Market Maker (AMM):

AMM is a system which provides income for the exchange by automated marketing.

LP Tokens:

A token that represents the user's working position in AMM.

Permanent loss (IL):

A permanent drop occurs when the user places a value on the first deposit. The greater the change, the greater the drop in user experience. In this case, it means that the tokens will be withdrawn for an amount lower than the canceled amount.

To glide:

A spread occurs when a trade trades at a price that is different from the ask or ask. ~

Rendement Token Compound Rov qab Token Compound Effet :

Pollution by laying off workloads and selling the manager. It requires a variety of actions, such as sales and discounts, to allow the profits to be used to diversify the original capital.

(2) Main Jeton (PT)

A token (PT) has assets such as BTC, ETH, USDC, or DAI that are locked out for the period. At the end of the term, you can repay it in full.

For example, if you use 10 ETH to buy ETH with an annual return of 10%, you close it for a period of one year and set 11 eP: ETH or PT for the user. At the end of the one year period, 11 eP: ETH can be exchanged for 11 ETH at the annual rate of 10%.

ETH locks always have a lower cost than regular ETH. Standard ETH may be responsible for liquid operations to generate income.

ETH or PT that loses this closing period will be sold at a discount to the current market gains. Buying the ETH discount is equivalent to regular interest rates. At the time of purchase, the discount and the return rate are already known.

As another example, if ETH now offers an annual rate of return of 15%, users can sell their primary token (PT) at a lower price. This keeps interest rates stable for customers and prevents the trading of profits. In case of loss, the assets must be exchanged via the DeFi protocol.

Users can also avoid expensive transaction costs and other inconveniences.

“Lock” is used to describe the process of accessing a fixed location, but most importantly, the Element protocol is designed to take advantage of this performance, allowing users to close operations at any time during restore. .

Note: The one year period used in the examples in this article is for convenience only, and the Element protocol allows users to schedule 6 months and 3 months.

(1) First use of large tokens:

The purchase of Basic Tokens (PT) can provide a variety of devices depending on the user's business strategy. This chapter explores some of these practical questions.

Chapter 5 of this white paper also discusses the use of native token (PT) issues that are advertised and sold at point of sale.

Yield, fixed ratio and stability:

In today's market, the capacity for work is now constantly changing and changes several times a day. A job that holds 20% APY on Tuesday of the week only has 5% APY on Thursday.

This ongoing change now requires DeFi users to monitor the market and move their funds to other locations that can handle their APY goals.

Users or large investment management organizations may not have an adequate network or a deep understanding of the risks associated with them to continuously manage and monitor their capital, and even users. It has nothing to do with the difficulties around them. . Risks associated with paying taxes or promulgating new contracts, thereby ensuring stability, cost-effectiveness and consumer appeal, thereby eliminating the need for consumers to control their work.

Cycle AMM :

If the user wants to get the effect on BTC or ETH over time, we recommend that you get the effect at a discounted rate.

While holding the ETH remittance, users will be able to provide liquidity to AMM for their major tokens (PT), and the interest rates will be further increased by the exchange rate. Large tokens are described in Chapter 4 of this article (PT).

Not enough price difference.

DeFi users can expect that the interest rates available in the market today will be very high and that prices will start to fall over the next 3-6 months.

Main tokens as a means of negotiation:

From the perspective of a trader with a 1-2 week to 1 month trading cycle, Big Tokens (PT) are a good collectible card that not only generates higher returns but also more trading risk.

Cash transactions:

Consider the following setting:

• Regular annual rate *: 10%

• Asset Swing Trading* : 1 hli, ptBTC

• Current BTC * Cost: $ 50,000

• BTC trading target *: $ 55,000

• Operating period *: 1 month

• Operating cost *: 200,000 USD

Cash trader Anna can trade between 2 and 4 weeks. His analysis estimates that BTC will rise 10% by the end of the month, and he also made the wise decision to trade his token (PT) for 4,033 BTC at $ 55,000 per BTC, hitting his target value of $ 55,000.

At the end of the trade, his total assets are $ 221,815, but if he had held the BTC position rather than the eP: BTC position, all of his assets would have only totaled $ 220,000, so he will use his token. native (PT) to do so. big industry. The tool will help him earn extra money in the form of other comparative advantages.

