Can the financial chain be used as a driver after the development of the automotive industry?

In the first half of 2020, many car manufacturers were hit by the "hot season" due to the impact of the drivetrain.25.3% loss.

By the first half of 2021, global car sales will increase compared to the same period last year.26.0% nec, The world's leading contributor to the Chinese automotive market with 31.4%,China has become a major battleground for the auto industry in the future, one of the leading automobile manufacturers in China and all of its exports protected the transmission system test.

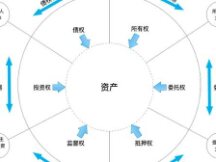

Looking at the entire transportation industry, from the river to the bottom, it can be divided into design and construction, raw material sourcing, manufacturing, transportation, sales, auto parts, auto maintenance, and finance. Money flows from one link to another. .High profitability of the whole chain.Thus, ensuring the financial chain has many functions to fulfill.

01,ThatAutomotive supply chain finance

Truck finance is usually provided to provide financial services to businesses up and down the truck i.e.B-end industry (Business Forum), unlike used vehicles, which is the consumer goods industry.

This section generally deals with the financial structure of automobile manufacturing and distribution.

02,in the manufacturing processAutomated supply chain finance model

From the point of view of the financial chain, the financial chain of the automobile manufacturers is centered on the companies of manufacture (manufacturers) of products and accessories for the OEMs.A financial model for companies upstream of the automotive sector.

In general, large truck parts manufacturers (typically Tier 1 retailers) have lower financing demand due to their high market share and highly competitive products. However, if there is a problem with investment capital or if the cost of purchasing raw materials and manufacturing equipment is a large part of the total cost of production, financing should be required.

Some small and medium-sized end-of-pipe companies do not have significant competition and rely only on OEMs to provide a range of non-core products to support operations, including low income ones. Although these industries face expansion and mold changes, they need special funds to invest in processes that improve and support the performance of the industry.

As a general rule, the repayment period of the finished manufacturer is usually long, so it is usually more than three months. Thus, down payment and down payment received and commodities often affect the profits of manufacturing companies. As a result, suppliers often need funds to supplement their working capital in order to manage the operations of the business.

Schematic financial aid for automotive suppliers

01, loan promise

When goods and supplies retailers supply OEMs, they get huge business benefits and the bank works on the seller's app after inspecting and verifying OEMs funds. Payment can be used as payment equipment. Once the loan is registered and the mechanic repays the loan, the loan is paid off.

02,Stock promise

Here we must first identify two points.Auto parts supplierandraw materials.Since raw materials are needed to produce auto parts, auto parts are the buyer and raw materials are the seller. These products are raw materials.

Therefore, product financial security as used here refers to how the consumer of consumer electronics receives the product (raw material) purchased from raw materials as a financial and payment responsibility. raw material. The exhibit is maintained by a third party trustee, and the sponsor will gradually publish the exhibit as the product is resold.

03,order finances

Same as money received from money, but exposed tostorage spaceandOEM (clients), the financing is based on the contract signed by the buyer and the seller.

The sponsor provides short-term financing to automakers to meet capital needs for the ordering, production and transportation of raw materials under contractual obligations of quality and profitability of auto parts and manufacturers. Refunds are estimates based on inventory orders.

04,factorisation

Under the agreement between the automaker and the dealership for the sale, the seller begins to transfer the goods received from the automaker to the factoring company, which provides them with financial services.

05,Discounted business tickets

The car salesperson sends the receipts without having to exchange them from the automaker to the cashier. Once the debtor receives this unpaid loan, the money is repaid at face value, after deducting interest. discount trade.

Reducing the price of a trade ticket can help suppliers negotiate faster, improve the efficiency of investments, and reduce capital costs.

03,circulation

Supply chain financial model

Automotive supply chain finance in the linkage cycle is often aboutdownstream vehicle sales, when the franchisee receives financial support from a merchant with the product, a certificate of eligibility, a deposit or a buy-back guarantee depending on the product.

01,Product support

Similar to financial models supported by the product market, start-ups will entrust their products to the bank as commodities, as well as products held by the third-party administrator for oversight. Collection of car sales.

