Bitcoin Revives Hope, Bulls Reports Recovery

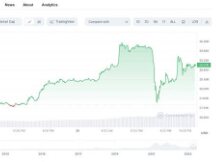

Traders are bullish after the price of Bitcoin (BTC) can stay in the $ 32,000 range for two consecutive days.

The data shows that the bull market has rebounded from the $ 32,000 level where Bitcoin hovers daily, but traders have patiently waited to further confirm that Bitcoin will remain in an exchange before any re-entry into the market.

BTC / USDT Calendar

Here's what analysts and traders can expect for the Bitcoin price:

The future CME is bullish

According to a recent report, the fundamentals of CME futures were reversed on July 21, which is a good sign for BTC traders to buy "cheap" futures. Since the future price is higher than the price of the asset, the probability of the future price is defined as bullish.

Bitcoin month-to-month futures base.

As can be seen in the figure above, open interest in CME Bitcoin Futures fell from $ 1.25 billion on July 19 to $ 2.5 billion on July 20 after the organization was " long followed a few short places ”.

Revenue is always at risk when using future CMEs to protect their sites, but Delphi Digital “may have to close some positions.

Delphi Digital this:

“Overall, CME's development of new futures is a bit of a wait as there is a little pump for BTC to get more in the next few hours. New York talks are coming to an end. As mentioned above- above, CME futures bases were negative yesterday.

Many attacks are still on the Bitcoin track.

The recovery of Bitcoin over $ 32,000 has rekindled the goodwill of many traders, but with so many defensive areas to come, there is no walk through the park.

Many of Bitcoin's previous support levels, including $ 35,000 and $ 37,000, could change quickly, according to anonymous Twitter cryptocurrency analyst Rekt Capital.

Overall, #BTC has the ability to defend against new levels. The weekly red level of $ 32,200 has fallen from last week's support level. The recent fall of the 50-week blue EMA ($ 33,700) and lows in 2021 (~ $ 34,800) still support the new $ BTC #Crypto Bitcoin pic.twitter.com/rYGSjoPAlY

- Rekt Capital (@rektcapital) July 22, 2021

The price of Bitcoin is trying to impact above $ 32,200, which corrects itself on a daily basis.

Historic trading rose sharply near the market bottom.

Anonymous Twitter user IzzyEibani sent another bullish signal, indicating that the recent rise in exchange rates could indicate they are falling.

Inspired by @MrBenLilly's exchange rate, hafnium inflows for cattle have tripled since 2017, with all equivalents remaining below par. And now the 4th peak has just ended ... July 22, 2021

If you look closely at the photo, there are three episodes on August 1, 2017, November 30, 2018, and March 12, 2020, respectively. Hit the ground immediately after entering.

Bitcoin price and influx of exchanges.

If the market improves similarly to the historical pattern, the recent drop to $ 29,500 will look like the bottom line.

The Bitcoin Weekly (BTC) option expired on Friday with around $ 330 million currently open. Considering recent efforts to raise $ 32,000, this event is a major test of the cow's desire to see signs of a reversal.

On July 21, Alameda Research reported that the company had bought less than $ 30,000 in Bitcoin, and Sam Trabucco, the company's largest trader, described BTC's explanation of additional, uncertain and unreliable fears ( FUD) from China. We are bullish on the BTC mining ban, the grayscale GBTC account and the stock market recovery.

BTC / USD price on Coinbase.

The chart above shows that if the $ 32,200 breakout price is denied, the current downtrend channel that started 3 weeks ago can be rejected. This decision seems to have been triggered by Elon Musk who claims that his company SpaceX also owns bitcoins.

In a July 21 meeting with Cathie Wood and Jack Dorsey, Musk said he rejects recent speculation that Tesla has sold part of its Bitcoin business, despite rumors.

Elon Musk has made it clear that Tesla will not sell Bitcoin after the sale.

- New York Post

It should be noted that these rumors have been supported in some instances because Musk has raised conflicting issues in the relationship. Additionally, Tesla previously sold 10% of its Bitcoin holdings last month.

The $ 32,000 support level is crucial for the Bulls.

The expiration of Friday's election could be the first test of the strength of recent protests. If the bulls need a support of $ 32,000, there is no better way than to do the most damage to the average when slowing down.

July 23 Bitcoin aggregation options.

