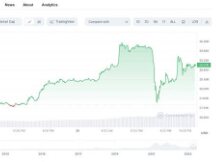

Comments on Possible US Commodity Collapse in August Zone Currency Tortuous Bitcoin Market

The currency market has rebounded in recent days, but interest has not gone away and expectations have risen. However, while the Blues believe that the turnaround is underway, they still believe the economy will be affected for more than eight years, it is important. the reason is August. The US economy is entering a period of turmoil and the risk of a recession cannot be ignored.

The image above is of Amazon's Daily K Line, one of FAANG's top five US tech products, and it's clear the market started to decline before Amazon announced the second budget. After the recent financial report, it started declining 8% on July 30 and the different type plunge on August 1. Is it because Amazon Q2 revenue is not good? In fact, the performance was not bad, sales amounted to $ 113.1 billion, up 27% year on year, slightly below the estimated estimate of $ 115 billion. It took the market average of $ 12.28 and performed flawlessly. It is also a very good idea for Amazon's e-commerce market in the first half of the year if there is a growing gap, but the industry is starting to stop buying. Why? Most importantly, "the results are all bad". If there is a lot of early gain, the increase is too good. This competition is the famous stalking of American stocks. “Bezos rises to the sky and Amazon falls to the ground” (Amazon CEO Bezos recently flew into the sky in a rocket).

For the global currency, US commodities will pay more for Robinhood Markets (HOOD) in the future. Robinson went public on July 29 and announced 55 million shares at an issue price of US $ 38 per share. However, this was not specified. It fell 8% on the first day. , disappointment ensued and the relative discount rate remained at 7.5%. Moreover, even the creators of Robinson are not happy with their stock. Co-founder and CEO Vladimir Tenev (Vladimir Tenev) and Creative Director Baiju Bhatt (Baiju Bhatt) participate in the IPO. 1.25 million shares were sold in China. - Pay quickly.

Looking at the Tesla company we know best, it can be said that second quarter revenue was very good. Revenue was $ 11.95 billion (about 77.5 billion yuan), up 98% from the previous year. Revenue was $ 1.142 billion (about RMB 7.4 billion), up 998% from the previous year. Yes, revenues are mainly drawn by carbon credit revenues, not only by the profit of the raw material, but also by the increase in electricity exports increased by 121%, which makes more than 200,000 vehicles delivered. However, in this scorching situation that was like 'the wind sends me in the sky', Tesla began to fundraise for each goal. It could also explain the declining and promising revenue declines, and lower profit margins, which is why Musk is so important to Bitcoin's return to the market. Following.

While the above examples don't necessarily prove the short-term success of American products, there are some negative signs. This unknown is true for some macro files. For example, the most obvious is the negative growth in private equity for several consecutive months and increased stock market skepticism by the company. In the second quarter, large companies and platforms performed excellently against the backdrop of the US economic recovery, but most businesses and individuals are unhappy with restocking and receive excellent attention when goods sell out quickly. Why? Understandably, they lack confidence in the aftermarket scene, and their prospects for the future are bleak. For manufacturing, for example, the company's total sales in the second quarter were US $ 8.5 billion **, down 1.5% from US $ 869.3 billion in the first quarter. trimester. In addition, recent events indicate that additional industry efforts have increased in the face of skepticism due to the rapid recovery and spread of new diseases, the spread of consumption, and declining cost savings. People will end up with “the helicopter money” from the start.

According to the history of relative mechanical performance, August is generally Equipment Repair Month in the United States, and many organizations in the United States have stable mental illness. Overall, the long-term impact on US commodities after spreading across the globe has largely affected global markets. Most of it went into the US stock market. This silver is the standard “gold”. He is more aggressive entering and running than others when he is in the wrong. According to the data, the gap has started to narrow, with US inflows reaching $ 168 billion in May, while inflows fell to $ 51 billion in June. He was released, but it's no surprise that he ultimately did the wrong thing.

So overall, even though the US stock market didn't go down in August, it seems to be entering a period of turmoil, people's hearts are already floating, and sentiment is starting to strengthen with some income. To get this idea, Amazon carefully examined our art form.

Needless to say, the difference between a free currency market when US stocks are fluctuating is very slim. Currency markets are generally "independent after the fact" and have always been favored by the US stock market before showing off their fine water resources. From a currency market perspective in August, there are some negative and sometimes “scary” points, which is good for economic growth, but the crisis in the United States may be the biggest in the stock market. It has an impact on foreign trade in August, and it will not be alone. Some days it is important to keep going, which needs to be done seriously.

Of course, even if the US stock market falls, any impact on the Bitcoin and currency markets will be short-lived. After all, after a three-month crisis, Bitcoin content has been updated to some extent. For example, recent statistics show that Bitcoin users have fallen from 143 million at the end of April to 221 million in June. Therefore, external shocks are only temporary and do not affect the growth of the market in the medium to long term. However, if it is short or short, you should pay attention to the improvement of American products at this time.

Scan QR code with WeChat