Despite unclear targets and security risks, OpenDao SOS tokens reach a market value of $ 250 million.

The power of airdrops emerged in the community design process, and the new brand hit its $ 250 million market mark in just four days.

However, prices will fall due to falling interest rates and interest rates will fall due to uncertain targets, risk risks will arise and the economy will not change. Its current market value is $ 270 million.

This Christmas, NFT merchants were created by the air of SOS tokens. This is a new OpenDAO policy.

Airdrop is a token distribution system that allows cryptocurrency users to obtain tokens. In this case, the drop can be used anywhere on Ethereum (with a capacity of over 850,000 slots) of NFTs purchased from the famous OpenSea store. Aside from the airdrops which focus on the OpenSea user base, OpenDAO has nothing to do with OpenSea.

According to the Dune Analytics dashboard, nearly 275,000 sites have requested weather forecasts so far, with an average cost of $ 125 at current rates. Many authors have reported 4 and 5 digit claims, and the exact counting process used to calculate undisclosed amounts.

While the plan is starting to heat up, many experts have warned the SOS could start to wane due to uncertainty and ambiguous plans.

Security

Shortly after the airdrop, several Ethereum developers cautioned on social media about the potential attack vector of the project's code, which poses a "RugPull" risk to its founders' contributors.

50% of the tokens are in the hands of our address managed by the main group. While these tokens are reserved for staking gifts, liquid mining gifts, and DAO warehouses, there is no on-chain security guarantee to protect them (such as time locks, acquisition times, or wallets. multiple signature or multi-signature).

Suppose the team can throw the Tokens from the Support Exchange and Distribution at any time to earn millions and zero token value. This is a good way for parties to avoid fraud.

A key OpenDAO supporter told CoinDesk that the electoral process is underway on the Discord channel to elect seven signatories.

Additionally, Fabrice Cheng, founder of Quadrata Network, told CoinDesk that the drop export model allows key groups to "slowly and quietly pay requests for tokens that are traditionally stored for the [OpenDAO] community. Time" .

It is difficult to determine how the request was enforced because the cast was not made public, but there was no clear evidence that the request was enforced. Primary groups are anonymous or pseudonyms by default.

The DAO will also close the parachute drop exchange period in June and unclaimed tokens will be sent to the DAO Treasury.

useless

As key groups struggle to implement security measures, communities now struggle to determine the actual use of SOS tokens.

Some media have speculated that OpenDAO will use the immediate funding to create an alternative to OpenSea, but the group said more needs to be done.

In the first announcement, the Main Group announced that the funds should be used to "protect NFT artists" and "support NFT artists", rewarding victims of NFT fraud and hacking.

Key stakeholders always assess data using community input.

As one supporter said in an interview, "Right now there are a lot of great and brilliant ideas out there, but we've got a good time before picking out multiple signature portfolios."

DAO has two options for insurers including announcing plans that will generate annual rewards and budget plans that will reward market donors in two years.

These are the most popular token devices (DeFi) used to generate token needs, but they often exist as part of a larger token market.

Although the use of tokens is restricted, key stakeholders have been successful in improving the token. At the Discord channel project, participants announce a strong partnership with certain portfolios and markets.

communautary development

Many observers are amazed at how quickly a project can change despite dangerous risks and lack of equipment or vision.

Unbeknownst to some experts, they believe that targeted airdrops, a way to send tokens that unite similarly behaving users on the channel, is part of the secret to its success.

Soban “Soby” Saqib, NFT aggregator and co-founder of Ex Populus, said: “SOS is a great example of how tokens can be a great medium for the average community, even using NFT, Web 3 for make this process possible.

In addition, the absence of a roadmap can, to a lesser extent, be the east wind of the project. A member of eGirl Capital said that interest eventually increased due to its proximity to OpenSea and the lack of details on the use of tokens in the end.

Looking forward to the future

Some well-known investors, personalities and developers have been included in SOS's top executive list, including co-founder Aave Stani Kulechov and anonymous super investor NFT Pranksy.

According to Nansen wallet analysis tools, the Sushi SOS-ETH decentralized exchange pool is still a "gold contract". noisy.

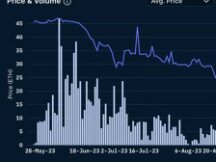

But the hype points to delays. According to data from CoinGecko, the packaging market has been growing steadily since Sunday and prices are also falling.

In a recent blog post, Jordan “Cobie” Fish, cryptocurrency trader and podcast host, writes that for popular assets like SOS, no proceeds, interest, and cost per project are available. The ability to control is generally straightforward. It is difficult to see with the naked eye.

He wrote: “When a treasure enters the memory of many players, it is easy for each player to rethink, but it is more difficult to get care without a lack of supplies and clients.

It is not known how long SOS can maintain interest in the cryptocurrency community, as it is sometimes blatantly slow and inefficient in regulatory processes and risk management. Security is always a threat and costs can fluctuate rapidly. the mind changes.

Scan QR code with WeChat