Market volatility hedgers trade volatility followers, and Bitcoin is what they hate.

Like Bitcoin and other cryptocurrencies, speculative stocks were unlucky on Monday. In the eyes of some industry watchers, this is no coincidence.

The 100-day relationship coefficient between Bitcoin and the S&P 500 is 0.33, higher than this year. This means that when the stock market rises, so does Bitcoin and vice versa. (one of 1 means the assets are in the same direction and -1 means the assets are all reversed)

Art Hogan, Head of Marketing at National Securities Co., said: “The recent downturn in Bitcoin and other cryptocurrencies has contributed to downside risk in emerging markets. "So we can see cryptocurrencies depreciating and commodities growing to the same extent."

Cryptocurrency proponents have long argued that Bitcoin and other digital assets fall into a special category that can be used as hedging devices in other areas of the financial markets. The deal was tested as investors hoped the medium-term bank would raise prices faster and speculative sentiment was heightened.

High-yield stocks fell on Monday. After US President Joe Biden was named Fed Chairman Jerome Powell, the economy began to rise and fall based on inflation potential next year.

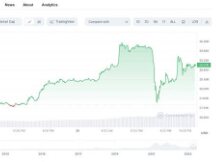

Bitcoin fell 6.5% on Monday, down almost 20% from its all-time high on November 10. At 9:50 a.m. Tuesday in New York, the stock was flat at $ 57,314, up 1.8%.

Miller Tabak Co. “The high tech industry has become the opposite of risk averse industry / forestry. As the mass market rises and falls, the risk of other assets will change. Says Matt Maley, chief market strategist.

The prices of everything from food to commodities to real estate have gone up, and many Wall Street investors and analysts have embraced the idea of using cryptocurrencies to avoid this difference. Economists in economic studies estimate that half of Bitcoin's recent gains could be explained by financial concerns and the other half could be due to economic prosperity and market share.

However, there is a lot of controversy for the inconsistency, the most important of which is that Bitcoin has the short term to prove its image as a rising hedge fund. Additionally, Cam Harvey, an expert at Duke University and a partner in Research Fellows, believes it works too well as a predictable asset and has an impact over time. .

Marc Chandler, a market expert at Bannockburn Global Forex, said he would like to see larger patterns in a few trading days. Indeed, Bitcoin in the short term will depend on many factors, and the next time the inflation data is higher than expected, we will see Bitcoin rise.

“People are trying to connect with something new every day,” Chander said. "What determines the value of Bitcoin? I think that is the root of the problem. What is the driving force? Many drive it daily or for short. If today is the day of the rise in prices? price, tomorrow is technology. dare to rest? assured? "

Scan QR code with WeChat