There are only 1.3 million Bitcoins on the exchange.

In the midst of Christmas celebration, the supply of Bitcoin (BTC) is running out, hitting its lowest level in years. In a recent tweet from CryptoRank, 1.3 million BTC, or 6.3% of all Bitcoin transactions, are still in the cryptocurrency exchange.

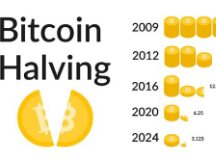

After Bitcoin's halving in 2020, the BTC blockchain was halved again and the stock reported declines. BTC issued by the exchange also followed suit, showing a decline last year. Currency trading accounted for 9.5% of BTC inventory in October 2020 and 7.3% in July of this year, just before the 2020 Christmas peak. December at 6.3% was the low of 2021.

Interestingly, the dominance of Coinbase's BTC portfolio continues to decline. This American exchange once held more BTC than any other exchange. Last year, the share fell from 50.52% to 40.65%.

The news came after a series of good price measures that coincided with the rise in Bitcoin prices. Firstly, the supply of illiquid BTC has been frozen for the winter because the supply of "non-current" "liquid" BTC is currently 100,000 BTC per month. It is important to note that more BTC than extracts are locked in a cold store.

Chain analytics firm Glassnode has reported more bullish news on the behavior change. BTC's 7-day moving average has moved to its 5-month low of 978.452 BTC and signals weekly declines. As the value of BTC referred to the exchange gets smaller and smaller, the exchange will continue indefinitely.

Also, many traders and some companies keep their BTC on the exchange, so the “illiquid” BTC will be lower. Some BTC holders will place their keys in exchange for storage instead of keeping their BTC offline in the freezer.

Naturally, Binance CEO and co-founder Changpeng Zhao supports the leadership of the wallet, although he supports Bitcoin holders like Andreas Antonopolous that “you can know your own Bitcoin by knowing the key. "

So even if you have 1.3 million BTC on the exchange, it will not be "fixed" and may in fact result in inefficiency.

Despite demand based on the positive analysis of the 'Christmas Gathering', the cryptocurrency market is still in a bear market. According to a tweet reported by BullRun Invest using data from Glassnode, 24.6% of BTC products were valued over $ 47,000.

This shows that about a quarter of BTC will be at this price currently on hand. Futures under the tree may be reduced tomorrow if BTC fails by $ 50,000.

Scan QR code with WeChat