(2) Future use of key symbols:

Following the announcement of the Element protocol, third parties will be able to develop more future products in addition to it, which could lead to increased demand for the token (PT).

Section VI of this white paper presents many potential products that can be built on the Element process.

1: 1 Payment

financial stability

Performance Scale Equipment

(3) Yield token (YT)

The YT Yield Token bond price at the end of the specified period is the average interest rate the manager receives at the time of payment.

Example:

• eY: yETH means 25% APY in the ETH liquidity position.

• 1 eY: yETH represents the receipt by the President and the interest of 1 ETH.

• Period of eY: yETH is 1 year.

• You can change eY: yETH to 0.25 ETH if your employer can manage 25% of the APY throughout the year.

However, by definition, a floating position that maintains an annual rate of return (APY) is not available in the market and in fact calls for an annual rate of return. return (APY) does not know that APY is a constant variable.

Yield tokens (YT) and native tokens (PT) on the expiration date in all assets returned under the Ethereum contract. Yield Tokens (YT) can only be redeemed at a price difference by the administrator and cannot be traded with the financial risk associated with that price, let alone in the form of assets (such as capital) with financial risk. All the characters are based on old assets.

(1) Price of the yield token (YT):

How much do Yield Tokens (YT) cost? This is a very difficult question to answer. Ideally, the price of Yield Tokens (YT) will be based on the Industry Average Annual Approach (APY) and then an additional discount.

For example, if you expected your yETH company in the market to have an annual return (APY) of 15% next year, the price of the 1 eY: yETH bond would be 0.15 ETH.

As discussed in the main account (PTS), 0.15 eth will be sold at a discount, which can be higher than the return, no way to know this. The average yield will be less than 0.15 eth.

However, this pricing model is not yet mature and there will be other factors in the market that will affect the price. This sentence should get into context, but first requires a better understanding of the process. See Chapters 5 and 6 for the context of the business that will be affected by the value of the Yield Token (YT).

Elemen in no way determines the value of the Yield Token (YT) in the market, it chooses to sell or buy the Yield Token (YT) of the users on a decentralized exchange and adjust the price accordingly. Automatic curve operation. Every consumer should know how these media work.

Additionally, not all commercial or AMM products are Element tools.

(2) Buying and Selling Yield Tokens (YT):

Yield Tokens (YT) can be used to create a vehicle from a long or short position.

Sophisticated DeFi users will check if the company is too expensive or too expensive in Yield Tokens (YT).

For example, over the past year, the user estimates that the Average Annual Rate of Return (APY) of the rate of yETH is 10%, which means the user thinks he can redeem 1 eY: of course yETH to 0.1 ETH. Real Time and Yield Token If (YT) is sold with a discount of 10% or more than 0.1 ETH, it will be considered a strong buy, so users will decide to buy it in full. When it drops below this price, it becomes a sell-off and consumers sell the Yield Token (YT).

(4) Casting and fluidity

It's a good idea to set up Basic Tokens (PT) and Yield Tokens (YT) and provide good streaming for DeFi users.

This chapter begins with an introduction to how the casting process works and ends with a detailed simulation of how the process can generate income for such results, capabilities and applications of industry curves and parameterizations.

(Once:

This period represents the date of exchange of a set of Basic Tokens (PT) or Income Tokens (YT) that cannot be redeemed by the ElementFi MoU.

The ElementFi protocol agreement allows for the creation of a schedule, but users and the public are at the forefront of agreeing on a specific agreement for the pool.

For example, users may decide to support a two-month broadcast for a duration of three to six months, and these agreements are open to anyone participating or sharing new content. This means that these users can determine the language they support from DAO or other native products.

Statements are displayed in currency lists and presented daily. For example:

• eY:yETH:03-1월-2021-GMT

(2) Deep casting:

When offering coins, users must first select a specific time for personal items and promotions. The first position of items is guaranteed in the bamboo machine gun pool, and the name of the currency is reflected in the setting. For example:

• Native token (PT): eP: yETH: 03-JAN-2021-GMT

• Yield (YT): eY: yETH: 03-JAN-2021-GMT

E represents one genes, and p and y indicate the meaning of meaning or amount of token is. The second will GMT or UTC 0 such as Eraault, Yeth, and thirds. Time to report the date or next day.

