September Research and Judgment, Now Bitcoin is Better to Fall Than Continue

Flight time, and next Tuesday is early September, the new moon. Marketing in August is very difficult. BTC is above 50,000 U and BTC is below 40,000 U. Bitcoin has rebounded, but the market has been a bit anxious in recent days. Many will become more disruptive, especially as the exchange rate of large benefits increases.

Personally, I think the downside is generally good, not necessarily bad. Everyone loves a slow bull trade. When the bull market starts and ends quickly, you won't have time to earn much. Many times we have to compete with time in the bull market. It is very difficult to catch the growth which is at its peak and at the same time it is at the breaking point. Therefore, those who think that in the barn will have less and less time to sleep. In a bear market, everyone is buying more than usual.

This guide generally identifies three issues.

1. Why is it better to go down than to go up?

2. Why is the short term BTC near 46500U?

3. What will September be like?

Let's talk about them one by one below.

Why is it better to go down than to go up?

There are several reasons for this. Seen for the first time on the Japanese line. On August 9, BTC first crossed the 200-day mark. However, there is no special advertising business after breaking the line every day. You will almost see that the build after August 9 is the start of three days of ups and downs, then 4 of ups and downs. He's still tied to the gap. And we can clearly see the promise (low volume).

As of August 27, the Bitcoin market volume was only 40,000 which is very small in itself. Without the support of this force, the market will be in trouble. Or, even if the current position reaches position 51000U, 52000U, it can be said that it will drop immediately. Because there is no oil in this place to raise the price. Here is an example you can see in Daily Line.

Second, we can look at the KDG indicator. You can remove the D and G lines and just look at the K line for clues. KDG is the most commonly used indicator for analysis and is the most commonly used with the RSI.

The value of K is between 0 and 100, which is greater than 80 by default. Of course, this definition varies from person to person, and some define it as 70 or 75. That means 80. When the value of K goes up to 80, it enters the overbought zone. . Everyone desperately grabs the chip and the price will go up. If you enter an overbought zone you should be aware of the risk and there may be a short period of time if the volume cannot be maintained.

In exchange, the value of K less than 20 enters the oversold zone. This means that everyone is going to desperately throw chips in their hands. However, if the oversold zone does not participate in volume and strength, a short lower zone appears instead of the large volume.

This is a general description. Specifically, you can see the market after August 7th. There is a clear difference. In other words, the price increases, but the value of K decreases. This difference is accompanied by a decrease in the quantity.

We can also see the days when Bitcoin hit a new high of 50,500U, where the K price broke through 80 and hit 81.6, but the K price is not as high as the previous one. At this point, the K value of KDG indicates that it cannot increase further. It is not surprising that the market experiences a correction after this deviation occurs.

Today the price after BTC K peaked and immediately fell. We can also compare. On July 20, BTC price hit its lowest point of 29278U while K price was 14.25. It is already below 20. And we can see that the market today is also in decline. So there was a very strong recovery on July 21. This is also necessary.

So, one can imagine that if BTC continues to rise from its current price, breaking through its short term high of 50500U, and the K value continues to rise, it will be difficult to break the downside. So when BTC hits the 51,000 and 52,000 positions, it looks like it is in danger of a major waterfall. The market itself has risen, but in a very long day, the upper shadow lines will come together and take the market straight.

In fact, it's something that people don't want to see. This is why I say it is better to call back now. The recall can gradually move vibration measurements such as KDG and K values in the correct direction. Now the price of K goes up to 50, but that doesn't mean that it will recover when the price of K goes up to 50. But at least the price of K comes from low tide, which must be remembered. You can use the K value as a benchmark, starting with the actual market. A break from the recession is likely to continue as the tide rises.

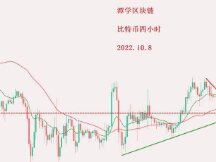

Third, culture. This week's current main line low is 46250U which is still a necessary drop as it is still above the main line.

