Values: The Concept of Crypto, US Dollar and Inflation

The concept of money is not new, and Nik Bhatia explains his theory of terms in his book Layered Money. In fact, our financial management depends on many financing processes, and central banks have interest rates that guarantee public debt to the public. In other words, the bank relies on the bank to be able to publish the money, hold the value of our money, use it interchangeably and globally, and use its capital where we can repay our deposit when we need it. . Support it (and often won't be real, as money is produced by the weather).

The government's ability to generate money often gives us problems. This is called an advantage. Each time a coin is issued, its value is reduced. As incomes fell, the rate of decline, rising inflation, and rising incomes created a vicious cycle.

By "Layered Money" by Nik Bhatia

Bretton Woods Dollar Thiab System

The burden based on aggregate values is also important. This is the main reason the United States is in the red, our advantages are still needed, and it is important for all economic, trade and investment opportunities because of the stability for a long time. How did it happen and why has it not changed?

For a history of financial policy, see the Bretton Woods Treaty of 1944.

The short answer is the financial process that emerged after WWII. A longer explanation by studying the history of human commerce. Let's move on from the removal of the gold standard to retain a long description of the prior trade using coins, gems, and seashells (which can be very detailed but can be very useful).

After WWII, national currencies were tied to a high gold standard for various reasons, but there were differences. The US dollar remained at around $ 35 an ounce of gold, and all other international gains were pegged to the US dollar. It was too late when the United States introduced the gold standard, as did many other countries. Time passed and the world needed dollars. However, the Fed only releases enough money for home use, so what Bhatia calls “offshore” money - creates money outside of Fed policy. It can be used as a personal form of mortgage loan in the United States, or it can be used for emergency medical facilities and other similar items. In short, the dollar's status as a reserve currency will not last long. The global financial system has always demanded dollars.

Pension agreement and loan

When other countries need dollars, they can meet the demand with repo contracts or other loans. A bond is when a bank that holds US Treasury bonds transfers the proceeds (in cash) to another bank upon collection with US Treasury bonds. The bank returns these funds with nominal interest rates (which affect government revenue and the London Interbank Offered Rate (LIBOR)) and guarantees. Other mortgage-backed securities may not be as secure (such as no liability). Finally, financial instrument futures (MMF) are a group of commodity futures contracts with a net profit margin (NAV or par) of $ 1 per share. It happened because the dollar was amazing at the time and had held its position. The US dollar continues to hold this position by becoming the king of liquidity.

Due to the impact on spreads, the Fed has adopted what is known as QE. In this case, the Fed will strike a federal deal to provide income to banks that need it. It increases income. Now we are entering the “economy” stage where once the money comes back to the Fed, the Fed burns it instead of using it to buy more loans.

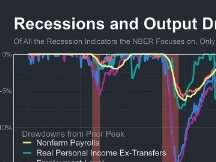

Inflation, shocks and counterparty risks

More and more people are familiar with inflation and affordability. How did you get there Today, the ability of fiscal policy to control inflation is minimal. In order to control real inflation, the Fed must raise interest rates and implement austerity measures that will benefit all patients. And for our lawmakers, who are more focused on elections than they should be 10 years from now, it's easier to make more money than necessary. Is the Dollar Worth the Market When Treasury Yields Are Below Inflation? If the US Treasury places gold at the top of the currency pyramid to guarantee a stronger dollar, a combination of weak currencies, rising inflation, and a low return on inflation will cause prices to fall again in the during the next period. feelings.

In times of crisis, the Fed relies on various solutions (QE) to keep the economy running smoothly. In debt, the Fed will deposit liquidity and buy government bonds from banks. Cash is used to pay urgent bills. That's why people say quantity is like printing money. The Fed simply put money into the system and continued to expand its supply market at very low interest rates.

Finally, some consideration of the candidate's risk. Our financial processes are interdependent, from CLOs, CDOs and CBOs to loans and exchanges. This is why our body is so strong that we should only take one big risk to damage the whole body.

To make matters worse, we don't seem to let things go. "Excellent cannot" only describes the private sector to help taxpayers in the worst case!

Bhatia prediction for Bitcoin

Bhatia's excellent book describes the financial hierarchy very elegantly. At the top of the pyramid are gold and US Treasuries. He also pointed out that Bitcoin (which is purposely designed to be gold) can be traded for gold. Or, he said, if the US Treasury were at the top of that pyramid, banks would be able to announce a new form of profit from Bitcoin itself. .

Bitcoin and gold share a few characteristics that Bhatia and other writers do well. There are now more bitcoins on the way than maybe the future currency or how much mineable. In other words, inflation and devaluation are not the same thing. The situation is similar, with most of the world's gold products going forward. Scientists call something that is difficult to propagate or create "currency". Finally, and at the heart of the crypto world: gold and gold without a root issuer. Bitcoin also does not have a central issuer and is decentralized and can be mined by anyone. This means that Bitcoin is resistant to inflation and puts devaluation issues aside.

Scan QR code with WeChat