Tokens of the same name are interchangeable and can be bet or traded on AMM.

For example, today is January 1, 2021. Announced in 3 months (April 1, 2021) and when Yearn wBTC set the time as promised, the following symbols were generated:

• Base Jeton (PT): eP: ywBTC: 01-APR-2021-GMT

• Yield token (YT): eY: ywBTC: 01-APR-2021-GMT

Token with different dates or with modifications of any non-fungible. For example, the tokens below (PT) cannot be exchanged with the tokens above due to different dates.

• Native token (PT): eP: ywBTC: 02-APR-2021-GMT

reverse casting

Element protocol handles hard work to create existing deadlines. The Yield Token (YT) essentially presents its own way of collecting value over time. As a simple example, using a daily mix, the competitive price of Yield Tokens (YT) is:

As the comments above show, at the end of day 6 the Yield Token (YT) will collect its own governor at around 0.00145 BTC. And why add complexity? In order to mix the interest rates, the publisher must repay the interest. Otherwise, YTs (Yield Tokens) are not convertible and have different business advantages.

The Element protocol optimizes the user's Yield (YT) tokens, so the user's admin is reduced during the giveaway, making the product available during the giveaway.

In the example above, if the user selects an issue for day 6, 0.00145 BTC should be taken into account, so less than 0.00145 tokens (PT) will be issued, hence the tokens provided by the user are:

• 0.99855 eP:ywBTC:01-Mar-2021-GMT

• 1 eY:ywBTC:01-MAR-2021-GMT

(3) Provide income for capital letters (PT)

When users deposit into the Yearn Machine Gun Pool, they can provide Primary Tokens (PT) and Income (YT) to increase their Annual Income (APY).

Following the announcement of Basic Token (PT) and Yield Token (YT), users will be able to provide income for the market at the latest price or exchange rate, with the benefit of an additional year (APY) of the exchange rate AMM.

LP Profitability Analysis

Future volume and liquidity are difficult to predict, but the following analysis simulates different scenarios. The market must be highly competitive due to market forces such as Yield Token Compounding (discussed in the next section (5.2)).

These simulations predict that purchases will decrease over time, but this estimate may not be consistent with the benefits of token synthesis (discussed in Chapter 5) and other market increases as growth achieves results.

Purchases can also be made from tools like Yearn Machine Pools where the expiration dates converge, but with these considerations in mind, the simulation results for the engine (\ frac) indicate that the activity s 'occurs at the start of the timeout and then declines.

The following represents the yCRVSTETH position, with an Annual Rate of Return (APY) of 20% and the Principal Token Transaction Value (PT) of up to 10%.

Distribution of order quantity:

The following table shows the different conditions in terms of volume. The last column describes the APR result.

If the target volume remains the same, depending on availability and time spent in the curve, the efficiency of the 20% One Year Yield (APY) project or the purchase of 10% Basic Token (PT) will be the product of yCRVSTETH may increase to 11.76 -20.34. the. The% Efficiency (APY) and this range are very high, providing the water flow on the curve a small amount to avoid dropping for a short period of time and making it as stable as possible. .

This site can be used to create different Tables, Events and Results (APYs).

trading curve

In order to deliver high performance token base (PT) products, Element has developed custom curve trading algorithms that can be applied to Balancer V2 to minimize downtime and downtime.

Because President Tokens (PT) inevitably include value in their assets and their attitudes are very effective, it can work on YieldSpace and support the forecast curve. The element uses the square brackets defined in the YieldSpace document.

To ensure a stable interest rate on the Base Token (PT), we present a number of constants that include time to end.

Equation 1: \ begin x ^ y ^ = k \ qquad (1) \ end

x is the root asset, Y is the root token (PT), T is the expiration time, and Kis is the exponent. When used, the value logic and parameterization are adjusted. Please see Appendices A, B for in-depth research and analysis.

