Has London's Enhanced Ethereum been more realistic with the Ethereum 2.0 Gold travel promise of over $ 1 million?

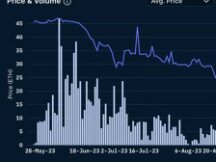

According to data from ultrasound.money, as of 11 a.m. on December 24, the total value of Ethereum burned was $ 1.25 million, and the total value was over $ 5 billion.

Among them, the application that destroyed Ethereum the most was OpenC, which burned more than 131,300 Ethereum, representing 10.5% of the total.Ethereum Transfer and Uniswap V2 received second and third place, accounting for 9.82% (122,800) and 8.9% (111,700), respectively..

In fact, in addition to the continued demand for fire since this year's London overhaul, the ETHereum 2.0 contract launched last year is also having a significant impact on continuing ETH needs to another level.

Ethereum 2.0 One-year review contract

The Eth2 staking, launched by Ethereum in December last year, means Ethereum has started to move from Proof of Work (PoW) to Proof of Stake (PoS). , and Ethereum 2.0 entered at level 0.

According to official data from ethereum.org, as of December 24, the number of ETH affiliates with Ethereum 2.0 exceeded 8.75 million and funding for all Ethereum tours. 14.28% or more, the total consumer value is 273,600.

The main differences from Ethereum 2.0 are in two ways: the approval mechanism (PoW for PoS) and sharding. Eth2 commitments generally concern the services of witnesses of interest. Users can pledge at least 32 ETH to join Ethereum PoS pledge to earn income. .

The Ethereum network is protected by validators that promise over 32 ETH, and the role of validators includes marketing, data collection, and adding blocks to the mainnet.

Among them, legitimate employees who work honestly and fulfill their responsibilities to the network will benefit from ETH, and employees who do not do their job or make mistakes will be rewarded.

In other words, the organization that secures the network is no longer the miner, but the witness, and to be the user, you must contract ETH under the Eth2 Pledge contract.

In fact, from this point of view, the function of the stakes of at least 32 ETH for the giveaway can be compared to "the graphical exploitation of Ethereum" in new terms. Mining production.

Ethereum 2.0 promises to pay close attention to these issues

At the same time, in October of this year, the Ethereum team completed the transformation of the Ethereum exchange to PoS, which means that Ethereum 2.0 has taken another important milestone.

However, for ordinary users who wish to join, direct participation in the Ethereum 2.0 promise comes with some initial risks and risks due to the development of a specialization for the Ethereum 2.0 factory.

Payment terms: 32 ETH

First of all, when you join an Eth2 contract, you deposit a minimum of 32 ETH (or more than 32) into the deposit agreement. Most users.

Technical standard: penalty for slash

As mentioned above, the evidence in Eth2 is similar to that of minors certified to work in Eth1. Users commit to 32 ETH to generate certificates, run software using new blocks, assist and receive rewards. .

Fines are acceptable when the secured node does not comply with the requirement i.e. it is cut off at least 32 ETH committed on the node.When any of the ETH token collateral drops below 16 due to the combination of fine particles, the node is disconnected from the Ethereum 2.0 network.

And the circumstances that lead to penalties surround the level of work and supervision, such as sign error, length of time taken offline, etc.

The validator node offers two blocks colliding with several methods (initial hashes of internal data) in the same hole.

Validation nodes prove two collision blocks in the same hole, i.e. two votes.

Votes cast in the affirmative will be “rounded” or “rounded” by the previous vote.

Since day one of the Eth2 engagement, around 600 people have been sentenced with convictions, and since then it can be said that the continuous slash has been sentenced for the same reasons.

Peev efficiency threshold: liquidity lock-in

ETH is promised by Eth2 always closed and will not be locked until phase 2 (or level 1.5) of Ethereum, with good results to be received.

From the above, it can be seen that the inability to participate in a small amount of ETH, the limitations of certificates and the marketing of token contracts are problematic, which ordinary users should be careful of when joining the Eth2 contract. .

Tracking of Ethereum 2.0 commitments has increased.

As a result, the promised services of Ethereum 2.0 have appeared on the market, which can be implemented as "two groups and four models" at the macro level.

accommodation

The great thing about hosting is that it encapsulates the process of creating and managing nodes, so end users don't have to worry about hardware and software configurations, fine-tuning, etc.

control everything

Users have full control without having to worry about analyzing and monitoring tasks. The administrator manages all node operations. Users only need to replace ETH with an administrator contract. Admin manages and operates 100% Ethereum. 2.0 Validation nodes for users, income from contract values.

Users can also contract smaller (less than 32 ETH). Because the trustee can help small entrepreneurs increase by 32 ETH to join the Eth2 contract.

tab sis two,At the time of the contract, users have no control over their assets, and if attacked, their assets are at greater risk.At the same time, users don't know if the agent's price is stable online, if their income is reasonable or reasonable, or if they are being penalized.

It is not yet known whether the supported treasure is used as a commodity. "We care about the income, but people worry about the money." Prison is very important.

Steak Pools Cia

Pool contracts as a whole not only focus on small contracts (less than 32 ETH) but also solve unreliable issues by closing the long term hour of the deposit agreement.

There is a special Ethereum 2.0 contract like Lido (this article will not talk about CEX support at this time) which allows users to earn income without closing ETH, the solution is the same - 1: 1 gives stETH income for the rewards :

Lido placed ETH on the Ethereum smart card and received stETH as received. The stETH token equivalents may be updated over time to reflect the distribution of promotional giveaways created by the contract.

To date, Lido's Ethereum contract is 1.53 million, the largest contract space, and the ecosystem is still under development, and SOL and LUNA have launched a contract service.

uncontrollable

Non-monitors are decentralized, and the difference with monitors is the difference between DEX and CEX.

self-formed knot

Direct reporting that is not handled by users running Eth1 and Eth2 clients and running and managing their own nodes is a strong and experienced force in node operations and management.

Therefore, users have full control over the nodes they create themselves, and there is no risk of centralized control, but it comes with the disadvantage of high financial and intellectual and difficult requirements for users. ordinary people to participate.

Semi-accommodation

When the tag chain wallet is created, two sets of keys are generated: the deletion key and the validation key.

The delete key will delete the ETH and the gift when the beacon chain is off (it will take a year).

Validation Key, the signing key that the validation software actually uses when validating the tag string.

Among them, the deletion key and proof do not need to be administered by the same organization, providing more flexibility in the form of ETH services.

The main idea of the solution is partly represented by imToken, etc. : In this design, asset management is still in their hands. The downside is that it still requires a minimum of 32 ETH and a large capacity.

In summary, the characteristics and advantages of each "two groups and four models" are:

Although the development of Ethereum 2.0 is not satisfactory, day by day, the promise of Ethereum 2.0 will become inevitable and important in the Ethereum world.

It also needs special attention as it is venturing on a large scale and in an innovative way in terms of improving the incomes of long-term ETH holders and developing capital in the process.

Scan QR code with WeChat