Ethereum 2.0 crash record value guaranteed! Up to $ 34.6 billion, Our First will add $ 60 million to ETH

On-chain data analytics firm Glassnode announced on the 15th that the number of contracts for the Ethereum 2.0 tag chain reached an all-time high of 8,662,786. The deal was worth $ 34.6 billion.

The Ethereum 2.0 tag chain deposit contract, launched in November last year, is waiting to be opened after integration with the Ethereum mainnet, so it cannot use or send Ethereum as a contract language, and it does not work.

According to Cointelegraph reported, this is now the biggest contract in Ethereum, but cannot be used without a fork, which is surprising if the hard time for the fork has still not been put in place, and Ethereum is well aware of the facts. The state of the fork can be determined after integrating the beacon chain into the Ethereum mainnet.

Launched in December last year, the Beacon Chain is an important first step in Ethereum's transition from Proof of Service (PoW) to Proof of Stake (PoS). Thus, the current contract value of $ 34.6 billion underscores the strong demand and prospects for the future Ethereum 2.0.

In December of this year, the developers of Ethereum asked community members to try and integrate the Ethereum mainnet with a beacon chain. The experience was divided into three stages: non-tech users, developers with no previous blockchain experience, and blockchain developers with the most knowledge and experience.

Go to the Pos mechanism

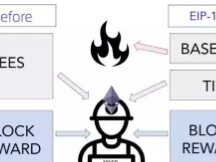

Once the beacon chain is connected to the Ethereum mainnet, the key to Ethereum moving to the PoS mechanism is complete. According to the official website of the Ethereum Foundation, the integration of Ethereum is expected in the first or second quarter of 2022.

According to previous reports, Trenton Van Epps, the developer of the Ethereum Foundation ecosystem, announced on April 17 that Ethereum would end its PoW approval in 3-6 months, and the Ethereum miners will have a plan in place. room for that.

Tim Beiko wrote a detailed article on the legitimate Ethereum Foundation website on November 29 regarding the impact of Ethereum application layer integration, noting that it is important in the case of unification after unification. Destroying a third of all Ether contracts is worth more than US $ 10 billion.

The Ethereum mainnet has completed the Arrow Glacier upgrade to 10, extending the hard shell for the fifth time. Tim Beiko, chief developer of Ethereum, told CNBC on the same day: “Hard rocker plans to slow down or stop mining of Ethereum. Ethereum has moved from PoW to PoS.

Our Arrows Capital continues to buy ETH.

In addition to the market side, according to previous data on the global financial system, Our Investment Company, a Singapore cryptocurrency investment developed by ZhuSu, is expected to buy large Ethereum. Arrows Capital is worth $ 56 million.

3 The Arrow Capital portfolio was changed again yesterday. According to Etherscan data, three companies traded 11,658 Ethereum shares through Binance yesterday at 3 p.m. Beijing time and 3,398 Ethereum shares from Coinbase at 10 p.m. Beijing time yesterday, for a total of 15,056 Ethereum (currently approximately US $) converted to $ 60.44 million).

3 Arrow Capital also confirmed that it traded 91,477 Ether worth up to $ 400 million through a major exchange on Day 7. ZhuSu was wary of 3 Arrow's decision to buy Ethereum after thinking which he planned to sell after announcing his closure. Ethereum on the 20th of last month and traded around $ 79.23 million worth of Ethereum on the exchange. .

In fact, ZhuSu said on Twitter on the 7th that he was focusing on sales and risky conversations, and also predicted 100,000 Ether would be a small thing and buy more.

Scan QR code with WeChat