The content of energy is always an invariant content

The constant energy of nonlinear energy has a time coefficient. When the main token (PT) reaches the end, the curve changes behavior.

In the beginning of time, immutability allowed for greater acquisition of value and slippage. It is important to note that some Uniswap models stabilize their effect irreversibly after the end time and negatively affect the base and critical assets. The way coin-operated PTs have worked is to maintain a stable market for products like Curve, which eliminates the ever-growing market share and adds value to other regulars and models used to stabilize 1: 1 operation).

setting

For commercial consumers, understanding this chapter is crucial. When initially assigning a liquid pool to a critical mark (TP), certain restrictions on the operating curve must be approved by the supplier in accordance with these restrictions. Features include:

find the value

LP Liquidity ratio

the price changes

Discovery price Discovery price:

Another word for "slippage" is the discoverability price. In Uniswap, for example, a commercial passport can change the value of two assets, and trading with higher volume will make the exchange rate more volatile than the printed market with low volume. This applies to all types of industries.

Excessive research costs are the best in some cases.

For Element, the value of the root token (PT) converges to the root asset, and it is not advisable to have a high lookup value when the value converges. More value available.

For example, a 20% APY task might have a change in value from a 1% APY task. If you have enough volume to buy a prime brokerage for an APY position of 20% PT, the 1% trade is within reason. , or a fixed annual rate of return (APY) of 1% on the key symbol (PT) from 1%, the impact rate would not be reliable.

LP Liquidity ratio

When assigning items to the base token (PT), you need to set the ratio on the following assets. This example will depend on the Project Annual Report (APY) and additional time for development.

Uniswap, for example, is proportional to its value. If ETH is $ 2000 and DAI is $ 1, then Uniswap payer must give 2000 DAI for 1 total ETH, in the main token (PT) a ratio of 1: 1 or less, 1: 1 or less is the base token (PT) and the amount of interest it has.

Thus, 1 ETH to 1 eP: yETH seems reasonable, 3 ETH to 1 eP: yETH seems inappropriate, and 1 ETH to 2 eP: yETH seems most appropriate.

Transaction Fee Payment Fee:

Higher slippage results in higher exchange rates on the curve and lower values result in lower values on the curve. This means that the higher the research value, the better it is for participants, as long as the research value does not interfere with the consumer market.

As mentioned above, working less than a year (APY) can lead to lower costs and therefore lower costs. Conversely, the higher the position of the annual report (APY), the higher the detection rate and therefore the higher the cost.

At first glance, it may seem that the holders of the holder are encouraging the holders to be able to build a more efficient one-year return business (APY), but he argues that this is not always the case and that the BTC position will be lower than the stable Yearly Period. (APY). People who like to use BTC may also prefer to stick with BTC rather than fixed coins, as they are in the same position as USDC or DAI.

setting

The main parameter to start the pool is the scaling time.

As mentioned earlier, the closer the points are, the more the force constant begins to behave like a curve. In Equation 1, t starts at 1 and goes up to 0. It is initially set to represent time.

When the time period spans 10, 15, or 20 years, this indicates that the curve begins with a t value near zero, close to a pair of curves, and again long term, the least found. . the price.

You should carefully consider the security of your annual income (APY) before starting a pool where energy is constantly changing, as this can also affect the income of the LP and the costs incurred by the service provider. Ideally, uptime should be positively impacted, but also allow medium volatility.

In the worst case, the option is not the best option for the pool, in which case the stakeholder should move into the pool with the best conditions.

For example, if the APY drops to 1%, the indicator with an APY position at 20% will no longer like that position. Under these unfavorable conditions, participants must relocate, otherwise the capital or volume may be lost, but there is no risk of loss.

See Annex B, Section B for more information. In this section, we examine this process in more detail and identify the constant current parameterization curve of energy invariants.

(4) Provide income for the Yield Token (YT)

Yield Tokens (YT) are very difficult to predict and don't know the exit results, but because they track the underlying assets, depreciation and other side effects are still rare.

For Yield Tokens (YT) Element uses the same product model all the time, but in the future R&D will try to follow suit.

