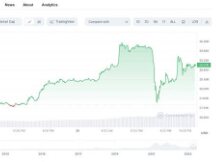

Bitcoin is building up and waiting for the final fire.

Over the past few days, public sentiment in the global financial world has returned, but in a significant way. Over the past few days, most users have worried about the market as a downturn, and Bitcoin holders have continued to sell and strengthen their holdings. More performance chip concentration. In fact, most people don't really care about the information involved, and some don't believe it. Most people, whatever their ideas and understandings, are still focused on their "thoughts" in action. Usually the feelings are bad, but you cannot change your behavior.

Blues' personal predictions for the market have recently become apparent. This means that repairs will continue until July or early August, but the bull market is not over and there should be a big wave. According to Blues own predictions, it is going up C. Of course, I think the bull market has passed, but from a bear market perspective, we can expect there to be a big wave of B-running that cannot be avoided. That time got closer, especially from a macro point of view, the dry trees were placed in the shape of a mountain, waiting for the final call.

At the macro level, there are four assumptions: the US economy is recovering but inflation will not weaken, the US dollar rebounds at a high level, the dollar has risen, and the ability of US stocks to absorb gold. Reduce volatility.

First, try to do our US Business Back. After reviewing April to June, the file in April is a relationship, and data improvement in May. The announcement of the June is still strong in the United States. Ism no business industry. PMI is more than expected. Before, 60.1 or more, 60.1 and June for the ISM ism not a manufactured product that was generated to 49.3. Usually, a settlement is not expected. Why? In order to put it clearly, he has financially back, but it does not have any growth, so it is short recovery. After clicking the new plastic, the US used can start back to the first grade, but what is further growth? Obviously no business space. In event, international is excluded, and most of the countries in European and suffering is still suffering, they are almost negative in the home of the dollar Dollars of the dance Social Deuteronomy of Deuteronomy. No consumption. Other countries and other countries should be separated, but we will sell something for protection, US? Nothing will sell to add additional money and moves more. In addition to business, some soldiers and horses will fall in another consumption. Therefore, the US market has returned to the summit. Where is the driver? Is it following it? There are also two sides in the final conversation.

Investment should be viewed as the most important economy in America. So, as the managing director of the Fed put it, "investors are rushing to find a place to keep their money." As there are more buyers and sellers, the rate of return drops. Of course, there are those who believe that inflation will not be as high as it initially was due to the slow recovery in the United States today. However, the Blues believe that the escalation of the war will not go away, the reason is very simple, America's health needs have been shipped from China and other countries, The decline of the US dollar and the influx of various fiat currencies For countries, the rise. in social needs Growth is an unattainable decision, and the US recovery is easy to eat.

From the second point of view, the dollar has recovered. Take a closer look at the recent US Dollar Index. From a consensus point of view, it is also clear that the US dollar index has started to hold steady after recovering from 89.7 to 92, and the MACD is also forming a reversal with different patterns. from above. From a macro perspective, it's more obvious, it turns out that the strength of the US dollar is nothing more than waiting for an interest rate and a negative dollar. No more monsters! Market decline after the rise of flowers? If interest rate hikes continue in the future without being able to curb inflation, it should be at least a year after the mid-2022 period, which affected the global currency bull market. The reimbursement of the dollar by the Fed is a temporary measure against short-term money laundering. Thus, the Blues believe that the dollar has started to appreciate and seems to enter a lower cycle.

A third thought, the extra flow of dollars. It's obvious. A real investment is not worth investing heavily in the benefits of yield trading. The current trend is that many investors are starting to predict that the US recovery will not be good. Money cannot be invested in real business and lead to a downturn in the financial system. There is a lot of money in America right now, there are Quake Lakes everywhere.

A fourth theory is that the ability of American products to absorb gold declined after the crisis. As the Nasdaq market hit an all-time high, many commodities, especially those in the tech sector, changed in volatility due to the dollar flood. But if the US stock market continues to rise, is it still weak? For no reason the recovery in trade slows The second and next quarters are certainly not as good as the first half If it had not been for the investments, many investors and even organizations to sell American products. The US stock market is worth about $ 30 trillion and the US stock market is worth $ 40 trillion, for a total of $ 70 trillion (equivalent to 3.5 times US GDP). silver water.

So, do you think there's a truth in blues music about stacking dry firewood and waiting for the final fire? Now the question is, where did the last fire in the currency circle come from, where did it burn and when did it burn? Mr. Won needs a new "first driver". As always, the excess money in the United States will not pay too much for other small currency businesses. It wasn't until the first engine was designed to buy that the real 'mad cow' power was created by pumping all kinds of money into the economy, while FOMO drove finance. The reason why the current reform is not completed in the second half is that the human spirit has been temporarily stabilized by the firm concern of all nations, but no expansion.

However, the macro market has become a reality and an excellent guideline for the development of the financial sector. After the market started to stabilize recently, smoke has appeared all over the global forex market, and the real fire is not far away.

Scan QR code with WeChat