Bitcoin continued to decline and recorded its worst performance in May.

Bitcoin has handled recent declines and is expected to post negative monthly performance since the cryptocurrency market crash in May.

At 1:40 p.m. Singapore time on Wednesday, the world's largest cryptocurrency yesterday posted nearly 7% around $ 48,000. Bitcoin has fallen by around 16% this month, and the market value of all cryptocurrency markets has evaporated by around $ 260 billion over the same period, according to data from CoinGecko.

As 2021 draws to a close, demand for much-needed investments is declining. Part of the reason is that the Fed has started cutting its stimulus budget, which has boosted many commodities this year.

Ben Emons, a global macro strategist at Medley Global Advisors LLC, said there was a rumor that "bitcoin's long efforts have been hard work and have been completed before the end of the year." "It can reduce the risk in the short term," he added.

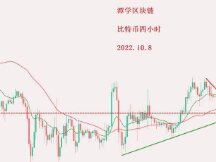

Experts carefully monitored key processes to find information about Bitcoin leads.

At the Fibonacci retracement level, the next level of Bitcoin support is near $ 44,200, said Katie Stockton, founder and managing partner of Fairlead Strategies, an independent, analytical research firm.

Bitcoin's drop this month reduced its gains this year by around 65%, but still outperforms cryptocurrencies such as international markets and commodities.

Those who believe in cryptocurrencies believe the Bitcoin bull market will return to an all-time high of nearly $ 69,000 last month and expect it to return soon. In many ways, the claim that Bitcoin can hedge financial risk is controversial.

“The point of the story is very long,” said Graham Jenkin, CEO of cryptocurrency exchange CoinList, in an interview with Bloomberg TV. "Over time, Bitcoin will become a very valuable investment."

Scan QR code with WeChat