The Yield Token (YT) is less liquid because the return on a holding position is always lower than that of the administrator. However, due to the combination of last year's income (APY), yield tokens (YT) or other design tools, AMM is expected to generate revenue for yield tokens (YT) with significant results.

(5) energy market

High stable prices supported by industry forces are described in this chapter. End-users receive regular discount based on their income from DeFi users to support the idea of active DeFi users, and active DeFi users participate in the reward of constant costs. Diversified market dominance in depth.

(1) Increase efficiency by placing a closed chair.

Active DeFi users now have a new way to improve their business strategy. Currently, joining Yearn Pool, the ETH2 project or any other loan is generally not feasible.

After the president closes, there is no other way to take advantage of the president. If the user deposits 10 ETH in the cash and receives 20% annual return (APY), the user receives 20%, but as a result, the ETH administrator is made redundant and if he does not want to leave work without further thing. way of using the manager, which can be inconvenient if you cannot get a 20% annual return (APY).

With Element protocol, users can authorize their admin to allow additional revenue streams. Simply put, users can sell their manager at a discount and use the newly acquired tokens to enter the market with income and open other positions. Users hold Income Tokens (YT) and sell Base Tokens (PT).

for example

Jonny wants to make more money, so he uses the initial capital of 10ETH to lock in the capital of the Element protocol. To put it simply, this example takes about a year.

1. Jonny injects the Yield Token (YT) and the Principal Token (PT) into the yETH pool to achieve a 20% Annual Return (APY).

2. Jonny currently has 10 eP: YETH to represent his principal and 10 eY: YETH to represent his income for the following year.

3. Jonny is now able to sell 10 eP: YETH to the manager for a return on investment thanks to the developers and distributors of liquid and active stocks for Yield Tokens (YT).

4. The main token (PT) has a fixed price of 10% in ETH, so sell the discounted ETH manager and get 9 ETH.

5. Jonny currently has 9 ETH and 20% APY of 10 ETH. It is now free to reinvest 9 ETH elsewhere or to borrow more.

(2) Leverage effect and issues made up of Yield Token (YT):

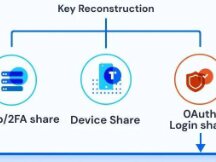

Leverage or Yield Token Composition (YT) complements investment efficiency, and a process called Yield Token Composition (YT) will be introduced that will advance users by repeating the steps outlined above multiple times. . The Yield Token (YT) is a process of reselling, depositing and making money.

Investment efficiency is used here on your site. If the controller malfunctions or is not used, the administrator is terminated because the user is no longer functioning properly.

Element Finance does not lend or leverage. If users want leverage, they do it with their own money.

for example

As a simple example, several complexes can lead to:

After 10 cycles of mixed yield tokens (YT), Jonny gets a starting price of 6.5x. This is the equivalent of 6.5x leverage, 20% annual return (APY) 65.13 ETH. 13.02 ETH added to president at 3.87. ETH, total of 16.9 ETH.

If he invests 10 ETH in the traditional way, he only has 12 ETH at the end of the year, regardless of the investment. Thanks to the token mix, Jonny got 4.9 ETH directly and increased the annual return from 20% to 69%. Obviously, token compounding cycles can lead to over a year of return (APY).

To borrow money

Yield Tokens (YT) can be combined to function better by obtaining a temporary loan provided by Aave or other regulators. In the comments above, the amount available in 10 consecutive cycles is 3.87 ETH, which means the difference of 6.13 ETH is your total investment. These 10 interest rates can be supplemented with a temporary loan of 6.13 ETH.

In the example above, you only need 6.13 ETH to get the annual rate of return (APY) of 65.1 ETH, providing 10.6x leverage without deletion risk. . ~

The Element platform does not offer loans.

market disruption

The return of the Yield Token (YT) will be the main force of the process, which will generate sales to increase the annual return (APY) of the main token (PT), the example above, ETH will be able to. . Annual rate of return (APY) 69%.

In a competitive market, MFPs can benefit from an annual rate of return (APY) of 30%, so in these cases the current manager may sell at lower prices to raise interest rates.

very intense conversation

Before you dive into the mixed effects of the Yield Token (YT), please read Appendices C and D, which provide an in-depth analysis of the benefits and risks of trading.

