Loss of assets in securities: how will the industry improve in the future?

Currency trading has continued to decline over the past few days, with Bitcoin falling below $ 56,000 from its high of $ 69,000. Bitcoin thus fell, and most other currencies, which had higher volatility than Bitcoin, fell sharply. He lost more than 1/3 everywhere. It can be explained as dangerous, and whoever holds the benefits is more depressed.

In particular, this time the "reason" for the slowdown is insufficient, so that the so-called "sell the coat" is not true, and the other "bad" is not considered bad at all by compared to 519. However, as the economy declines and the recession is not shallow, it appears that the recession is continuing. If prices go up too much, that will inevitably change.

So what is the real reason for a volatile financial exchange? My research on the knowledge over the past few days can be done as follows: To be honest, if the currency market has been ruled by house earnings in the past, this decline will not be very steep. In general, the decline was affected by factors such as the US stock market.

The two charts here are recent US stocks on the Dow Jones and the Nasdaq Daily Lines, showing that the Dow Jones has started to correct the downtrend while the Nasdaq is still slightly higher. The reason for this difference is simple. The Dow Jones Index is a starting point determined by the 30-year-old monopoly market share and is a major battle on Wall Street, and the decline indicates the behavior of Wall Street. The Nasdaq is often compared to the Dow Jones, but in recent years the market has been boosted by early Apple startups. Many products of the electric car industry were affected last year, especially after the interest of the famous "American businessman" who supported the Nasdaq stock market. But you can also see it on the K line, and it's very nervous.

Current events in the US stock market have been described as "Wall Street vs Retail". Wall Street is down and only traders are bullish. The Blues have always believed that US investors alone benefited greatly from the Fed's helicopter crash last year and a further rise in US commodities caused by flooding rivers. Needless to say, that was the point of the writing. on Wall Street. Wall Street writings always call for a downturn in the US stock market, but you never know when they will rise or when they will start. However, at least recently, the shadow of these dangers has become more apparent.

This risk now generally stems from two factors.

The first is inflation. In the past, when the United States entered high inflation, especially hyperinflation, it was almost a time of declining markets. The US inflation rate was 5.4% in September and 6.2% in October, indicating that the United States has entered a phase of hyperinflation (based on a 5% increase). It seems that the situation has slowly worsened. In theory, high inflation means a fall in the value of the company, so under normal circumstances the stock market will fall. Another important factor is mental health, high inflation means the business environment is bad, which often leads to mental illness, that is, the economy declines, leading to a recession in the market capital.

The second is the evolution of the circulation of the US dollar. Now the US dollar index is rising and the currency is almost up to the non-yuan key, indicating increased demand for the US dollar. At the same time, yields on 10-year US Treasury bonds also registered gains, reducing demand for US Treasury bonds. According to the Dow Jones Indices, total cash gains mean money in circulation, and an increase in short-term liquidity is good for investment protection. What dangers do they avoid? Obviously, it exceeds the potential for an economic downturn such as a slowdown in commodity prices in the United States or a decline in commodity prices.

It is not certain that the above events will lead to a near-term rise in the US commodities market, but at least there are risks. The currency zone decline is initially synchronized with the Dow Jones indices, and it can be seen that the divergence in the US stock market dominates the currency zone pattern in the short term. The potential collapse of the global speculative market resulted from the collapse of the US stock market. Some schools or large investors have seen a decline because of these risks and some have deducted funds.

So what will happen to foreign trade in the future? Of course, you have to wait until you feel the risk is lower. Or, the US economy is in decline, still reducing risk risks and leaving room for further gains. Or the risk of losing big is immature. After a short period of time, market demand rebounded. After a small adjustment, the US stock market continued to rise slightly and the currency certainly gained strength. For consumers, there is no sign of a major turnaround in the US stock market, the decline is expected in the near term, earnings continue to grow and market gains remain. The bull market in US commodities will come to an end. Of course, the same goes for currency.

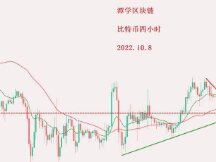

From an indicator standpoint, Bitcoin's 30-day trend has fallen sharply and left its mark, indicating a deep correction. The short term is already deeper than the 30 day moving average, and while there is a high probability of a short term return, the return will generally not exceed $ 62,000 (current position). day line) and hit. below two or three times after return. .

Keep in mind that a 30 day row is a short trampoline, which is pulled backwards by gravity even if it goes up or down too much. Where is the support? The target is on a 30 week row with a trampoline in the middle. Currently the 30 week line has crossed the $ 46,000 mark and the spread is not expected to change anytime soon, with the market correction the 30 week line is still expected to hit $ 50,000. In general, foreign trade needs to be adjusted, and the area of the platform below the 30 day line and above the 30 day line will appear to change over time, and the theme is under construction between 50 $ 000 and $ 60,000 on average. s.

The overall review should look at risk, but it has more than doubled Bitcoin's competitiveness over the past two years, rising 2.4 times from the $ 28,000 wave to $ 69,000. This is a feature that may require further modification regardless of the state of the macro, and this is also true. The Blues initially predicted that a major repair risk would arise after $ 75,000, but the facts turned out to be very good.

A limitation of this adjustment is due to the short duration, the overall cure will not be as deep as the cure has increased by over 60% in the last five months. Currently, the probability is 40%, this wave is up 40,000 US dollars, and we estimate that 40% of the recall is 16,000 US dollars, or about 53,000 US dollars in points.

Other than that the decline was around 49,000 US dollars based on a 50% increase. In other words, the probability of the decline ending is between $ 49,000 and $ 53,000. All changes will take at least 3-5 weeks. Let's see how the business grows like this.

Scan QR code with WeChat