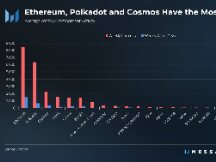

Everything grows. Why can Acala be the target star in so many Polkadot projects?

The Polkadot slots auction is starting soon and what Polkadot players are looking forward to is the Acala network called the all-in-one Defi Hub. This sentence deals with the origins of Akala. And how to participate in card games?

Polka Dot Challenge Hub

AkalaFirst global distribution and open financing partnership, Polkadot Ecological Financial Center.

Acala is based on Polkadot ecology,Develop open source strategies for the ecosystem, increase investments in global crypto assets and increase investment capital..

Source: Akala official account

The Acala network is divided into four sections, the two most important of which are:Inter-chain multi-asset collateralised Stablecoin Honzon protocolandHoma Protocol releases liquidity from guaranteed assets.

Honzon Protocol

Multi-asset collateralized Stablecoin protocol to improve investment performance

Unlike Ethereum external agents (external agents), which monitor and stop malicious operations, the Honzon protocol uses human resources. The role of the liquidator is replaced by a collector who can:It is safer and more functional to ensure the proper functioning of the body..

Source: Image courtesy of CryptoYC. Complete the CDP process: After depositing the product, the user becomes the holder of the CDP, borrowing the aUSD from the fund pool, finally repaying the aUSD and securing the fees. freeze and close the CDP. Along the way, acala has implemented a number of energy management risks.

The Honzon protocol allows users to deposit digital assets on any network blockchain to open a secured debt position (CDP) and exchange it for USD pegged to US dollars. The AUSD exchange by Honzon protocol can connect to Polkadot at any time on the blockchain. Use, borrow and borrow money from

able to control

The biggest concern of robust processes is their ability to manage risk. soHow ala to keep safe?

There are a total of 3 protection mechanisms in the Acala liquidation process. First in AkalaAn integrated decentralized exchange can act as a guaranteed liquidator.; second,The dSWF's most valuable assets will be used as a safe haven for income payment.; Three,The ACA will be sold for income.. In this way, the automatic liquidation of risky CDPs is carried out and the special Acala auction mechanism is used.

Source : https://www.chaindd.com/3431654.html

1. Akala Integrated Exchange

The first layer that claims to be able to manage risk is Acala's exchange rate, and if the loss of assets is less than 20%, the system will automatically opt out of DEX Trading Company.

An exchange made at Acala can follow the responsibility, and the exchange receives the AMM mechanism.. As a substrate, you can use all the benefits of the off-line worker frame to get the most out of any hazardous environment. With exchanges, anyone can become an active employee by providing income, and every money changer can benefit directly without any competition. .It is very effective in reducing crime to allow users to join Honzon protocol..

The features supported by the exchange are as follows.

· More user-friendly payment.

· TPS 1000, too high.

· Multi-currency arbitrage improves profitability of assets.

Source: Akala official website

2. SWV

The second layer of asset protection is dSWF security storage.In the event of a loss between 20% and 30%, the proceeds of the dWSF serve as a security deposit to finance the profits. The dWSF's income comes mainly from the security of CDP fees, CDP penalties and fees related to L-DOT bonds.

dSWF is a decentralized “National Fund” which holds “Forex Reserves” (crypto assets from other blockchain networks) and “Strategic Investments”.

dSWF works in three ways: cost, efficiency and energy consumption. The source of funds is the project budget balance, and having a balance in the project diversifies the investment and maximizes long-term return on investment. For example:

Source: Network

3. ACA auction bottom bag

I don't know if you still remember MakerDAO lost millions of dollars at 312. Acala improved their trade security and improved their bidding process in order to handle the situation Black Swan is more stringent in terms of competition and security mechanisms. However, it is only when the share price drops by 50% that the Acala network auction mechanism can work and benefit. Next, let's take a look at the security measures Acala has taken to ensure that the operation does not interfere with the system.

Up to 200 TPS functions

In Polkadot, 20% of the space of each island is reserved for functional work as a priority. Faced with a large number of assets to complete, like the 312, the system will produce several commercial products at the same time, which Ethereum could not control after the crisis, causing a huge loss to Makerdao. Acala is based on Polkadot, and the Polkadot parachain supplements a minimum of 200 TPS, ensuring that conversions can be made even when the system is under pressure.

Effectiveness of risky CDP liquidation

As mentioned above, Acala threatens the career with a combination of "competition and trade". Then, when the system detects that the commodity is affecting the market, the first step is to try and pay the large costs by selling the commodity through an exchange, and if that is not according to the circumstances, the race will begin. At this point, if a bid is successful in the auction, the final bid price is compared to the bid price at the end of the auction so that the goods can be sold for the best price.

Homa liquidity release agreement

Improve the operational capacities of treasury users

Suppose there is an office in the city center and you want to partner with the office, and the money is divided into three main groups.First, you sell your home office directly to someone else and get a different price. Second: renting office space, renting works for large and small businesses to earn income, third: loans, home equity loans and applying for a bank loan.