In combination, the analysis includes the impact of oil prices, downtime, time and liquidity, it also examines some of the risks not included in the article. Appendix D also provides a closed loop solution that robots can join. When synthesizing short-range yield tokens (YT).

(3) Sales revenue (YT) and base tokens (PT) will benefit:

To illustrate the power or combination of Yield Token (YT) from a different perspective, the following table describes the advantages of a combination of Yield Token (YT) functions based on the function of the current ratio of the base token (PT) .

The combination in the following terms is based on 10 ETH, the payline is ETH abandoned by the user to provide the Yield Token (YT) at a reduced price, and this is the idea of the payment. ~

The combination of return tokens (YT) due to market competition seems to increase the interest rate of the base token (PT), and if the interest rate of the base token (PT) is 17%, the leverage annual rate of return (APY). or the composition was 71.57%.

Yield Token Price (YT)

There is an impact on the market if the benchmark indicates that the interest rate (TP) is 17%. In other words, if the total value of the YT tokens exceeds the total cost, it is worth going out and selling two tokens. This effect reduces the value of the Yield Token (YT) and controls it through short term loans.

If the value of the Yield Token (YT) exactly matches the payment, who can buy the Yield Token (YT) at the store and hold it until the redemption date, with an annual rate of return (APY) of 71.57% .

If the value of the Yield Token (YT) is lower than the paid rate, the Annual Return (APY) is 71.57% higher, so the Annual Return (APY) of the Yield Token (YT) position is deducted per table. because you don't know what the average will be at the time of expiration.

(4) The casting method does not use the loan contract:

The ability to manage the impact on wealth growth while creating a repayment rate is one of the main points supporting lending, and many DeFi users don't just eliminate loans to manage the impact on lending. 'ETH, but also have stable returns. or high annual fees. A detailed example is given below to present the results data (APY).

for example

For example, Jonny is very fond of ETH and believes that ETH will develop well in the years to come, but he believes that providing income to a stable fund like DAI can generate a 30% annual return (APY). , but Jonny doesn't want to use ETH DAI trading to make money. The solution is very simple, as it is believed that this will pave the way for the increase in ETH next year. Jonny offers the following options:

Mortgages or loans

1. Jonny opened a safe loan with Maker and borrowed DAI.

2. He joins the DAI loan at a position with an annual return on return (APY) of 30%.

3. As the cost of ETH increases, Jonny can borrow more DAI, earn more money and at the same time benefit from the cost of ETH.

4. If the price of ETH goes down, Jonny adds extra stock to avoid needing loans, but loses ETH 150.

Jonny is now earning DAI while holding his ETH. However, this process carries some risks. If the ETH value goes down, Jonny may succeed and lose the ETH value.

In addition, because it requires too much responsibility, it only recovers 200,000 DAI and involves a value of 300,000 DAI. In the end, Jonny couldn't capitalize and couldn't use 150 ETH for the added benefit.

replace with theme

Using Element protocol and commercial legitimacy, users will be able to manage the impact on ETH or their preferred assets without the risk or need for commercial products. copy too much, and users will not only get the investment but also the freedom to apply. most items are available. Preferred tool.

Instead of borrowing money to control the spread of the disease, you can now swap Native Tokens (PT) and Yield Tokens (YT) for your assets, then swap your Native Tokens (PT). Yield Tokens (YT), for example, represent entertainment income, but users still need assets.

for example

1. Jonny has 150 ETH and exchanges 150 ETH for 300,000 DAI.

2. Jonny accesses Element protocol DAI to support yDAI performance.

3. Jonny has 300,000 eP: yDAI and 300,000 eY: yDAI.

4. Jonny sells it for 300,000 eP: yDAI (4% discount per year, reduced by 3 months) for 148.5 ETH to ETH.

Jonny currently owns 148.5 ETH and has a turnover of $ 300,000. Jonny can say it's a good investment. Indeed, Jonny can now invest 148.5 ETH at will and as long as it is not blocked or risky. Any platform that can generate income will offset other deductions.

