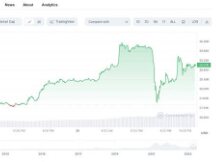

Bitcoin options market rises more than 10 times in January

Over the past 30 days, total open interest on Bitcoin options on the Chicago Mercantile Exchange (CME) has increased more than tenfold. June 10. $ 373 million. In addition, from June 5 to 10, job vacancies reached a maximum of 6 consecutive days.

The strong growth of the CME in the future indicates an immediate interest of companies in complying with Bitcoin derivatives. Despite the positive growth, the CME spokesperson told CoinDesk that the group "has no plans to announce any other crypto products." As a result, the CME Group's cryptocurrency offering now only includes Bitcoin.

CME only announced its Bitcoin options products in early 2020 and now represents over 20% of the global Bitcoin options market, measured by open positions (e.g., limited to all open derivative contracts). According to data from Skew, CME is now the second largest Bitcoin market in the world after Deribit, the largest cryptocurrency options exchange in the world.

Matt Kaye, CEO of Los Angeles-based Blockhead Capital, said the growth of the CME bitcoin industry is "a strong signal that companies are getting involved in the bitcoin industry." However, CME's investment cost is higher. And there are no offers. Holidays. "

As shown in the figure below, the CME market generally recovered during the Deribit downturn. As of January, the common market for Bitcoin options exchanges such as LedgerX, Bakkt and OKEx has been stable.

In addition to these options, CME Bitcoin futures also show positive growth, with growth and overall growth outperforming almost all other Bitcoin derivatives platforms. CME Bitcoin Futures volume has grown 29% over the past 30 days as companies continue to enter the Bitcoin derivatives market.

Scan QR code with WeChat