CME CME Group Micro Ethereum Futures opened, up 4.48% on Monday

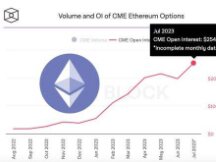

The Chicago Mercantile Exchange (CME) group is one of the most diversified trading companies in the world, enabling companies to trade futures, options, slots and exchanges (OTC) and enhance their investment in capital. According to previous data from the financial community, the METZ1 micro-ether futures, originally slated for December 6, were announced on time, making it the fifth action by the board of directors of the derivative currency of the CME cryptocurrency.

Futures contracts cost just 0.1 ETH, according to the CME website, and offer schools and investors the opportunity to protect their risk while enjoying the benefits of companies operating on Ethereum.

CME Group also announced in a tweet yesterday (6) that CME Group will introduce a new member of its cryptocurrency business. The latest member of the CME group of the cryptocurrency series has arrived and is now available for future MicroEthereum exchanges.

The CME website states that future contracts will be paid in cash at the CME CF Ether-Dollar benchmark rate and will follow CME guidelines.

Tim McCourt, CME Director of Global Justice Indices, said: A way for companies to protect their risk-taking value on Ether.

Brooks Dudley, Global Marketing Director of ED & FMan Capital Markets, said: Response.

increased by 4% on the first day of trading

Chicago's CME trading platform launched Micro Ether Futures (MET) yesterday (6) on its open trading platform for investors. Data showed the first day of trading was up 4.48% to close at $ 4,395, up $ 188.50.

Scan QR code with WeChat