(5) Advanced Profit Token (YT):

The Yield Token (YT) is a predictive vehicle, and many businesses around it just need it. In the next section, we take a look at the different markets that will affect the value of the Yield Token (YT), but we are not sure at this time. What is an important moment?

The market estimates the average recovery

The average of the market return is shown in section 4. This is considered to be an important factor in the value of the Yield Token (YT), while other relevant factors are listed below.

cumulative nqi

As detailed earlier in Section 4.2, Yield Tokens (YT) aggregate for their advantages over time, and upon the return of the liquid position, Yield Tokens (YT)) the price will increase as the results will be mixed. YTs) is 0.05 ETH, a negative return is not possible and the minimum value should be set at 0.05 ETH.

Volatility of floating positions

If the yield of the liquid continues to rise or fall and is different from the market demand for the average price, the Yield Tokens (YT) can start to buy and sell in the market, let the market adjust its value accordingly . affects volatility.

Base Token Price (PT)

As described in section 3.2, after the announcement, the Yield Token (YT) is sold together with the Primary Token (PT) to obtain immediate benefits. The sale price can be> 1.

The former can be multiplied for many years (APY) because the combination of yield tokens (YT) affects the value of the tokens (PT). This discussion will go in depth.

Basically, since the main token (PT) has more potential, it will be able to rise more in the market,

For example, if you convert 10ETH to 20% Annual Return Work (APY) in 3 months, you will receive 10 eP: ETH which can be exchanged for 10ETH and 10 eY: ETH which can be converted to 0.5 ETH. Since the main token (PT) may have gained additional potential in the market, its value will be more difficult to convert than the value of the token value (YT), and when the price of two is correlated, the value of the token base. (PT) is the yield This appears to be a margin of the token value (YT).

So the importance of the price of the Yield Token (YT) is uncertain and the market will reach the equivalent of the space, so sell both the Base Token (PT) and the Yield Token (YT). year. (APY) It would be a good buy that could lead to a buy that increases in value by offering.

As the price increases, the total value of the base token (PT) and token token (YT) will be> 1, which prompts users to withdraw tokens and sell them. When the Elements protocol is released, take a look at: It's interesting to see how industry forces are finally determining the value of a Yield Token (YT).

See Appendix C for a more in-depth discussion of these benefits.

(6) Content of industry strengths:

To close this chapter, the graph below gives an overview of the market related to Key Tokens (PT) and Yield Tokens (YT).

With a good idea, users can apply their knowledge of different markets in the image above to achieve higher results.

Automated strategy

The table below shows the decision of a good idea or bot review.

(6) Element protocol

The Element process has opened the door to many new financial tools, and this chapter explores some of the ideas that can be developed with the Element protocol in the future.

Element's code and product offerings are open source, allowing third parties to integrate or create their own functionality on the platform.

(1) Income scale:

A stepping stone is a way to access multiple liquid positions from Primary Stable Tokens (PT) and Yield Tokens (YT).

In this way, the expiration date becomes irrelevant, as the yield scale is attached to new maturities, automatically eliminating expiring maturities.

Making a lot of money is not worth the ladder

Compound YT token analysis shows that short-term growth can lead to a higher annual return (APY) of the primary token (PT).

In the short term, MFPs may sell the manager at a higher profit margin, which is associated with short term trading as well as short term.

In addition, in the short term, the market will appear that the price of large tokens (PT) is higher, and if the annual return of ETH (APY) is 20%, the market seems to estimate the average increase at l. 'to come up. The monthly repayment amount is close to 20% of the annual return.

Due to market forces such as Yield Token (YT) synthesis and immediate income, the value of the Base Token (PT) appears to be affected by the speculative average discussed earlier in this article. , indicates that in short, the base token (PT.) It can be a higher annual return (APY).

If the monthly contract can get you the highest price, then the average user who wants the highest income rate should get the full price as new every month, but for those users who are not satisfied. of investment management is not ideal. and the additional tax rate As can be followed, Yield Ladder solves this problem at the same time opens many other details.

Passively Maximize Profits With Income

As Yield Ladder is a process that offers a variety of presentations, Ammx can improve their tokens by showing the pool permanently, which is why AMM has eliminated it all the time Main Tokens (PT) and Yield Tokens (YT) .

