2021 best total return of 60%, BTC best practices for 3 consecutive years

Bitcoin's total cashback increased 66.5% at the end of 2021, making it the best performing asset for the third year in a row. Bitcoin tops 16 other class assets, including gold, commodities, and common assets like US Treasuries and bonds.

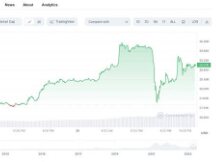

(Bitcoin performance in 2021)

Relative to Bitcoin, the stock traded well with a return of 41.4% in 2021. The US Real Estate Investment Trust (REITS) ranked third with a return of 40.5%.

At the end of 2021, the Financial Times also noted that rising inflation made it one of the most important assets in 2021. In the minds of some, the luster of this precious metal is “digital gold”. Bitcoin. In contrast, Bitcoin is seeing a big increase in 2021 (although there is more volatility) and is up 65% this year.

According to the data, not only over the past three years, but in fact, Bitcoin has become the ninth most valuable asset over the past 11 years. In 2014 and 2018, US REITS and US. However, at present, Bitcoin is still the most valuable asset with a total ROI of over 1 million% and a total annual return of 197.2%.

At the start of 2021, the Ecoinometrics report showed that Bitcoin was growing rapidly. According to the report, Bitcoin's four-year total return was 2675%, Tesla second at 1406% and AMD third at 695%. On the 8-year chart, Tesla, Nvidia, AMD, and Amazon all saw significant returns on investment, while Bitcoin rose less than 20.238%.

Bitcoin has grown rapidly over the past decade, but on that basis it is still very profitable as early as 2021, outperforming other major cryptocurrencies. According to the Goldman Sachs report, as of March 4, 2021, Bitcoin's recovery from the start of the year is around 70%, roughly twice the second largest power industry (around 35%).

With this strong growth, the potential value of Bitcoin hovering around $ 46,000 now after the price of bitcoin continues to rise until 2021. The market has a mix of potential trade thoughts.

Anonymous PlanB, who developed the S2F model, said in an interview that they are not worried about the short-term value of Bitcoin and could reach $ 100,000 to $ 1 million in the long term.

In addition to market participants, PlanB's new Twitter poll found that nearly 24% of people believe the price of BTC will be less than $ 50,000, 31.1% believe the price of BTC will be between 50,000 and less. and $ 100,000, and 32.6% of people think the value of BTC will be between $ 50,000 and $ 100,000. They believe that the value of BTC will be between $ 50,000 and $ 100,000, the value of BTC will be between $ 100,000 and $ 200,000, and 12.6% believe that the value of BTC will exceed US $ 0020 .

According to Santiment's survey of December 26, 2021, Bitcoin could still be at the $ 50,000 level.

Salvadoran President Nayib Bukele announced on Twitter his plans for Bitcoin in 2022, with Bitcoin's value reaching $ 100,000 and many countries receiving it as a boon. He said it would be an election issue. Bitcoin City will begin to form and Volcano Bonds will be oversubscribed.

Forbes predicts that if inflation continues to rise, workers' wages will drop and Bitcoin could become another way for the US dollar to appreciate.

Brock Pierce, founder of Block.one, estimates that the global economic situation could push the value of Bitcoin up to five digits next year, even as high as $ 200,000 for the short term. It is believed that the administration can help the cryptocurrency, but it can only be controlled after careful consideration and included in the management. In addition, Tom Lee, CEO of Fundstrat Global Advisors, estimates that the value of Bitcoin could reach $ 200,000 by 2022.

Mike McGlone, chief commodities strategist at Bloomberg, said the Bitcoin bull market is not over yet and could reach $ 70,000 in the near future.

Scan QR code with WeChat