The first signal that the downtrend is about to dominate is the price call. 0.81 indicates average bullish call options expiring July 23.

However, the drop will fall into its own trap, as 96% of spending strikes are below $ 32,000. If Bitcoin drops below this level on Friday at 8:00 UTC, only $ 8 million of the proposed option will expire.

On the other hand, the $ 29 million call option has an exercise price of $ 32,000. This $ 21 million difference is the result of the bulls. It's small, but it's different from the shelf life of under $ 32,000.

If $ 32,000 had not been withheld, the decrease would have been $ 9 million per leader because only 9% of appeals under $ 31,000 were raised. Not only are the benefits significant, the benefits are available for larger monthly options that expire July 30. This is an important reason why bulls need to follow their stance to maintain their current strength.

ETHereum (ETH) is now leading the way by contracting smart capabilities and a number of network operations, but efforts to create products on Bitcoin (BTC) have failed. The interpretation by decentralized finance (DeFi) is reported on the network.

One project that aims to combine the power of DeFi with the security of the Bitcoin network is Stack (STX), a Layer 1 blockchain protocol designed to integrate smart contracts and cloud computing (dApps). Introduction to the Bitcoin network.

After falling to a low of $ 0.50 on June 22, data showed that the price of the STX rose 195% to $ 1.47 after Bitcoin registered some gains on July 11, the price of the STX rose 195% to $ 1.47. again increased by 10% on July 22.

4 hour STX / USDT chart.

Our focus on the recent strength of STX includes the release of the Stacks 2.0 and Clarity programming languages which bring smart contracts to Bitcoin, the ability for STX holders to be offered at BTC, and DeFi and non-fungible (NFT) tokens. ). . Bitcoin network.

Smart contracts are coming to Bitcoin

The introduction of the Clarity programming language for Stacks has been an important factor in the development of the Stacks ecosystem as it enables the development of smart contracts on the Bitcoin network.

I've heard that Bitcoin smart contracts can be a big deal. @stack

July 8, 2021

Clarity calls it “verbal decision making” which means “the in-laws itself, the program knows exactly what to do”.

The main difference between Clarity and other smart contracts is that it is a decisive language and it does not prove to be complete, and because the terms are not compiled and interpreted and published as is in the blockchain, "it ensures that code execution. is human. It is readable and auditable.

The integration of the two networks means that popular platforms like DeFi and NFT will be able to run and operate on the Bitcoin network without having to worry about market delays and rising costs.

STX holders can earn BTC by trading.

Stacks recently announced the staking of STX for its holders to receive BTC as a gift.

The Stacks Network uses a new mining technology called Proof of Communication (PoX) that works seamlessly with Bitcoin and uses the BTC network as a reliable broadcast for block headers.

While most JV Certificates offer paid giveaways in the form of tokens, members of the Stack community can earn an average of 10% BTC by staking STX tokens.

This is one of the few occasions in the entire cryptocurrency space where token holders can attach their tokens and receive BTC as a gift.

DeFi and NFT are coming to Bitcoin

On July 10, STX developed and sold the first Bitcoin NFT on the Stacks blockchain.

During the history of #BitcoinCara Delevingne's "Mine", the first #NFT Bitcoin was offered and auctioned on the #Stacks blockchain selling 18,000 STX. $ 21,000 (current price) 'Mine' offers and exchange rates are only 0.0007 #STX or $ 0.001. July 10, 2021

The event aims to mark the start of a new era of smart trading for Bitcoin, with the good news that US Dollar Coin (USDC) will expand to the Stacks Network. This has led some experts to comment on the Bitcoin legislation, which has stated that "attempts to supplement cryptocurrency will eventually get to Bitcoin."

The emergence of NFT and DeFi features has revealed a new way to support this hot industry to acquire BTC, which may attract new players.

As a result of these improvements, STX's strength in July was manifested in rising prices and the rise of the 24-hour packaging industry.

Prior to the recent pricing, STX Records began rolling out STX approval on July 19.

Cointelegraph's unique VORTECS ™ scores are algorithmic comparisons of historical and current markets that include a mix of data such as market sentiment, volume and price movements or, and Twitter activity.

VOTECS ™ scores (green) against STX rates.

As you can see in the image above, STX's VOTECS ™ scores increased by 70 after entering the green on July 19, approximately 34 hours later, and the price increased by 42% on both days. following.

Scan QR code with WeChat