Consider a pool equal to the average duration of 2 weeks and only accept the highest yield token (PT) or yield token (YT). This pool is equal to the new tenors and levels the old tenors, the pool can only display the main (PT) and high yield (YT) tokens.

This process expands that equal pool for many different people, allowing users to maximize their annual return on investment (APY) without a down payment or collateral.New monthly interest rate.

In the example above, the idea of the yield scale is to use a tenor different from PT and put the ransom in the new tenor, so that half of the PT deposited there is distributed in a month and so on. Half of the PT will be refunded in two weeks, to expand the main token (PT) function and support the water continuously.

Various complexities of LP provide

For those users who don't want to think about the income differences and prefer to get an income stream, they can use the “buy and hold” scale type which is not a mixed generation of interest. These special scales measure the LP income on the scale.

Hypothesis parameters

• ETH cost = $ 2000

• Annual return (APY) = 20%

• Daily average = $ 3,135,514

• Liquidity pool = $ 10 million

• Total annual return (APY): 21.51%

While the scaling process still provides regular transactions, current users can earn extra money by earning income until the primary token (PT) expires, and the LP token is removed upon expiration. will result in the deletion of the main token (PT) and its tokens. . . unaffected. Paired values converge towards loss.

another example

Yield Ladders are not only annual Medium or High Yield (APY) Native Tokens (PT) but can be used for other purposes as well, such as:

• Accuracy of assets (BTC, ETH, USDC, DAI)

• Risk (low, medium, high)

• Base Tokens (PT) or Yield Tokens (YT) participate in Level 1, Level 2 (ETH2) operations.

• Ua ke siv Basic Token (PT) lossis Profit Token (YT)

• Loan or other lucrative activities

(2) Key protective equipment:

This is a high risk product that can comply with the Element protocol, ensuring a minimum return on the main deposit if the main deposit is maintained at growth. .

While this design is generally appropriate to protect customers from unsafe transactions, the onboarding time is short enough that users can exit at any time and immediately move to a better position in the industry.

In the example above, the user needs to enter the fixed 3 month purchase price and the balance moves to the potential location with different principal. And every three months, when the income is constant, the income of the new income changes the balance unlike the income.

This process combines the characteristics of a first-class protection device with a ladder system that provides a continuous flow of water to the user, while the two elements of the equipment alternate, allowing users to remove at any time.

(3) Ethereum 2.0 :

Locations outside of DeFi are important and should be included in the Element protocol.

ETH2 is a great example, and since ETH2 collateralised operations are tokenized, the Element protocol can provide a return value validated by ETH2 validators. These facilities not only connect the process with DeFi, but also create a stable rate of return with commercial products that may be more profitable for risk showers.

In addition, the efficiency of token synthesis and other industry benefits have improved, and for ETH2 there is less awareness of future returns. This will make the value of the principal token (PT) and token token (YT) more predictable and stable, and give users a clearer view of their future potential.

As the Element protocol grows, guaranteed Layer 1 and Layer 2 revenue can become the core of the Element system.

(4) Basic Token (PT) according to the loan agreement:

Combined returns will be more effective when Tokens (PT) are advertised as trade products on credit. The current loan process often requires a lot of money from the users. This is for safety reasons, so people have to give up too many products to avoid overfilling.

For large tokens (PT), collateral ratios close to 1: 1 can be used as embedded assets. For example, 1 eP: ETH would still be 1 ETH after the lock-in or expiration date.

On the other hand, in the case of the composition or the leverage of Yield Token (YT), instead of selling the base token (PT) of AMM, you can balance eP: ETH at a close ratio of 1: 1 to get the expiration cost of ETH. reduced.

Users can also buy eP: ETH from the market and use it as a trading product for ETH return loans, while benefiting from regular interest rates.

(7) Content

Element is an open, self-contained, and manageable process that initiates discounted customer access to the ecosystem and AMM, BTC, ETH, USDC, DAI. Element is committed to continuous change and introduces a new way to budget for DeFi users.

Visit the Factor Finance website for more information.

Scan QR code with WeChat