If you do simple and bad statistics, you can check the numbers. While another positive line closed this week, Bitcoin has already risen for the sixth week in a row. So far we have only seen a 6 week price increase over the past few weeks. It happened twice this time, once, when the cattle market opened in October of last year, and it has increased for seven weeks in a row. After 312, this year continues its ascent for seven consecutive weeks. So if you are currently on a node, you will most likely get a callback next week. It doesn't seem to be increasing. It may also affect why I think it's better to go down now than to go up further.

short term bitcoin below

In fact, if you look at the BTC model today, you can see that it stayed below 4650U for a short time and then fell below 4625U. Basically, when it goes below 4650U, the market immediately rebounds. Next, we need to investigate why the 4600-4700U would become too short term for BTC.

1. Location of MA200. The MA200 index is currently at 46500. And we are seeing that the MA200 and the Bollinger Band, the MA20, the 200 and the 20 times moving average, are now forming better support. And so far, stepping back from a 20-day line can still be seen as a viable task. It's old or because it's a small business and doesn't break work.

And when the market volume drops below the 200 day line and falls below the 45,000 and 44,000 levels, the status of the market will change. If you still don't like this post. You can draw an ascending line yourself.

In the uptrend cycle, you can see that the current position is still in an uptrend. However, line art is a term that some people believe is currently at the bottom of the uptrend line.

When the difference line you draw is broken or tripled, I think it's best to figure out which difference you need to identify. Looks good now. I also hope that the explanation will give everyone some faith.

how to have september

Finally, let me take you through how Bitcoin will play out in September. Now we can see a lot of differences in the market. The MA200 line is simple. I thought it was very magical. It's flat at the moment, so it might be a coincidence, but it's still amazing. I think it can provide a lot of support for all disks. The market has therefore not decided that there will be transport throughout the month of September.

But the most important thing is to measure the energy. There must be a burst of energy. It is also the heart of today's business. If it's lowered, it shouldn't be up and down.

In the short term, you will be able to see the MA200 position and at the same time look at the MA20 line, and the reaction will be more noticeable. If the market goes up, the MA20 will follow the market. The last real problem now is climbing on the support poles made by MA50 and MA60.

We hope the tips above will help everyone know where the support is in the short, medium and long term. And now the key to restricting trade. Not a lot. It may take a week or two to resolve the issue. Don't be surprised if the boring business is bored again next week. It's normal. It will increase further in the second or third week of September.

I also hope everyone is patient enough. As long as you have a coin in hand, don't throw away your tokens easily.

The above is the full text of the message. Trading and investing in cryptocurrencies should comply with national and regional laws and be aware of the high level of uncertainty and risk involved.

As a weakness, I have heard more and more about walking recently. First, the number of new home friends entering the cryptocurrency space since May has plummeted. To understand what's inside and what the DEX private key usage is, you need to know how to use a wallet. They have the best skills and problems with their novice friends.

Second, business investments in the key cryptocurrency market are all about buying and holding in terms of asset allocation, and the simple process is unlikely to change much. Considering that the price of holding companies, like Tesla, which only started at the beginning of the year, is between 32,000U and 33,000U, cannot further increase the position today. It goes without saying that often there are many or many organizations that benefit from the future.

The third is the craziest NFT and Metaspatial arena, which gets more attention because it costs more money.

Overall, the crypto world is still in a state of isolation from its products. The industry has always believed that the healthcare industry needs more products and services developed by the industry to create value outside the industry due to the exchange rate, exchange rate and increase more the value of the first and second market capitalization. Due to the circulation, only the external funds (bottled water) will continue to enter, solving the problem of separation of the joints. Of course, one can see a satisfactory result, for example, in the field of distribution, companies have started to implement IPFS protocol and use data storage and archiving, and are willing to pay for these services. like Oracle and Privacy. Willingness to pay Defi's DID system experience can work on existing finances and build purchasing power.

When you walk around the store, the short term is not important, the medium time for the long term is more important. Some are optimistic about the medium to long term outlook for Bitcoin and crypto in the Austrian market, with confidence in geeks and individuals alike. And I would support the idea of a traditional business more. More importantly, when the cryptocurrency market doesn't need monetization benefits and doesn't have to rely on airdrops for a cold start, we can get out of the cycle immediately. We have the courage to work for more industries and raise expectations for standards.

Scan QR code with WeChat