Let's go back to Polkadot's staking policy with the example above. Users who participate in the special trend for DOT devices in Polkadot can receive staking rewards, but DOT / KSM non-staking must wait for the system-defined non-staking time (7 days for KSM, 28 days for DOT). The Acala liquidity release contract eliminates the need for uninterrupted long-term expectations and releases income for stranded assets. Specifically, users have committed to using their DOT / KSM assets to launch L-DOT / L-KSM to generate channel income while securing assets. Casting L-DOT / L-KSM can be traded and used in other ecosystems. application.

The Acala Institute provides solutions to financial problems through the lending assets of the Polkadot network, enabling users to generate income without wasting their resources and gifts, and to engage citizens such as loans, corporate bonds leverage and the right jobs. and other financial aid.

Akala EVM

100% compatible with Ethereum growth environment, maintaining 100% substrate quality

Source: Akala Land

In addition to the two policies above, EVM is also an integral part of Acala.Acala is a smart contract with a similar EVM, and layers similar to applications developed by Ethereum can be quickly shipped to Acala Parachain and accessed in the Polkadot ecosystem without there being any communication over the bridge.Acala offers the out-of-the-box process for DeFi-enabled products, easy-to-use tools, and existing users, along with many new developments that Ethereum cannot complete right now. . For example, users of the Acala network, a custom network company, can use all the assets of the Acala platform to pay for the network. upgrades, etc.

How to participate in the Polkadot Parachain Acala auction?

Source: Akala Land

Acala freed the main network by renting the parachain from Polkadot.Previously, Karura was successfully completed with the Kusama card game.Acala uses Dot for crowdfunding like KAR.. The Polkadot Slot Card Auction is a candle auction specially designed to sell the lease rights to Parachain slots.

As mentioned above, there are 4 ways to participate in the Acala Crowdloan auction.

The first intervenes directly in the chain. The requirement is a minimum of 5 DOT and the DOT must be closed for 2 years.

The second is the involvement of the lcDOT liquidation mission. The starting point is not only 1 DOT, but also the output layer of its own chips through lcDOT. After the lease expires, lcDOT is free to buy back DOT.

The third and fourth methods are to engage mid-sized exchanges or wallets that support Polkadot auctions.

DOT's commitment to join the closed loan group is 2 yearsHowever, Acala will be able to exchange the existing DOT for LcDot Tokens by Homa, a cash release deal, which will release the product. Mining with LcDot gives you both competitive advantages and competitive advantages. However, if you choose Dot to trade for LcDot, you need to refer to income and trading environment in time.

After 2 years, LcDots can be converted to Dots.

Sure,If you decide to participate in a game card, you should consider the following questions::

1. Can you turn off the cash on the card ASAP?

2. Are the circumstances large and rich enough to spend and earn money?

3. Is the liquidity sufficient? If the measurement of liquid derivatives is too low, will there be any future trade or mining restrictions?

Note: Akala inside the loop

Would you like to explain with a simple example how acala can increase investments and increase income?

Assuming the current DOT price is $ 40 each and the DOT and L-DOT ratio is 1: 1, if you have 10 DOT and switch to L-DOT at the start of the Acala mainnet, you will receive 10 L -DOWRY. Right now, Polka Dot's annual rate of return is around 10%, and I enjoy a 10% rate of return when I have L-DOT. Since L-DOT can generate USD as excess stock for Honzon contracts, we have set up 10 L-DOT as stock options and select loan rates through the system up to 200% (automatic loan system). 150%), generate 200 aUSD, I am happy with the future development of DOT, so I switched 200 aUSD to 5 DOT in exchange on the Acala network, then I exchanged DOT to L-DOT, then at this point the detention time The number of L-DOTs will be 15, and compared to the first 10 DOT, an annual return of 10%, the annual return of 15 DOT is now 10% and the return is 1 year. , Originally had 1 DOT income, it is now 1.5. That is, we got an extra 5% return on 10 DOT.

If the above income is not enough or you want to seek income, you can bring the LcDot exchange to the store to earn cash, and other deFi such as mining.After 2 years, bring the Lcdot to the store and redeem the Dot to receive an Aca token. This completes the entire Akala card auction process.

PS: Recently, the inter-chain Acala and BNC work started. You can earn Liquid Mining Income and Loyalty Income by joining LP Business Partner kUSD-BNC by clicking on the link below:

KAR and BNC are about to embark on a journey through the DeFi chain.

https://mp.weixin.qq.com/s/f3Y7qb8zmh8RhecGO3ydWA

How to join BNC / kUSD liquidity incentive activities for the first time

https://mp.weixin.qq.com/s/4gmD4unD46StSlkegOKyYg

Siv:

1.https://acala.network/

2. Akala official publication number

3.https://www.chaindd.com/3431654.html

4.https://www.chainnews.com/articles/475229969718.htm

5.https://mp.weixin.qq.com/s/J390kzeG0Ic9A7y9_y0z0g

Scan QR code with WeChat