02,car certificate contract

Intermediate retailers or specialty retailers (usually 4S retailers) are unable to return cash quickly and have bulk inventory. The truck requires a lot of personnel and equipment, so the dealership usually chooses the vehicle certificate from the bank as the responsibility. Get financial help from a bank quickly and easily.

03,neeg account overdraft

Business account overdraft in the automotive supply chain financial sector refers to a business that provides short-term and easy financial payment in the form of an overdraft on the account and contractual restrictions are approved by the bank after the car dealership has received a bank loan. line.

When a start-up or specialty store needs a short-term loan and the savings are not enough for external payments, over-consumers provide financial convenience to start-up merchants. .

04,auto manufacturer tickets

Here, the business model is generally"Triangle accepted", the third party means the car company, car dealership and bank, as well as specialized activities for the car manufacturer to provide a guarantee to the seller and the bank to become the payment intermediary. Employers can obtain financial assistance up to their credit. With manufacturer's warranty ...

The bank reported the refunds to the auto company when paying the seller, and the primary dealership received a receipt from the auto company afterwards. send the goods to another manager of the company and send the receipt to the bank. The seller pays for the goods or the managing body sends the goods after deposit.

05,Buy-back guarantee

Car dealers don't have enough money to buy more finished cars from OEMs, so they have to pay the bank to buy cars, and OEMs have to contract with dealers to sell finished cars, which is incoherent. There is therefore a purchase guarantee.

Return guarantee refers to the model in which the OEM guarantees that the goods will be returned and the money is returned to the customer when the seller is unable to reimburse the cost of the business on time.

These financial models are often used and are a good option for suppliers, but are riskier for OEMs. Therefore, the choice of distribution method is also difficult for OEMs.

04,Could it be the blockchain?

What are the new drivers after the development of the automotive industry?

Relations between each company and each link in the financial transport equipment supply chainfile blocking,credit is differentAll of this affects the growth of the entire auto industry, and the adoption of blockchain technology offers many benefits to every part of the auto industry.

01,Help small businesses and resellers get paid fast

Used car dealers with low turnover rates have low mortgage rates and cannot raise money cheaply through security, making it difficult and expensive to raise money.

The various financial models mentioned above are all designed to solve the financial problems of car manufacturers, retailers, dealers, etc., and blockchain technology can create the basis for trust. The system recognizes online collaboration in a variety of reliable ways, such as contracting, delivering invoices, services, shipping and other forms of delivery, and industry background checks.

At the same time, this information is stored on the chain using traceable and tamper-proof blockchain technology, which increases the reliability and speed of financial analysis.

02,Help financial companies acquire long-term clients quickly

For financial companies, the use of blockchain technology can reach many small and medium suppliers of automotive products, and can use blockchain technology to remove data interference from commerce and finance and bring further improvements in business and finance. Integration to achieve sustainable and sustainable development.

05,Boncredit authorizedAutomotive supply chain financial case

Wanglian technology combines the heritage-centric and industry-focused modeling of automobile manufacturers used to createauto loansandput two financial chainsfinancial equipment.

The system tracks the actual connections between dealerships, automakers and retailers, allowing retailers to place orders and pay, consolidate funds through deposits. Rights with finance and lending companies are widely used in the automotive industry and sales. Cloud credit that can be easily distributed and redeemed by keeping 4S of the proceeds from the sale of the car available in the electronic payment card. The fastest loanT0 can.

At the same time, the system connects directly to banks and businesses, using bank savings and special transaction withdrawal and settlement to quickly complete loans and make quick decisions, and achieve piloted mission goals. by two technologies. The upstream and downstream stability of the economy and the economy, and an excellent economic and ecological alliance have been formed, laying a solid foundation for the long-term business of the enterprise.

06

xaus

As the main base of the industry promotes the rapid growth of our national economy, the auto industry financial industry has high expectations. Wanglian Technology is committed to developing financial chain products based on auto parts, auto manufacturers and auto parts retailers, where the technology truly drives business, lowering financial costs for leading products and reducing costs. purchasing costs for key companies. Healthy development of the industrial ecosystem.

Scan QR code with WeChat